- Hong Kong

- /

- Industrials

- /

- SEHK:3686

Clifford Modern Living Holdings' (HKG:3686) Earnings Are Of Questionable Quality

Clifford Modern Living Holdings Limited's (HKG:3686) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for Clifford Modern Living Holdings

A Closer Look At Clifford Modern Living Holdings' Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

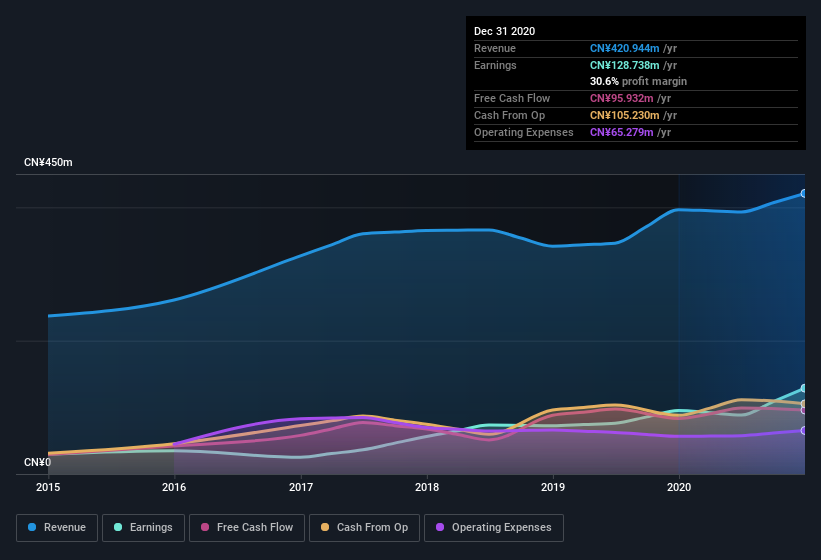

Over the twelve months to December 2020, Clifford Modern Living Holdings recorded an accrual ratio of 0.44. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. In fact, it had free cash flow of CN¥96m in the last year, which was a lot less than its statutory profit of CN¥128.7m. We note, however, that Clifford Modern Living Holdings grew its free cash flow over the last year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Clifford Modern Living Holdings.

Our Take On Clifford Modern Living Holdings' Profit Performance

As we have made quite clear, we're a bit worried that Clifford Modern Living Holdings didn't back up the last year's profit with free cashflow. For this reason, we think that Clifford Modern Living Holdings' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 3 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Clifford Modern Living Holdings.

Today we've zoomed in on a single data point to better understand the nature of Clifford Modern Living Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Clifford Modern Living Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3686

Clifford Modern Living Holdings

An investment holding company, provides services to residents in developed properties under the Clifford brand name in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives