- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2588

BOC Aviation Limited's (HKG:2588) Share Price Could Signal Some Risk

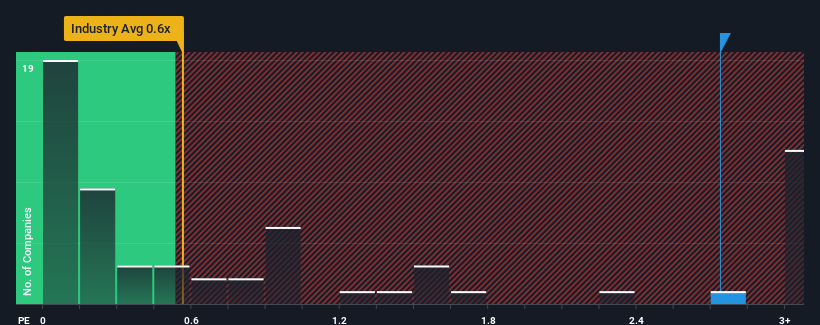

When you see that almost half of the companies in the Trade Distributors industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.6x, BOC Aviation Limited (HKG:2588) looks to be giving off strong sell signals with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for BOC Aviation

What Does BOC Aviation's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, BOC Aviation has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on BOC Aviation will help you uncover what's on the horizon.How Is BOC Aviation's Revenue Growth Trending?

BOC Aviation's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 7.5% gain to the company's revenues. Revenue has also lifted 5.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% per year over the next three years. That's shaping up to be similar to the 12% per annum growth forecast for the broader industry.

With this information, we find it interesting that BOC Aviation is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does BOC Aviation's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that BOC Aviation currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for BOC Aviation (of which 1 is potentially serious!) you should know about.

If these risks are making you reconsider your opinion on BOC Aviation, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BOC Aviation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2588

BOC Aviation

Operates as an aircraft operating leasing company in Mainland China, Hong Kong, Macau, Taiwan, rest of the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Undervalued slight.