Asian Value Stocks Trading Below Estimated Intrinsic Worth In April 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and economic policy shifts, Asian stock markets are responding with cautious optimism. With China's potential for increased stimulus and Japan's strategic trade negotiations, investors are keenly observing opportunities to identify value stocks trading below their intrinsic worth. In such an environment, a good stock is often characterized by strong fundamentals, resilience in the face of market volatility, and potential for growth despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥149.07 | CN¥296.52 | 49.7% |

| Micro-Star International (TWSE:2377) | NT$136.00 | NT$265.69 | 48.8% |

| Tonghua Dongbao Pharmaceutical (SHSE:600867) | CN¥7.27 | CN¥14.11 | 48.5% |

| LITALICO (TSE:7366) | ¥1166.00 | ¥2305.35 | 49.4% |

| World Fitness Services (TWSE:2762) | NT$79.80 | NT$156.42 | 49% |

| CS BEARING (KOSDAQ:A297090) | ₩5350.00 | ₩10442.66 | 48.8% |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥6.87 | CN¥13.33 | 48.5% |

| Swire Properties (SEHK:1972) | HK$16.08 | HK$31.96 | 49.7% |

| Innovent Biologics (SEHK:1801) | HK$47.25 | HK$93.85 | 49.7% |

| SAMG Entertainment (KOSDAQ:A419530) | ₩36600.00 | ₩72265.47 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Sany Heavy Equipment International Holdings (SEHK:631)

Overview: Sany Heavy Equipment International Holdings Company Limited specializes in the manufacturing and sale of mining and logistics equipment, robotic and smart mine products, petroleum and new energy manufacturing equipment, along with spare parts, with a market cap of approximately HK$16.91 billion.

Operations: The company's revenue segments include CN¥10.90 billion from mining equipment, CN¥7.91 billion from logistics equipment, CN¥1.87 billion from oil and gas equipment, and CN¥1.97 billion from emerging industry equipment.

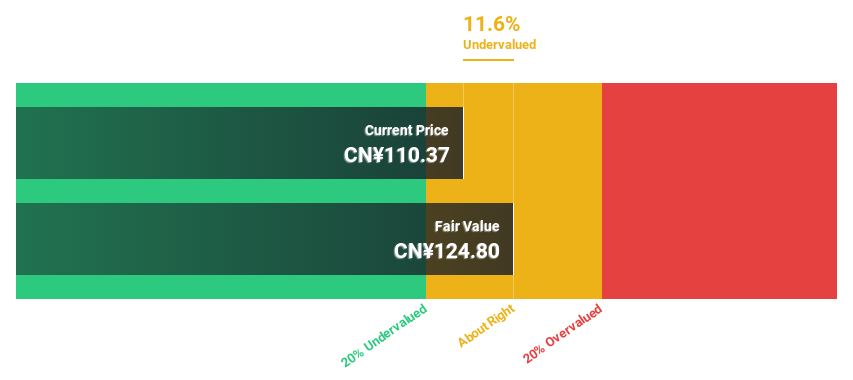

Estimated Discount To Fair Value: 34.4%

Sany Heavy Equipment International Holdings is trading at HK$5.26, below the estimated fair value of HK$8.02, suggesting it is undervalued based on cash flows. Despite a decline in net income to CNY 1.10 billion from CNY 1.93 billion last year, the company proposed a final dividend of HKD 0.29 per share for 2024. Earnings are forecast to grow significantly at over 31% annually, outpacing both revenue growth and market expectations in Hong Kong.

- Our comprehensive growth report raises the possibility that Sany Heavy Equipment International Holdings is poised for substantial financial growth.

- Take a closer look at Sany Heavy Equipment International Holdings' balance sheet health here in our report.

ACM Research (Shanghai) (SHSE:688082)

Overview: ACM Research (Shanghai), Inc. focuses on the research, development, production, and sale of semiconductor equipment both in China and internationally, with a market cap of CN¥45.34 billion.

Operations: The company's revenue is primarily derived from its semiconductor equipment and services segment, which generated CN¥5.62 billion.

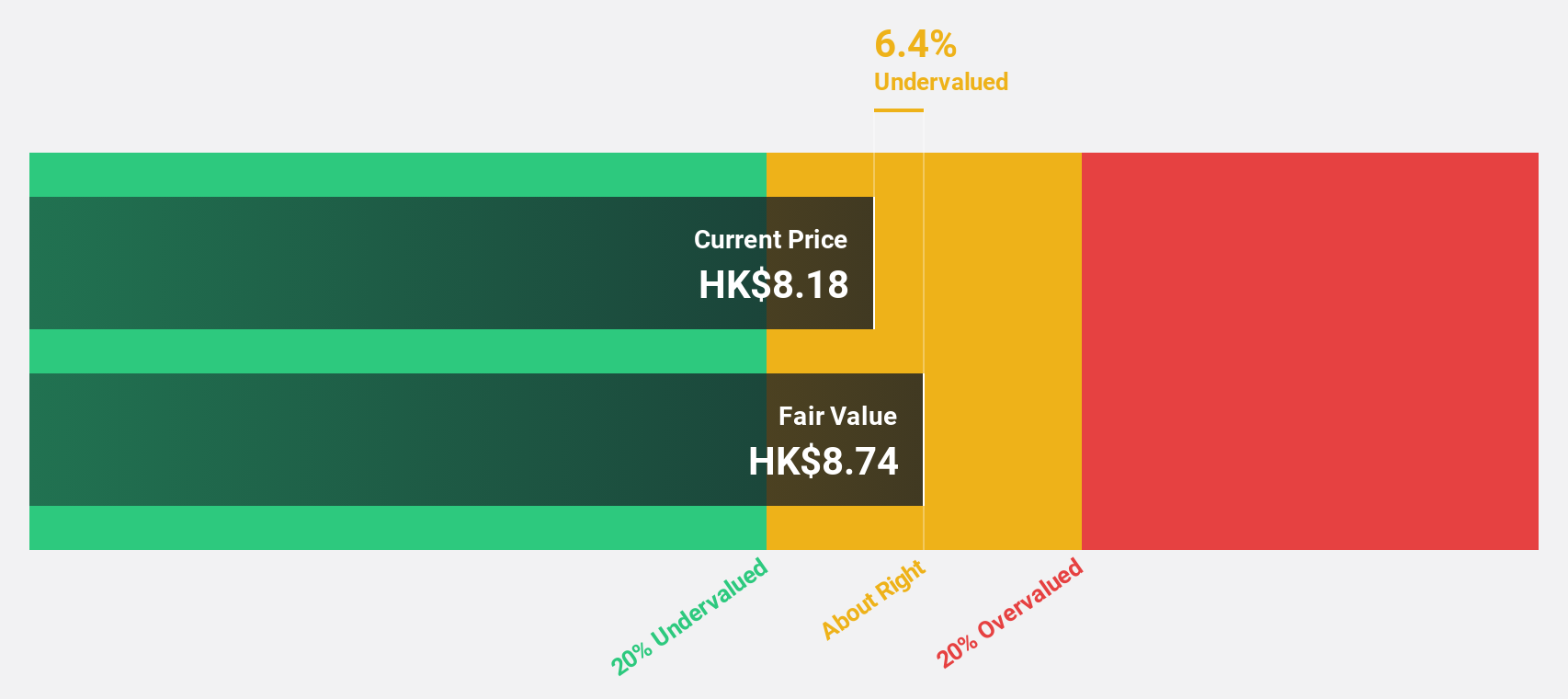

Estimated Discount To Fair Value: 10.3%

ACM Research (Shanghai) is trading at CN¥102.75, slightly below its estimated fair value of CN¥114.59, indicating it may be undervalued based on cash flows. With earnings projected to grow significantly at 25% annually and revenue expected to increase by 20.7% per year, the company's financial outlook surpasses market averages in China. Recent earnings show sales rising from CN¥3.71 billion to CN¥5.44 billion, with net income up from CN¥910.52 million to CN¥1.15 billion year-over-year.

- According our earnings growth report, there's an indication that ACM Research (Shanghai) might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of ACM Research (Shanghai).

create restaurants holdings (TSE:3387)

Overview: Create Restaurants Holdings Inc. operates and manages food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan with a market cap of ¥304.07 billion.

Operations: The company's revenue segments include the planning, development, and management of food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan.

