- Hong Kong

- /

- Industrials

- /

- SEHK:53

Guoco Group Limited (HKG:53) Stock Rockets 58% As Investors Are Less Pessimistic Than Expected

Guoco Group Limited (HKG:53) shareholders have had their patience rewarded with a 58% share price jump in the last month. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

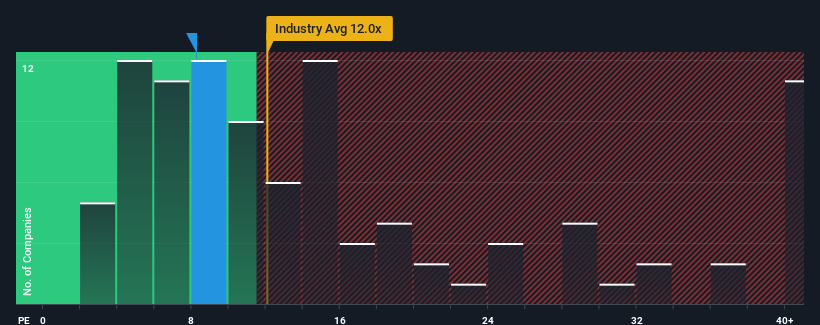

In spite of the firm bounce in price, it's still not a stretch to say that Guoco Group's price-to-earnings (or "P/E") ratio of 8.3x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Guoco Group as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Guoco Group

Is There Some Growth For Guoco Group?

In order to justify its P/E ratio, Guoco Group would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 74% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Guoco Group's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Guoco Group's P/E?

Guoco Group's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Guoco Group revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Guoco Group you should be aware of, and 1 of them is a bit unpleasant.

You might be able to find a better investment than Guoco Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Guoco Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:53

Guoco Group

An investment holding company, engages in the principal investment, property investment and development, hospitality and leisure, and financial service businesses in Hong Kong, the People’s Republic of China, the United Kingdom, Continental Europe, Singapore, Australasia, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives