- Hong Kong

- /

- Construction

- /

- SEHK:240

Top Asian Dividend Stocks To Consider

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by geopolitical tensions and evolving economic policies, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for those looking to balance risk and reward.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.06% | ★★★★★★ |

| NCD (TSE:4783) | 4.22% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.16% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

Click here to see the full list of 1171 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

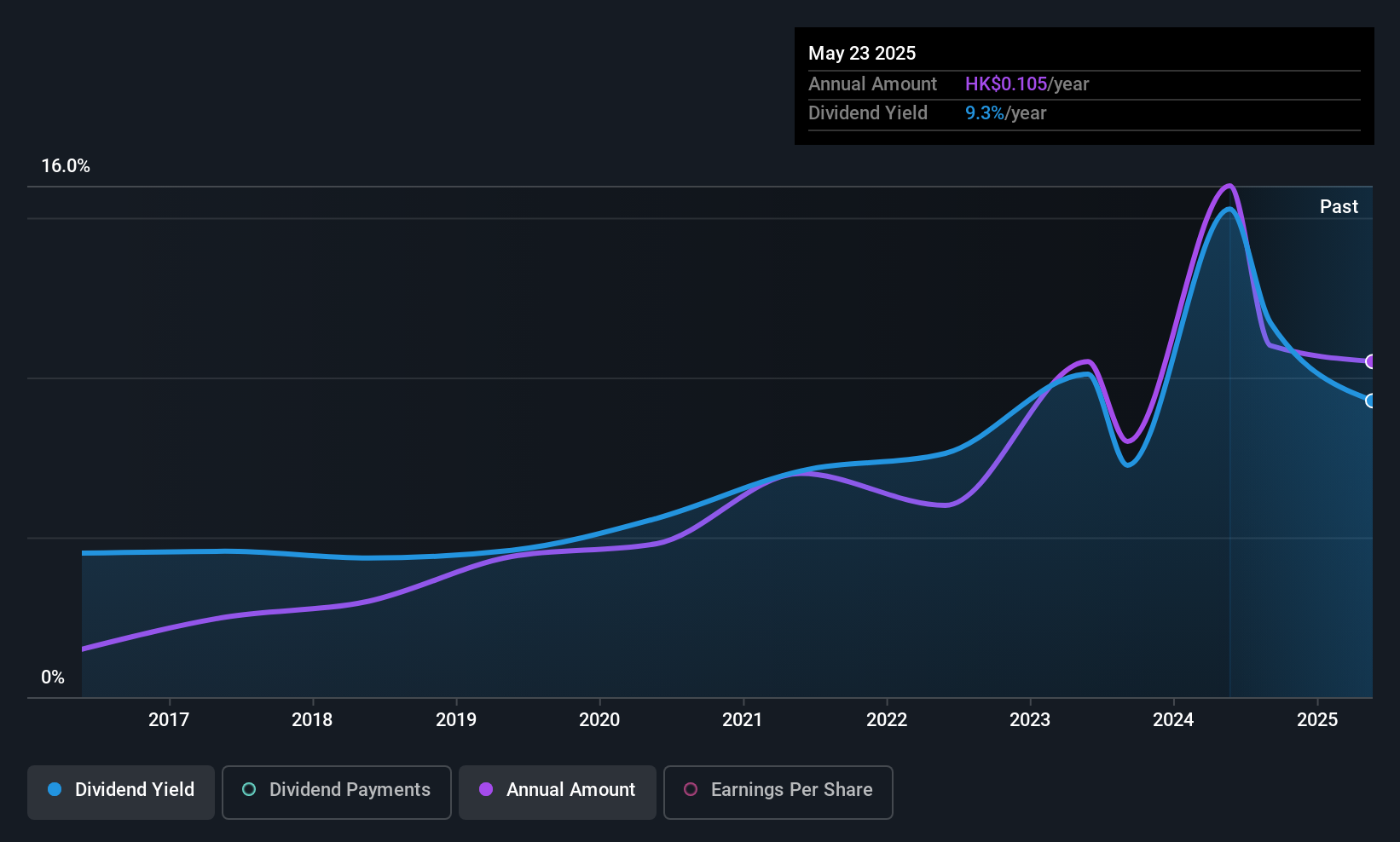

Build King Holdings (SEHK:240)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Build King Holdings Limited is an investment holding company involved in building construction and civil engineering projects in Hong Kong and the People's Republic of China, with a market cap of HK$1.61 billion.

Operations: Build King Holdings Limited generates revenue of HK$14.37 billion from its construction work segment.

Dividend Yield: 8.1%

Build King Holdings offers an attractive dividend yield, ranking in the top 25% of Hong Kong payers. However, its dividend history is marked by volatility and unreliability over the past decade. Despite this, dividends are well covered by earnings and cash flows due to a low payout ratio of 30%. Additionally, recent agreements with NWD and CTFS may provide new revenue streams through 2027, potentially stabilizing future payouts.

- Take a closer look at Build King Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility Build King Holdings' shares may be trading at a discount.

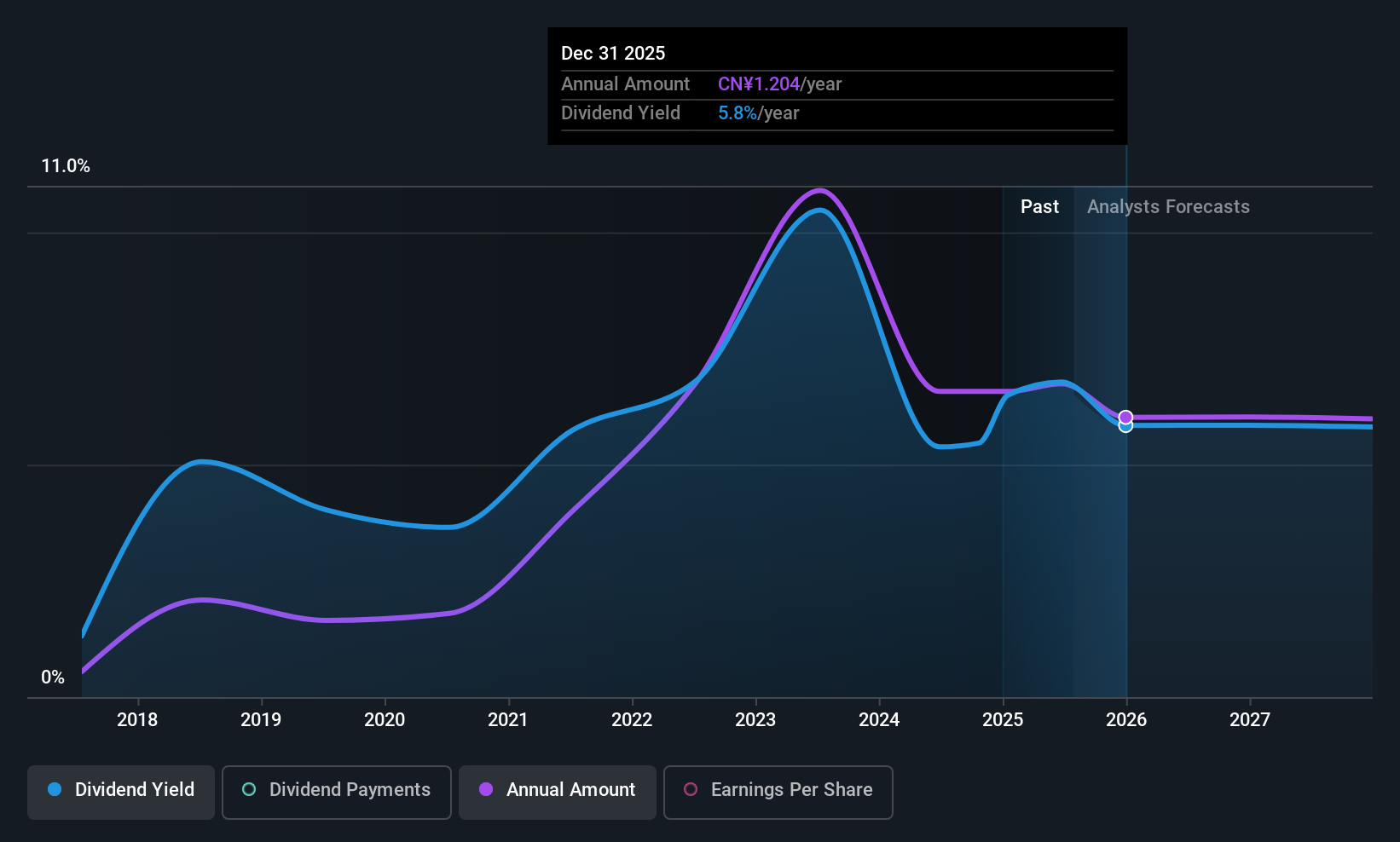

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited, along with its subsidiaries, is engaged in the mining, production, washing, processing, and sale of coal both in China and internationally with a market cap of CN¥203.89 billion.

Operations: Shaanxi Coal Industry's revenue is primarily derived from its activities in mining, producing, washing, processing, and selling coal both domestically and abroad.

Dividend Yield: 6.4%

Shaanxi Coal Industry's dividend yield is among the top 25% in China, supported by a payout ratio of 58.5%, indicating coverage by earnings and cash flows. However, its dividend history shows volatility over the past decade. Despite recent earnings showing a slight decline, the stock trades at an attractive value compared to peers, potentially appealing to value-focused investors. Recent financials reported sales of ¥40.16 billion and net income of ¥4.80 billion for Q1 2025.

- Get an in-depth perspective on Shaanxi Coal Industry's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shaanxi Coal Industry's current price could be quite moderate.

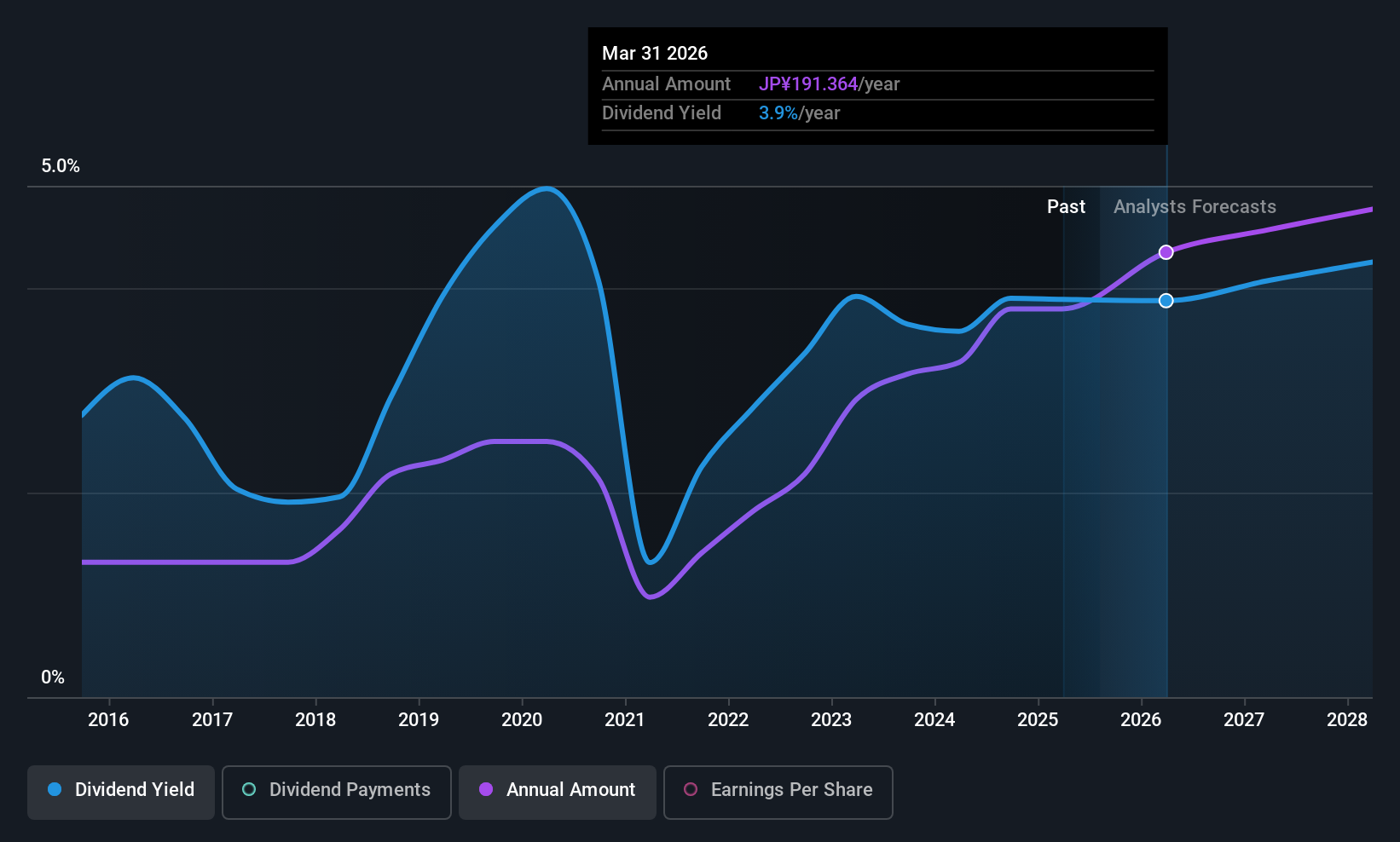

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komatsu Ltd. is a global manufacturer and seller of construction, mining, and utility equipment, with operations spanning Japan, the Americas, Europe, China, the rest of Asia, Oceania, the Middle East, Africa, and CIS countries; it has a market cap of ¥4.90 trillion.

Operations: Komatsu's revenue segments include Construction Machinery/Vehicles at ¥3.80 trillion, Industrial Machinery Others at ¥223.60 billion, and Retail Finance at ¥123.21 billion.

Dividend Yield: 3.6%

Komatsu offers a mixed dividend profile, with its payout ratio of 40.1% ensuring dividends are covered by earnings and cash flows. However, the dividend yield of 3.57% is below the top quartile in Japan, and payments have been volatile over the past decade. Recent buyback activity totaling ¥30.48 billion may enhance shareholder value despite a reduction in expected dividends to ¥95 per share for fiscal year ending March 2026 from ¥107 previously.

- Click to explore a detailed breakdown of our findings in Komatsu's dividend report.

- Our comprehensive valuation report raises the possibility that Komatsu is priced lower than what may be justified by its financials.

Where To Now?

- Click this link to deep-dive into the 1171 companies within our Top Asian Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build King Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:240

Build King Holdings

An investment holding company, engages in the building construction and civil engineering works in Hong Kong and the People's Republic of China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives