Imagine Owning RENHENG Enterprise Holdings (HKG:3628) And Trying To Stomach The 87% Share Price Drop

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Imagine if you held RENHENG Enterprise Holdings Limited (HKG:3628) for half a decade as the share price tanked 87%. And we doubt long term believers are the only worried holders, since the stock price has declined 75% over the last twelve months. The falls have accelerated recently, with the share price down 55% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for RENHENG Enterprise Holdings

While RENHENG Enterprise Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last half decade, RENHENG Enterprise Holdings saw its revenue increase by 1.5% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 33%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

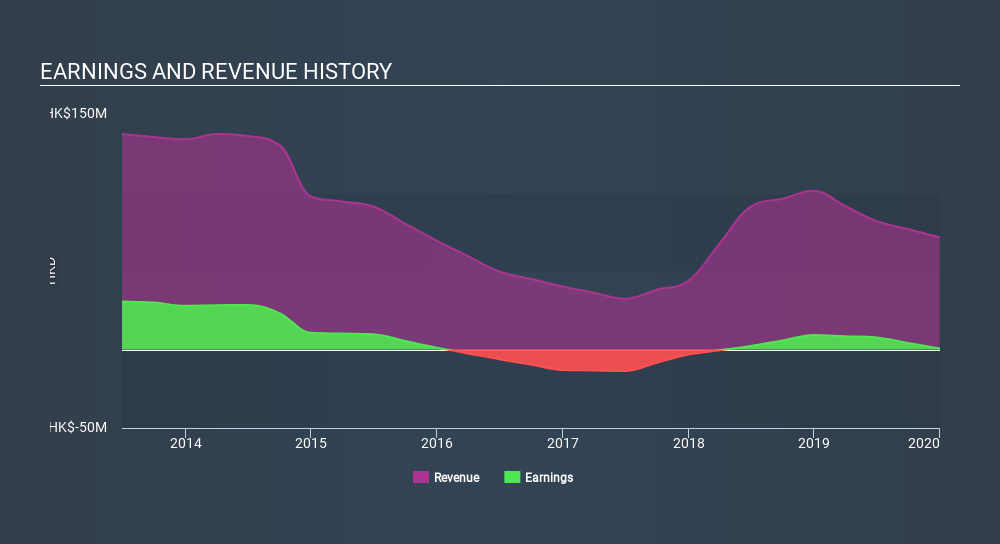

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 6.9% in the twelve months, RENHENG Enterprise Holdings shareholders did even worse, losing 75%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 31% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand RENHENG Enterprise Holdings better, we need to consider many other factors. For example, we've discovered 3 warning signs for RENHENG Enterprise Holdings (1 is potentially serious!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:3628

RENHENG Enterprise Holdings

An investment holding company, engages in the manufacture and sale of tobacco machinery products in the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives