- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:2507

Is Cirrus Aircraft’s (SEHK:2507) New Trade‑In Program Quietly Redefining Its Upgrade‑Cycle Economics?

Reviewed by Sasha Jovanovic

- In December 2025, Cirrus Aircraft launched “Cirrus Next,” a trade-in and upgrade program that simplifies purchasing a new Cirrus by offering a streamlined pathway and trade-in option for existing aircraft, covering late-model SR Series and all generations of Vision Jets.

- By removing the hassle of managing overlapping ownership or downtime without an aircraft, Cirrus Next directly targets a key friction point that can slow upgrade cycles for committed owners.

- We’ll now examine how this focus on easing upgrade friction for existing SR and Vision Jet owners shapes Cirrus Aircraft’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Cirrus Aircraft's Investment Narrative?

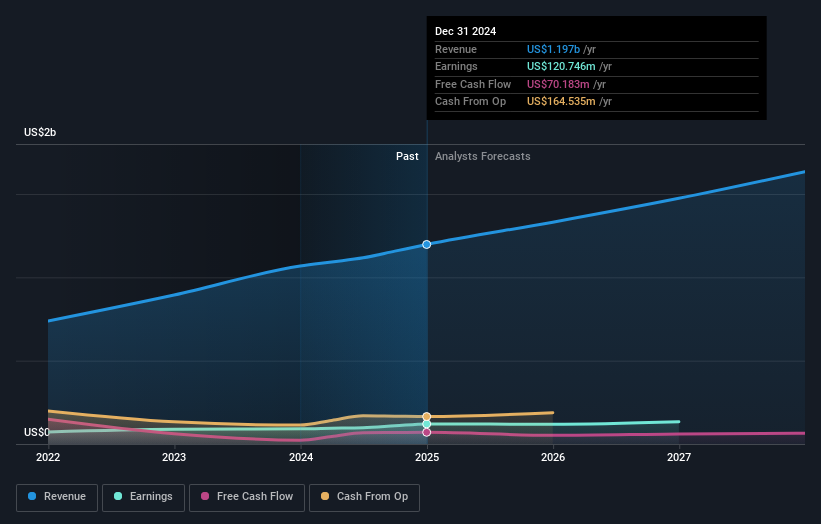

To own Cirrus Aircraft, you really have to believe in its ability to keep deepening an ecosystem around the SR Series and Vision Jet, not just selling airframes. The company already combines hardware, training, finance and digital services, and Cirrus Next slots neatly into that story as another way to keep existing owners “in the family.” In the short term, the bigger share-price drivers still look like production ramp execution, the Grand Forks expansion, and whether recent earnings momentum can justify a valuation that screens as relatively expensive versus local peers. Cirrus Next probably will not move the needle on its own, but it could modestly strengthen near-term demand visibility and support pricing power. The main trade-off is that it also increases execution and balance sheet risk if inventory handling or trade-in values are misjudged.

However, one emerging risk around governance and capital allocation is easy to miss at first glance. Cirrus Aircraft's shares have been on the rise but are still potentially undervalued by 13%. Find out what it's worth.Exploring Other Perspectives

The Simply Wall St Community has 1 fair value estimate clustered around HK$59.41, showing little dispersion. Set against recent earnings growth and programs like Cirrus Next, that single point of view underscores how differently others might judge the balance between execution risk and upside. Readers should compare several of these perspectives before forming their own view.

Explore another fair value estimate on Cirrus Aircraft - why the stock might be worth just HK$59.41!

Build Your Own Cirrus Aircraft Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cirrus Aircraft research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cirrus Aircraft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cirrus Aircraft's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2507

Cirrus Aircraft

Manufactures and sells piston aircraft and single-engine turbine jets worldwide.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026