- Hong Kong

- /

- Construction

- /

- SEHK:6063

Lotus Horizon Holdings Limited's (HKG:6063) Shares May Have Run Too Fast Too Soon

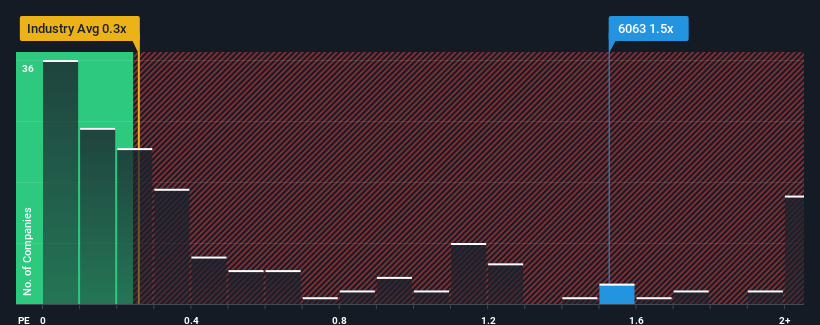

When close to half the companies in the Construction industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.3x, you may consider Lotus Horizon Holdings Limited (HKG:6063) as a stock to potentially avoid with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Lotus Horizon Holdings

How Has Lotus Horizon Holdings Performed Recently?

Revenue has risen firmly for Lotus Horizon Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Lotus Horizon Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Lotus Horizon Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Revenue has also lifted 9.9% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 9.9% shows it's noticeably less attractive.

In light of this, it's alarming that Lotus Horizon Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Lotus Horizon Holdings currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Lotus Horizon Holdings is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Lotus Horizon Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6063

Lotus Horizon Holdings

An investment holding company, provides design, supply, and installation services for facade works and building metal finishing works in Hong Kong.

Flawless balance sheet low.

Market Insights

Community Narratives