- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:2357

AviChina Industry & Technology Company Limited's (HKG:2357) Shares Climb 32% But Its Business Is Yet to Catch Up

AviChina Industry & Technology Company Limited (HKG:2357) shareholders have had their patience rewarded with a 32% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.6% over the last year.

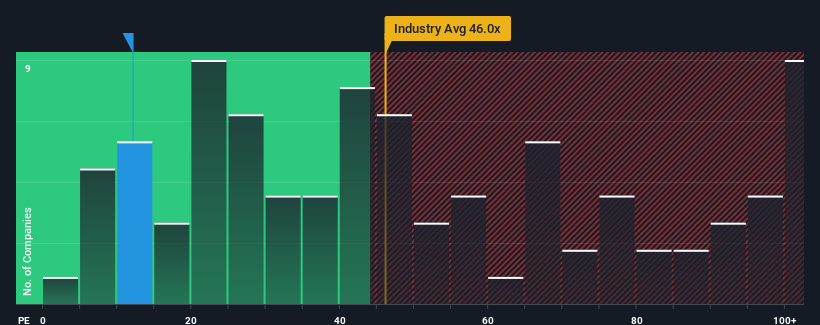

Since its price has surged higher, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider AviChina Industry & Technology as a stock to potentially avoid with its 12.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

AviChina Industry & Technology's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for AviChina Industry & Technology

Is There Enough Growth For AviChina Industry & Technology?

In order to justify its P/E ratio, AviChina Industry & Technology would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.3%. The solid recent performance means it was also able to grow EPS by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the six analysts watching the company. With the market predicted to deliver 16% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's curious that AviChina Industry & Technology's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

The large bounce in AviChina Industry & Technology's shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that AviChina Industry & Technology currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for AviChina Industry & Technology (1 is a bit unpleasant) you should be aware of.

You might be able to find a better investment than AviChina Industry & Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2357

AviChina Industry & Technology

Engages in the development, manufacture, and sale of civil aviation and defense products in Hong Kong and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives