Does China Glass Holdings (HKG:3300) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China Glass Holdings (HKG:3300). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide China Glass Holdings with the means to add long-term value to shareholders.

View our latest analysis for China Glass Holdings

How Fast Is China Glass Holdings Growing Its Earnings Per Share?

In the last three years China Glass Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. China Glass Holdings boosted its trailing twelve month EPS from CN¥0.26 to CN¥0.32, in the last year. That's a 20% gain; respectable growth in the broader scheme of things.

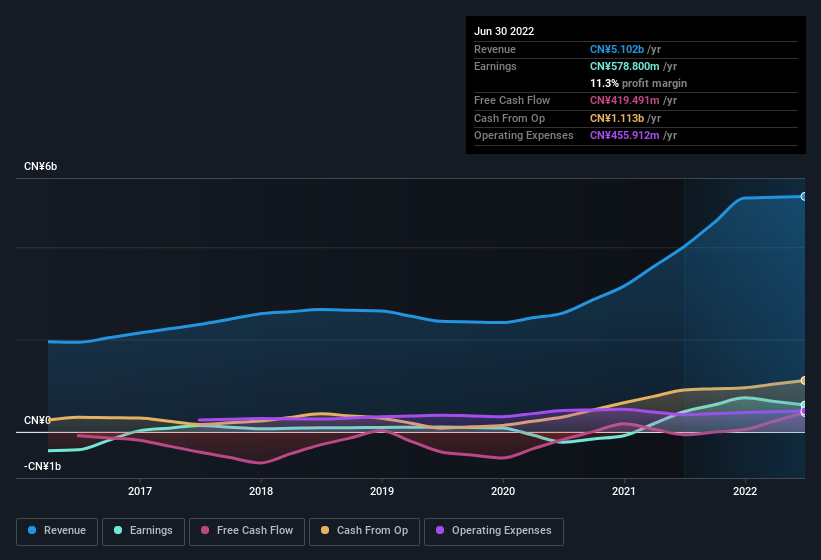

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, China Glass Holdings has done well over the past year, growing revenue by 27% to CN¥5.1b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China Glass Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First and foremost; there we saw no insiders sell China Glass Holdings shares in the last year. But the really good news is that CEO & Executive Director Guo Lyu spent CN¥2.4m buying stock, at an average price of around CN¥0.80. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

The good news, alongside the insider buying, for China Glass Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CN¥251m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 9.8% of the company; visible skin in the game.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Guo Lyu, is paid less than the median for similar sized companies. For companies with market capitalisations between CN¥1.4b and CN¥5.4b, like China Glass Holdings, the median CEO pay is around CN¥2.5m.

China Glass Holdings' CEO took home a total compensation package worth CN¥2.1m in the year leading up to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is China Glass Holdings Worth Keeping An Eye On?

As previously touched on, China Glass Holdings is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Glass Holdings , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of China Glass Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3300

China Glass Holdings

Engages in the production, marketing, and distribution of glass and glass products in Mainland China, Hong Kong, Nigeria, the Middle East, Italy, Kazakhstan, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives