If You Had Bought Lung Kee (Bermuda) Holdings (HKG:255) Shares Three Years Ago You'd Have A Total Return Of Negative 12%

While it may not be enough for some shareholders, we think it is good to see the Lung Kee (Bermuda) Holdings Limited (HKG:255) share price up 11% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 34% in the last three years, significantly under-performing the market.

See our latest analysis for Lung Kee (Bermuda) Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

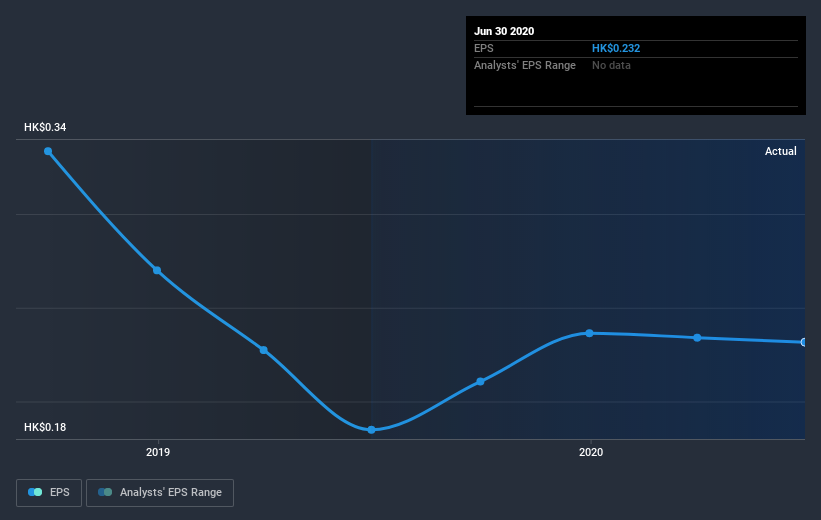

During the three years that the share price fell, Lung Kee (Bermuda) Holdings' earnings per share (EPS) dropped by 18% each year. This fall in the EPS is worse than the 13% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Lung Kee (Bermuda) Holdings' key metrics by checking this interactive graph of Lung Kee (Bermuda) Holdings's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Lung Kee (Bermuda) Holdings, it has a TSR of -12% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Lung Kee (Bermuda) Holdings provided a TSR of 11% over the year (including dividends). That's fairly close to the broader market return. We should note here that the five-year TSR is more impressive, at 16% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Lung Kee (Bermuda) Holdings has 1 warning sign we think you should be aware of.

We will like Lung Kee (Bermuda) Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Lung Kee (Bermuda) Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:255

Lung Kee Group Holdings

An investment holding company, manufactures and markets mold bases and related products in the People’s Republic of China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives