- Hong Kong

- /

- Electrical

- /

- SEHK:2727

Shanghai Electric Group Co., Ltd.'s (HKG:2727) Shareholders Might Be Looking For Exit

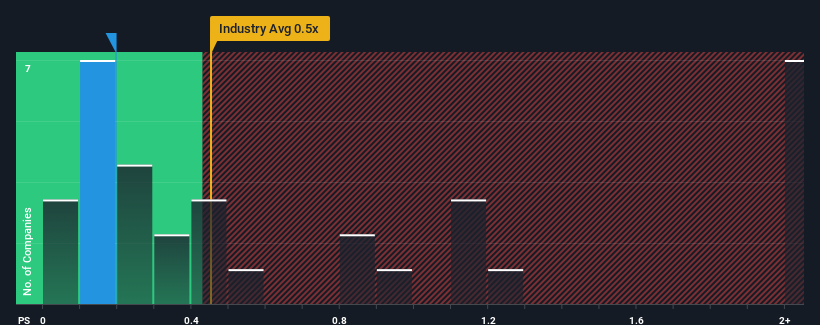

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Electrical industry in Hong Kong, you could be forgiven for feeling indifferent about Shanghai Electric Group Co., Ltd.'s (HKG:2727) P/S ratio of 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Shanghai Electric Group

What Does Shanghai Electric Group's Recent Performance Look Like?

Shanghai Electric Group could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Electric Group.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Shanghai Electric Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 9.9% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 25%, which is noticeably more attractive.

In light of this, it's curious that Shanghai Electric Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Shanghai Electric Group's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Shanghai Electric Group with six simple checks on some of these key factors.

If you're unsure about the strength of Shanghai Electric Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2727

Shanghai Electric Group

Provides industrial-grade eco-friendly smart system solutions in Mainland China and internationally.

Undervalued with excellent balance sheet.