As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, small-cap stocks have shown resilience amidst volatility, with the S&P 600 providing a glimpse into this dynamic segment. Despite challenges such as AI competition fears impacting broader indices, opportunities for growth remain, particularly in sectors that can adapt to technological advancements and shifting economic policies. In this context, identifying undiscovered gems involves seeking out companies that demonstrate strong fundamentals and innovative potential within these evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Gulermak Aglr Sanayi Insaat ve Taahhut (IBSE:GLRMK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gulermak Aglr Sanayi Insaat ve Taahhut A.S. is a company engaged in heavy industry construction and contracting services, with a market cap of TRY49.62 billion.

Operations: GLRMK generates revenue primarily from its heavy industry construction and contracting services. The company has a market cap of TRY49.62 billion, reflecting its significant presence in the industry.

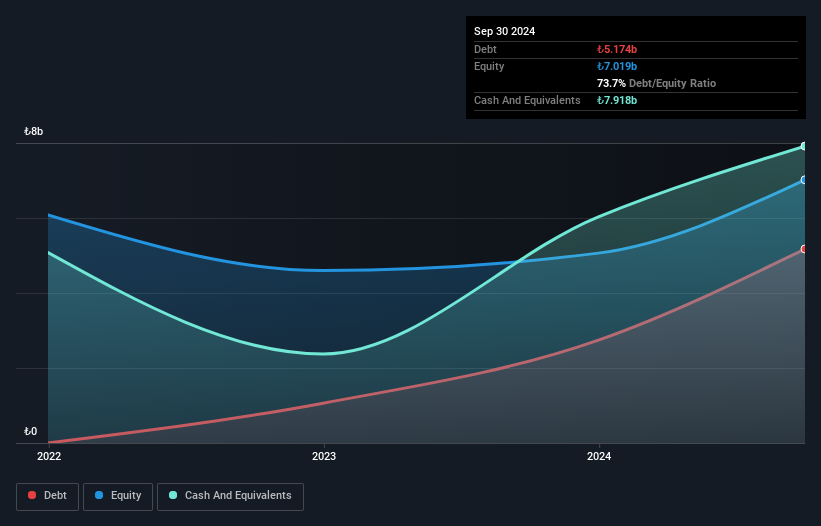

Gulermak has made waves with a recent IPO raising TRY 4.85 billion, marking its presence in the market as a small-cap entity. The company's earnings skyrocketed by 750% last year, outpacing the construction industry's growth of 92%. Cash reserves exceed total debt, highlighting financial prudence and interest coverage is robust. Despite high-quality earnings, share liquidity poses challenges for investors seeking flexibility. Gulermak's strategic contract in Poland further solidifies its position in infrastructure development, showcasing technical expertise and long-term market engagement. This blend of financial strength and industry capability makes it an intriguing prospect for investors exploring new opportunities.

- Delve into the full analysis health report here for a deeper understanding of Gulermak Aglr Sanayi Insaat ve Taahhut.

Understand Gulermak Aglr Sanayi Insaat ve Taahhut's track record by examining our Past report.

Sun.King Technology Group (SEHK:580)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for various sectors in China, with a market cap of HK$2.31 billion.

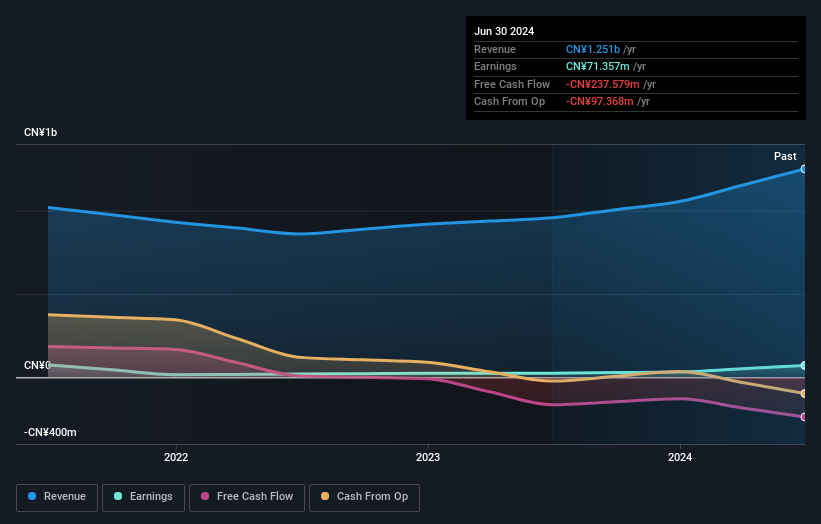

Operations: The primary revenue stream for Sun.King Technology Group comes from its manufacturing and trading of power electronic components, generating CN¥1.25 billion. The company's financial performance is highlighted by a notable trend in its net profit margin, which reflects the efficiency of its operations and cost management strategies.

Sun.King Technology Group, a nimble player in the electrical sector, has shown impressive growth with earnings surging 185% over the past year. This rise outpaced the industry average of 7.7%, highlighting its robust performance. Despite a historical annual decline of 46% over five years, recent developments suggest improvement. The company's debt situation seems manageable, with interest payments well-covered at nearly eight times by EBIT and a slight reduction in its debt-to-equity ratio from 19.8 to 19.6 over five years. Recent guidance indicates revenue could exceed RMB1.6 billion, driven by high-margin projects and international ventures like Brazil's Itaipu Binacional project.

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PharmaSGP Holding SE is a company that manufactures and sells over-the-counter drugs and other healthcare products in Germany, with a market cap of €321.34 million.

Operations: PharmaSGP generates revenue primarily from its Pharmaceuticals segment, which accounted for €114 million. The company has a market capitalization of approximately €321.34 million.

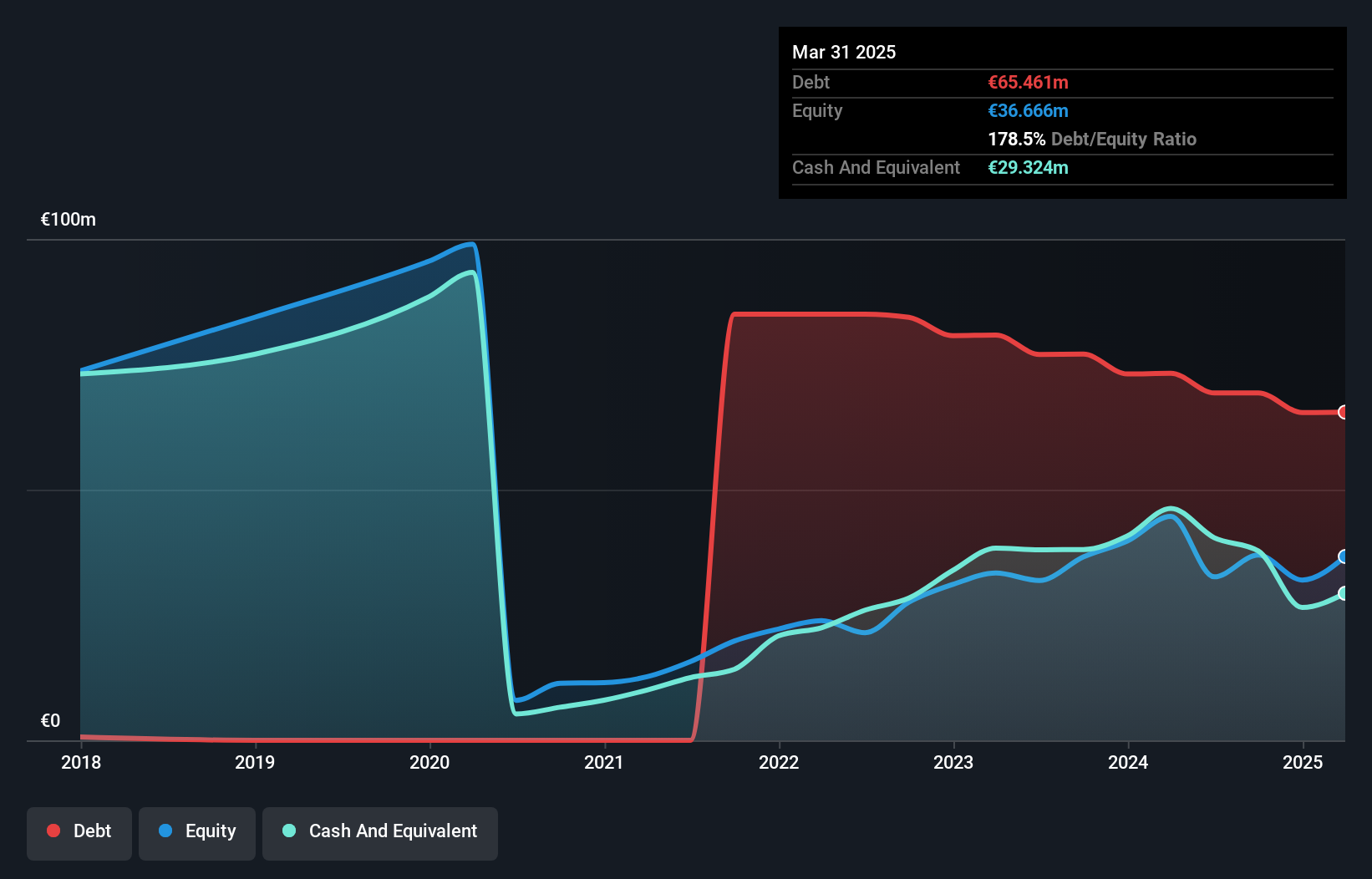

PharmaSGP, a niche player in the pharmaceutical industry, shows promising attributes despite its high debt level with a net debt to equity ratio of 85.4%. The company has turned negative shareholder equity positive over five years, reflecting improved financial health. Trading at 61.2% below estimated fair value suggests potential undervaluation for investors seeking opportunities. Its earnings have grown by 5.1% annually over the past five years and are forecasted to rise by 14.13% per year, indicating robust growth prospects. Recent results highlight sales of €88.58 million and net income of €14.05 million for nine months ending September 2024, showcasing consistent performance improvement from the previous year.

Next Steps

- Gain an insight into the universe of 4678 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PSG

PharmaSGP Holding

Manufactures and sells over-the-counter drugs and other healthcare products in Germany.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)