With EPS Growth And More, China Lesso Group Holdings (HKG:2128) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like China Lesso Group Holdings (HKG:2128), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for China Lesso Group Holdings

How Quickly Is China Lesso Group Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, China Lesso Group Holdings has grown EPS by 21% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

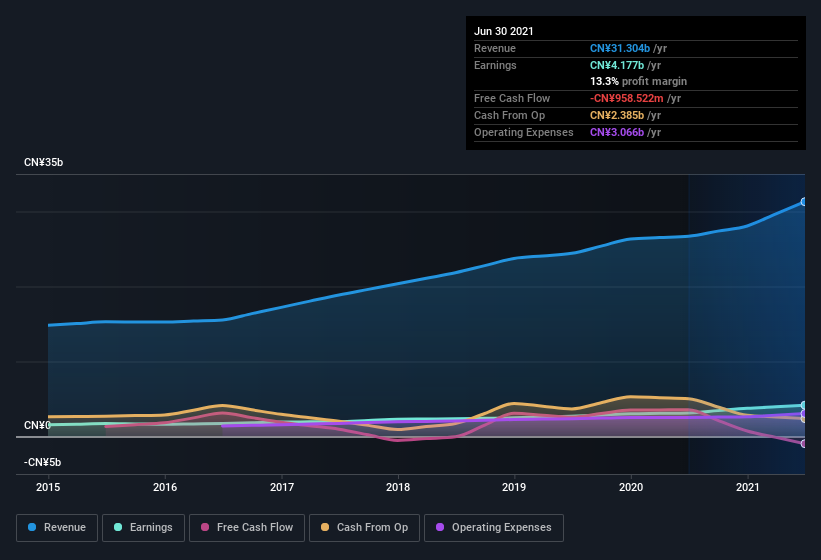

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). China Lesso Group Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to CN¥31b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for China Lesso Group Holdings.

Are China Lesso Group Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for China Lesso Group Holdings shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Independent Non-Executive Director Zhigang Tao bought CN¥369k worth of shares at an average price of around CN¥12.30.

And the insider buying isn't the only sign of alignment between shareholders and the board, since China Lesso Group Holdings insiders own more than a third of the company. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping CN¥25b. Now that's what I call some serious skin in the game!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Manlun Zuo is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like China Lesso Group Holdings with market caps between CN¥13b and CN¥41b is about CN¥4.2m.

The CEO of China Lesso Group Holdings only received CN¥1.7m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is China Lesso Group Holdings Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about China Lesso Group Holdings's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 2 warning signs for China Lesso Group Holdings (1 is significant!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of China Lesso Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2128

China Lesso Group Holdings

An investment holding company, manufactures and sells piping and building materials in China and internationally.

Average dividend payer and fair value.

Market Insights

Community Narratives