Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Shanghai Electric Group Company Limited (HKG:2727) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Shanghai Electric Group

What Is Shanghai Electric Group's Net Debt?

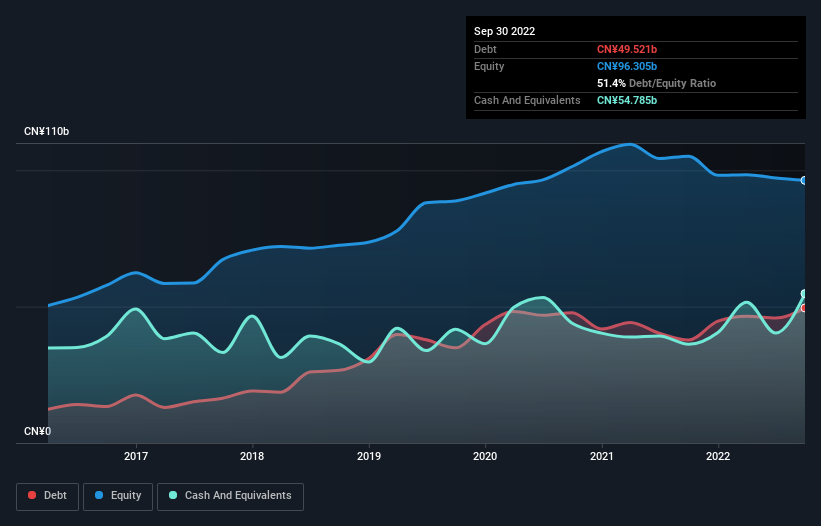

The image below, which you can click on for greater detail, shows that at September 2022 Shanghai Electric Group had debt of CN¥49.5b, up from CN¥37.7b in one year. However, its balance sheet shows it holds CN¥54.8b in cash, so it actually has CN¥5.26b net cash.

How Healthy Is Shanghai Electric Group's Balance Sheet?

According to the last reported balance sheet, Shanghai Electric Group had liabilities of CN¥173.2b due within 12 months, and liabilities of CN¥35.0b due beyond 12 months. Offsetting this, it had CN¥54.8b in cash and CN¥93.9b in receivables that were due within 12 months. So its liabilities total CN¥59.5b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of CN¥58.1b, we think shareholders really should watch Shanghai Electric Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Given that Shanghai Electric Group has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Shanghai Electric Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Shanghai Electric Group made a loss at the EBIT level, and saw its revenue drop to CN¥116b, which is a fall of 22%. That makes us nervous, to say the least.

So How Risky Is Shanghai Electric Group?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Shanghai Electric Group had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through CN¥2.5b of cash and made a loss of CN¥7.0b. With only CN¥5.26b on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Shanghai Electric Group has 1 warning sign we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2727

Shanghai Electric Group

Provides industrial-grade eco-friendly smart system solutions in Mainland China and internationally.

Undervalued with excellent balance sheet.