Here's Why CIMC Enric Holdings (HKG:3899) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that CIMC Enric Holdings Limited (HKG:3899) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CIMC Enric Holdings

How Much Debt Does CIMC Enric Holdings Carry?

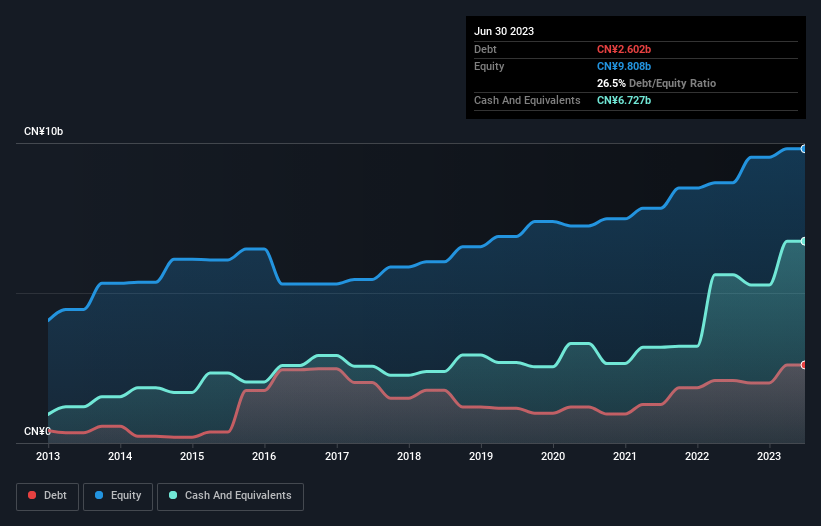

As you can see below, at the end of June 2023, CIMC Enric Holdings had CN¥2.60b of debt, up from CN¥2.08b a year ago. Click the image for more detail. But it also has CN¥6.73b in cash to offset that, meaning it has CN¥4.12b net cash.

How Strong Is CIMC Enric Holdings' Balance Sheet?

We can see from the most recent balance sheet that CIMC Enric Holdings had liabilities of CN¥11.4b falling due within a year, and liabilities of CN¥2.40b due beyond that. On the other hand, it had cash of CN¥6.73b and CN¥5.28b worth of receivables due within a year. So its liabilities total CN¥1.77b more than the combination of its cash and short-term receivables.

Of course, CIMC Enric Holdings has a market capitalization of CN¥13.0b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, CIMC Enric Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely.

The good news is that CIMC Enric Holdings has increased its EBIT by 9.1% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if CIMC Enric Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While CIMC Enric Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, CIMC Enric Holdings produced sturdy free cash flow equating to 74% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

Although CIMC Enric Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥4.12b. And it impressed us with free cash flow of CN¥1.1b, being 74% of its EBIT. So is CIMC Enric Holdings's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - CIMC Enric Holdings has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3899

CIMC Enric Holdings

Provides transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026