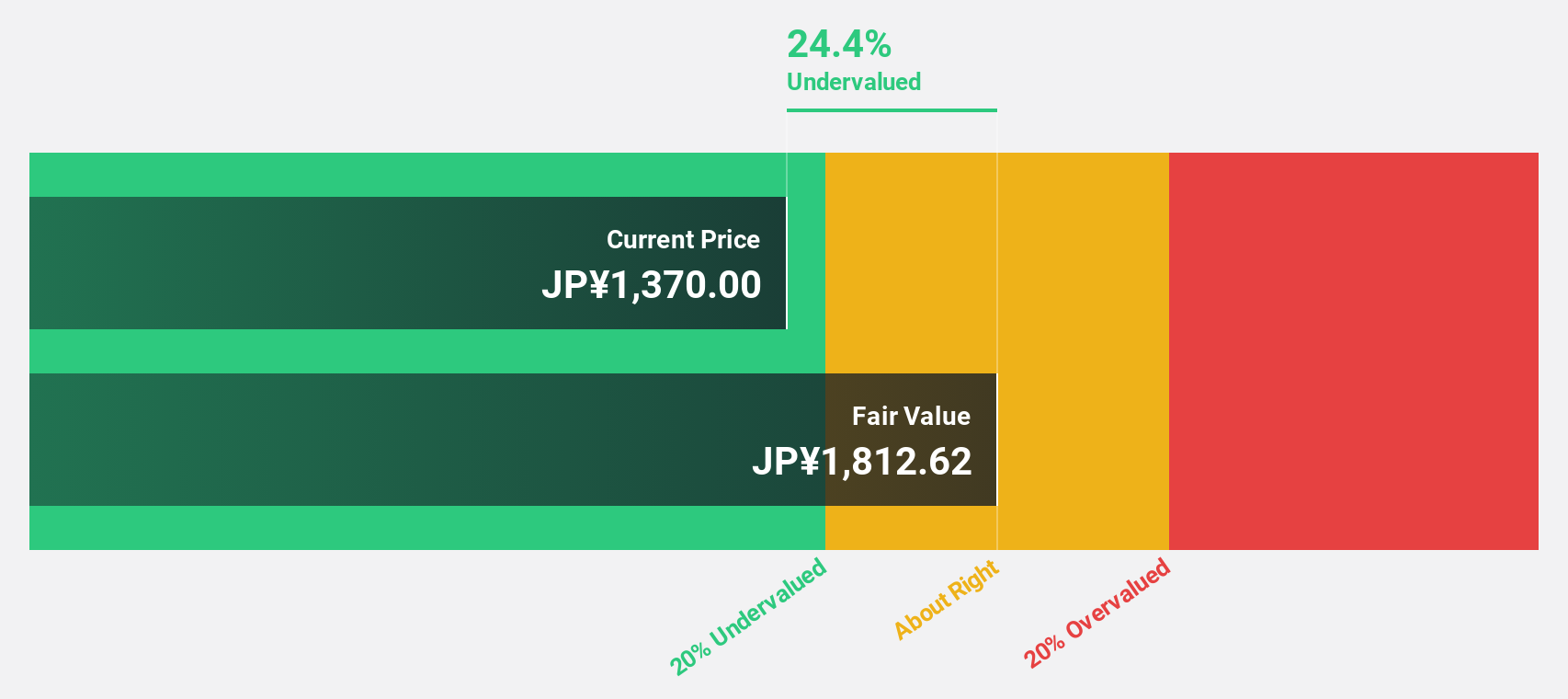

Estimated Discount To Fair Value: 10.7%

Create Restaurants Holdings is trading at ¥1445, slightly below its fair value of ¥1618.18, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 22.7% annually, outpacing the Japanese market's growth rate. The company recently announced a dividend increase and established a joint venture with SFP Holdings for store design efficiencies, which could enhance operational effectiveness and cost management in the long term.

- Insights from our recent growth report point to a promising forecast for create restaurants holdings' business outlook.

- Delve into the full analysis health report here for a deeper understanding of create restaurants holdings.

Where To Now?

- Discover the full array of 274 Undervalued Asian Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:631

Sany Heavy Equipment International Holdings

Manufactures and sells mining and logistics equipment, electricity, power station project products, petroleum and new energy manufacturing equipment, spare parts, and related services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives