Does Sany Heavy Equipment International Holdings (HKG:631) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Sany Heavy Equipment International Holdings (HKG:631). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Sany Heavy Equipment International Holdings

How Fast Is Sany Heavy Equipment International Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Sany Heavy Equipment International Holdings has grown EPS by 47% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

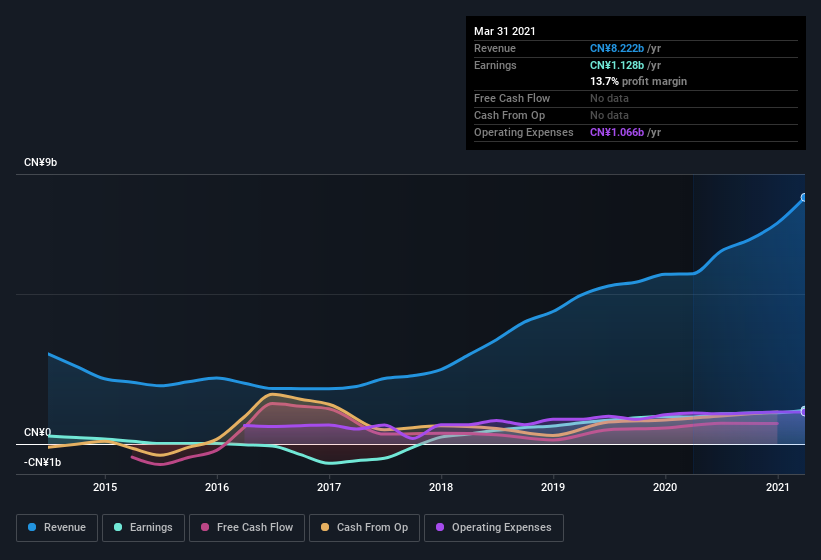

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Sany Heavy Equipment International Holdings maintained stable EBIT margins over the last year, all while growing revenue 45% to CN¥8.2b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Sany Heavy Equipment International Holdings?

Are Sany Heavy Equipment International Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth -CN¥3.2m) this was overshadowed by a mountain of buying, totalling CN¥12m in just one year. This makes me even more interested in Sany Heavy Equipment International Holdings because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Non-Executive Director Xiuguo Tang who made the biggest single purchase, worth HK$5.1m, paying HK$8.46 per share.

Along with the insider buying, another encouraging sign for Sany Heavy Equipment International Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they hold CN¥153m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.6% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Sany Heavy Equipment International Holdings Deserve A Spot On Your Watchlist?

Sany Heavy Equipment International Holdings's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Sany Heavy Equipment International Holdings belongs on the top of your watchlist. Of course, just because Sany Heavy Equipment International Holdings is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sany Heavy Equipment International Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:631

Sany Heavy Equipment International Holdings

Manufactures and sells mining and logistics equipment, electricity, power station project products, petroleum and new energy manufacturing equipment, spare parts, and related services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives