At HK$8.18, Is CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) Worth Looking At Closely?

While CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) might not be the most widely known stock at the moment, it saw significant share price movement during recent months on the SEHK, rising to highs of HK$9.17 and falling to the lows of HK$7.45. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether CSSC Offshore & Marine Engineering (Group)'s current trading price of HK$8.18 reflective of the actual value of the mid-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at CSSC Offshore & Marine Engineering (Group)’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for CSSC Offshore & Marine Engineering (Group)

Is CSSC Offshore & Marine Engineering (Group) still cheap?

Great news for investors – CSSC Offshore & Marine Engineering (Group) is still trading at a fairly cheap price according to my price multiple model, where I compare the company's price-to-earnings ratio to the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 2.49x is currently well-below the industry average of 12.78x, meaning that it is trading at a cheaper price relative to its peers. What’s more interesting is that, CSSC Offshore & Marine Engineering (Group)’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of CSSC Offshore & Marine Engineering (Group) look like?

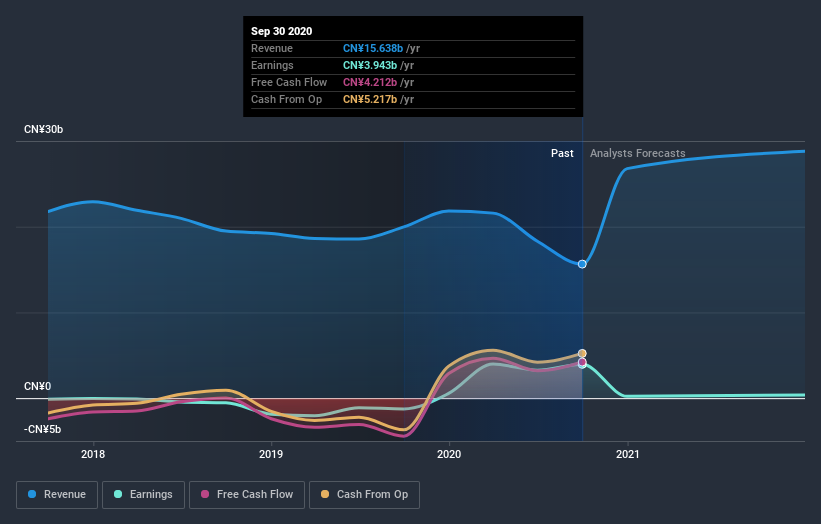

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. However, with an extremely negative double-digit change in profit expected next year, near-term growth is certainly not a driver of a buy decision. It seems like high uncertainty is on the cards for CSSC Offshore & Marine Engineering (Group), at least in the near future.

What this means for you:

Are you a shareholder? Although 317 is currently trading below the industry PE ratio, the adverse prospect of negative growth brings about some degree of risk. Consider whether you want to increase your portfolio exposure to 317, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on 317 for a while, but hesitant on making the leap, I recommend you research further into the stock. Given its current price multiple, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Our analysis shows 3 warning signs for CSSC Offshore & Marine Engineering (Group) (1 is a bit concerning!) and we strongly recommend you look at them before investing.

If you are no longer interested in CSSC Offshore & Marine Engineering (Group), you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade CSSC Offshore & Marine Engineering (Group), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Reasonable growth potential with adequate balance sheet.