- South Korea

- /

- Machinery

- /

- KOSE:A017800

Asian Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating economic indicators and policy shifts, Asian stock markets have shown resilience, with investor enthusiasm particularly strong in technology and AI sectors. Against this backdrop, dividend stocks in Asia present an intriguing opportunity for investors seeking steady income streams amidst broader market dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.54% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| NCD (TSE:4783) | 4.49% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1033 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

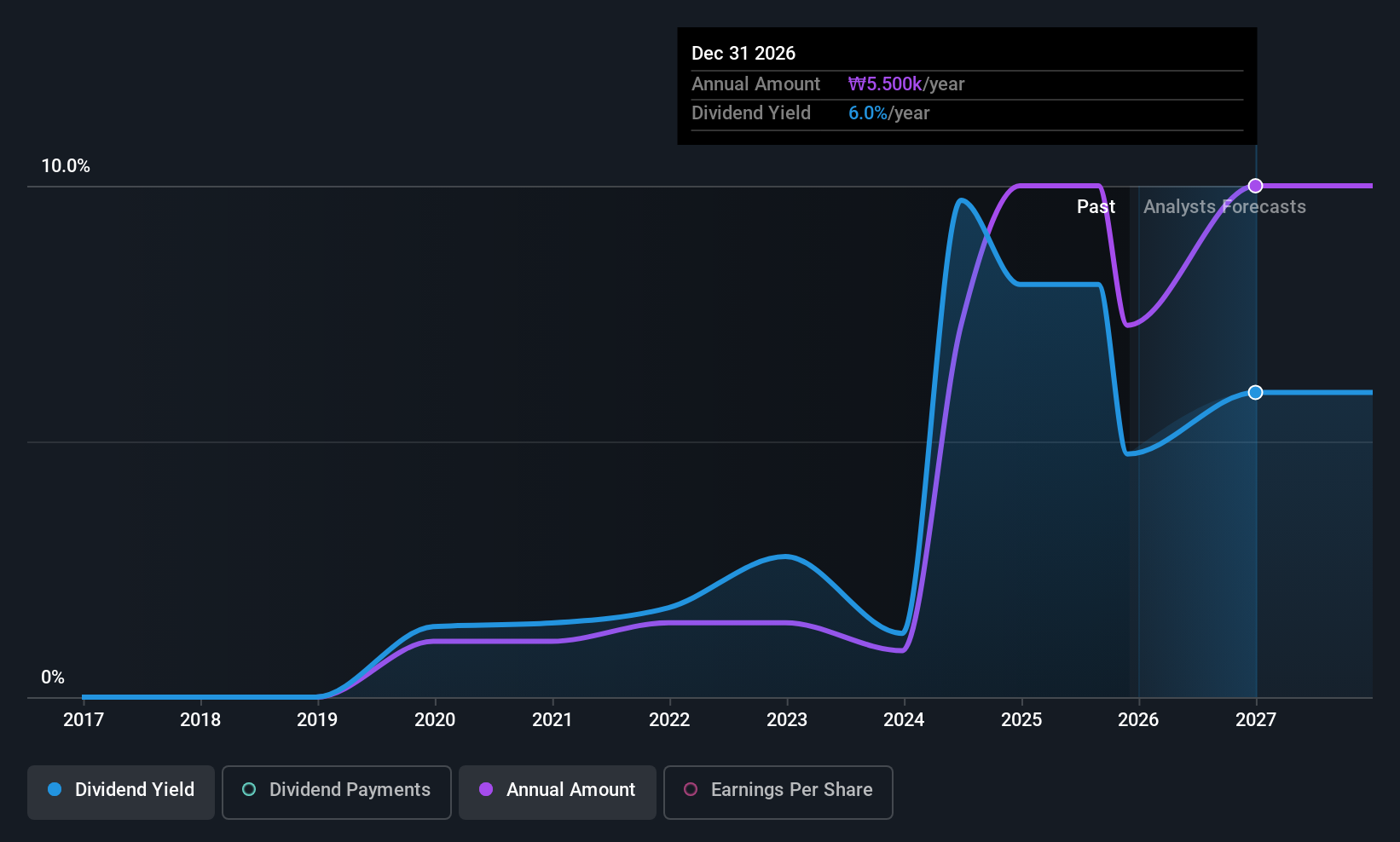

Hyundai Elevator (KOSE:A017800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Elevator Co., Ltd. designs, manufactures, installs, maintains, and modernizes elevators in South Korea and internationally with a market cap of ₩3.33 trillion.

Operations: Hyundai Elevator Co., Ltd. generates revenue through the design, manufacturing, installation, maintenance, and modernization of elevators both domestically and internationally.

Dividend Yield: 4.3%

Hyundai Elevator's dividends, while covered by earnings and cash flows with payout ratios of 67.3% and 77.5% respectively, have been unreliable due to volatility over the past six years. Despite trading at a good value relative to peers and showing significant recent earnings growth, its dividend history is short and unstable, having only been paid for six years. The company's recent financial results show strong net income growth despite declining sales.

- Take a closer look at Hyundai Elevator's potential here in our dividend report.

- Upon reviewing our latest valuation report, Hyundai Elevator's share price might be too pessimistic.

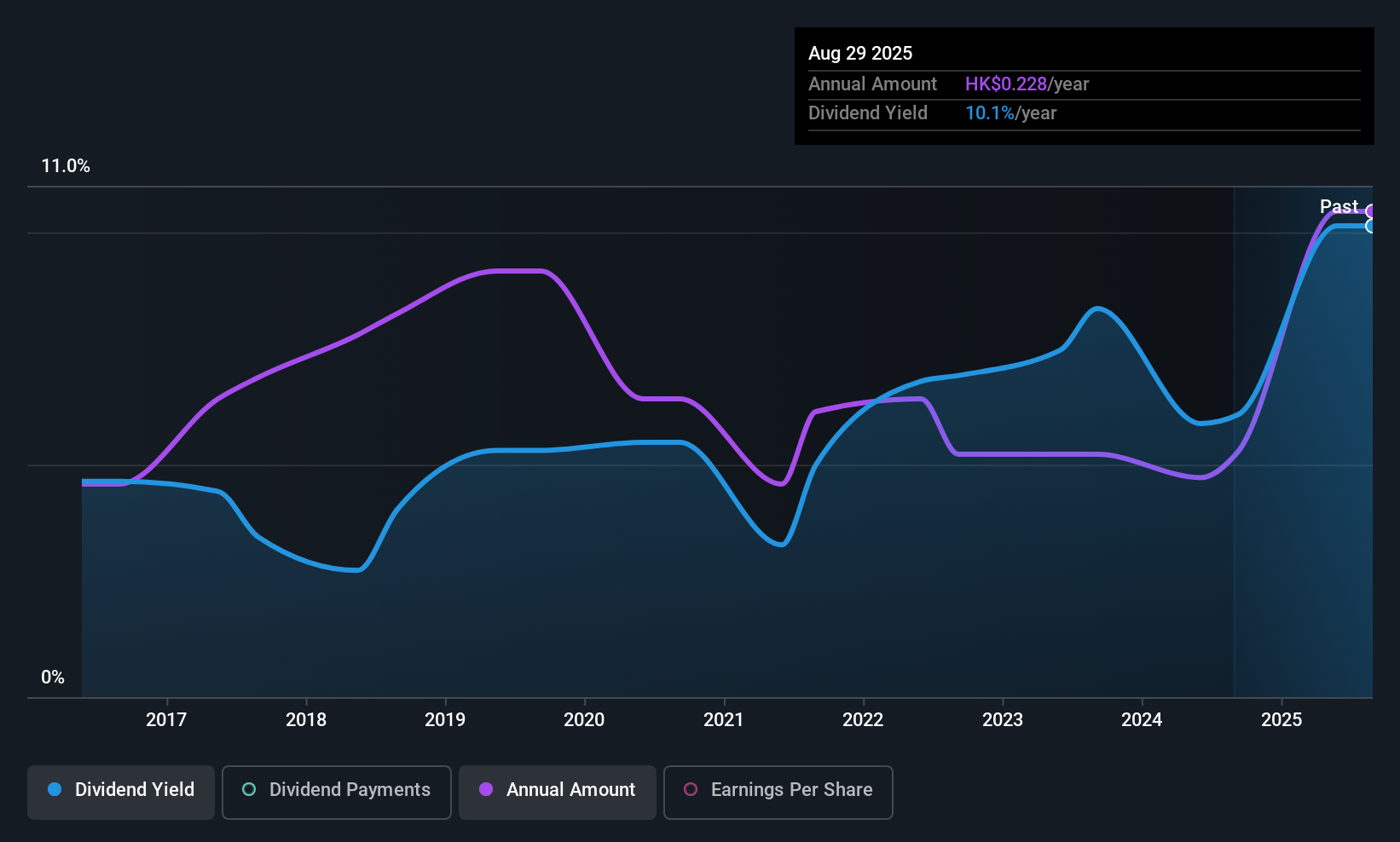

TK Group (Holdings) (SEHK:2283)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$2.18 billion.

Operations: TK Group (Holdings) Limited generates revenue primarily from two segments: Mold Fabrication, contributing HK$893.09 million, and Plastic Components Manufacturing, which accounts for HK$1.62 billion.

Dividend Yield: 8.8%

TK Group (Holdings) offers an attractive dividend yield, ranking in the top 25% of Hong Kong's dividend payers. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.4% and 74.8%, respectively. The stock trades at a significant discount to its estimated fair value, enhancing its appeal as a value investment. However, investors should note the volatility in its dividend history over the past decade despite recent growth in payments and earnings.

- Click to explore a detailed breakdown of our findings in TK Group (Holdings)'s dividend report.

- Our expertly prepared valuation report TK Group (Holdings) implies its share price may be lower than expected.

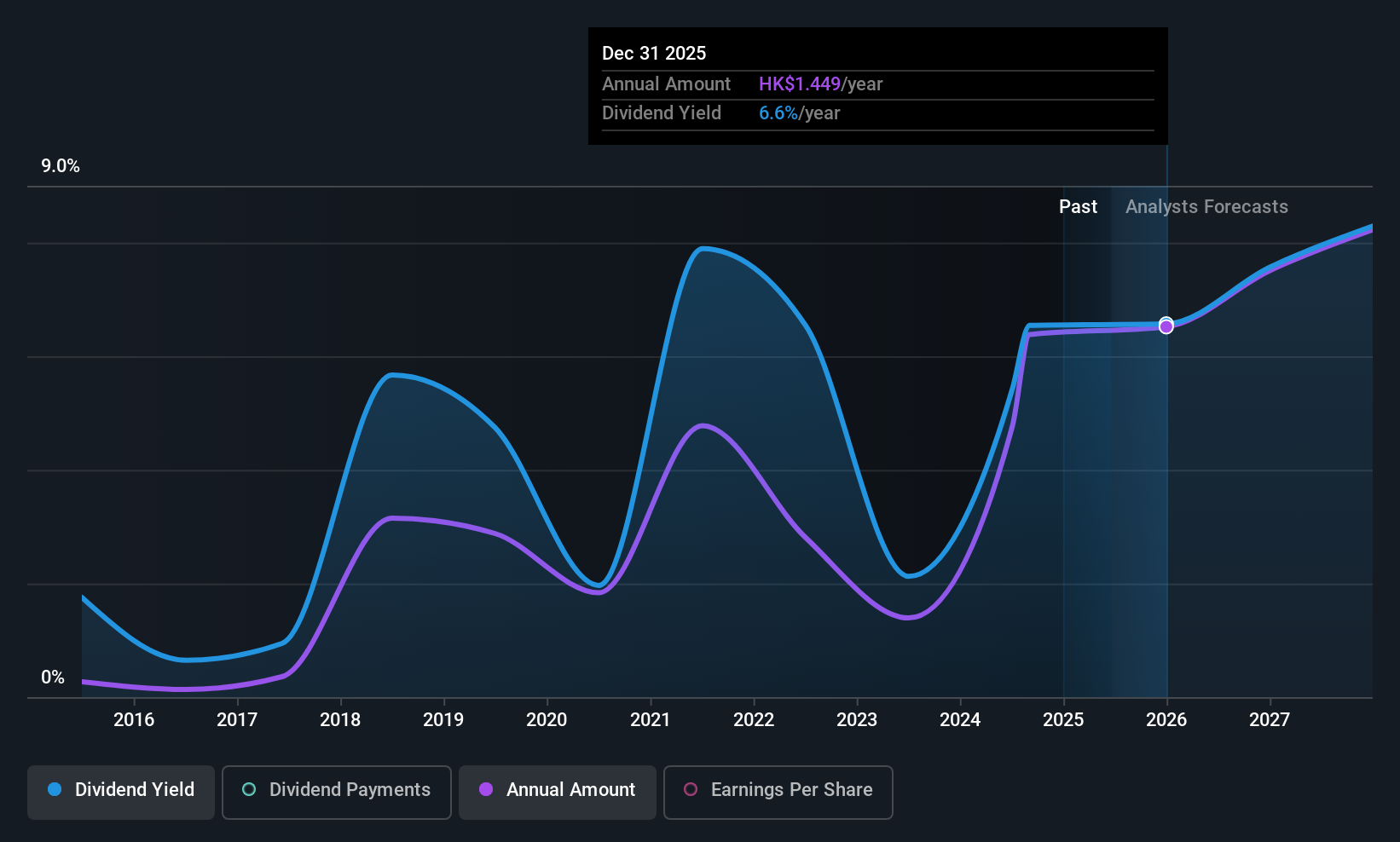

Sinotruk (Hong Kong) (SEHK:3808)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotruk (Hong Kong) Limited is an investment holding company involved in the research, development, manufacture, and sale of heavy-duty trucks, medium-heavy duty trucks, light duty trucks, buses, and related parts both in Mainland China and internationally with a market cap of approximately HK$80.90 billion.

Operations: Sinotruk (Hong Kong) Limited generates revenue primarily from its Heavy Duty Trucks segment at CN¥85.87 billion, followed by Engines at CN¥14.46 billion, Light Duty Trucks and Others at CN¥11.64 billion, and Finance at CN¥1.32 billion.

Dividend Yield: 3.8%

Sinotruk (Hong Kong) provides a moderate dividend yield, lower than the top quartile in Hong Kong. While its dividends are adequately covered by earnings and cash flows, with payout ratios of 54.3% and 48.8%, respectively, its dividend history has been volatile over the past decade. The stock trades significantly below its estimated fair value, offering potential value for investors despite the unstable dividend track record and anticipated earnings growth of 13.51% annually.

- Unlock comprehensive insights into our analysis of Sinotruk (Hong Kong) stock in this dividend report.

- Our valuation report unveils the possibility Sinotruk (Hong Kong)'s shares may be trading at a discount.

Make It Happen

- Explore the 1033 names from our Top Asian Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Elevator might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A017800

Hyundai Elevator

Designs, manufactures, installs, maintains, and modernizes elevators in South Korea and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026