- Japan

- /

- Trade Distributors

- /

- TSE:3166

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of rising U.S. Treasury yields, fluctuating consumer confidence, and geopolitical uncertainties, investors are increasingly seeking stability through dividend stocks. In the context of these market dynamics, selecting stocks with a strong history of consistent payouts can offer a reliable income stream and potentially mitigate some market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ten Pao Group Holdings (SEHK:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ten Pao Group Holdings Limited is an investment holding company that develops, manufactures, and sells electric charging products across China, Asia, the United States, Europe, Africa, and internationally with a market cap of approximately HK$1.55 billion.

Operations: Ten Pao Group Holdings Limited's revenue segments include Telecommunication (HK$1.46 billion), Smart Chargers and Controllers (HK$1.81 billion), New Energy Business (HK$820.12 million), Media and Entertainment (HK$370.37 million), and Lighting (HK$298.56 million).

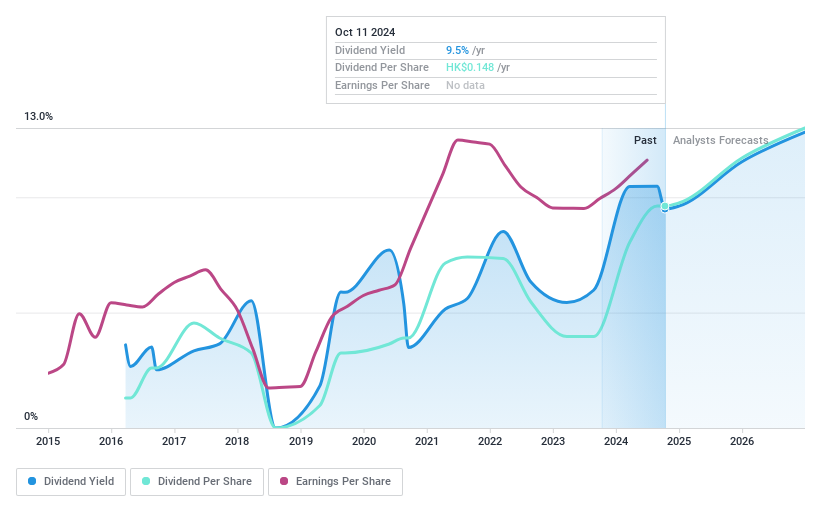

Dividend Yield: 9.9%

Ten Pao Group Holdings offers a high dividend yield of 9.87%, placing it in the top 25% of dividend payers in Hong Kong. Despite this attractive yield, its dividend history is less stable, having been volatile over its nine-year payment history. The dividends are well-covered by earnings and cash flows, with payout ratios at 41.4% and 37.1%, respectively. Currently trading significantly below estimated fair value, it presents a good relative value proposition compared to peers and industry standards.

- Unlock comprehensive insights into our analysis of Ten Pao Group Holdings stock in this dividend report.

- Our expertly prepared valuation report Ten Pao Group Holdings implies its share price may be lower than expected.

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company involved in the manufacture, wholesale, trading, and distribution of sofas and ancillary products across China, Europe, Vietnam, Mexico, and other international markets with a market cap of HK$18.46 billion.

Operations: Man Wah Holdings Limited generates revenue from several segments, including HK$12.30 billion from Sofa and Ancillary Products, HK$2.71 billion from Bedding and Ancillary Products, and HK$747.24 million from the Home Group Business.

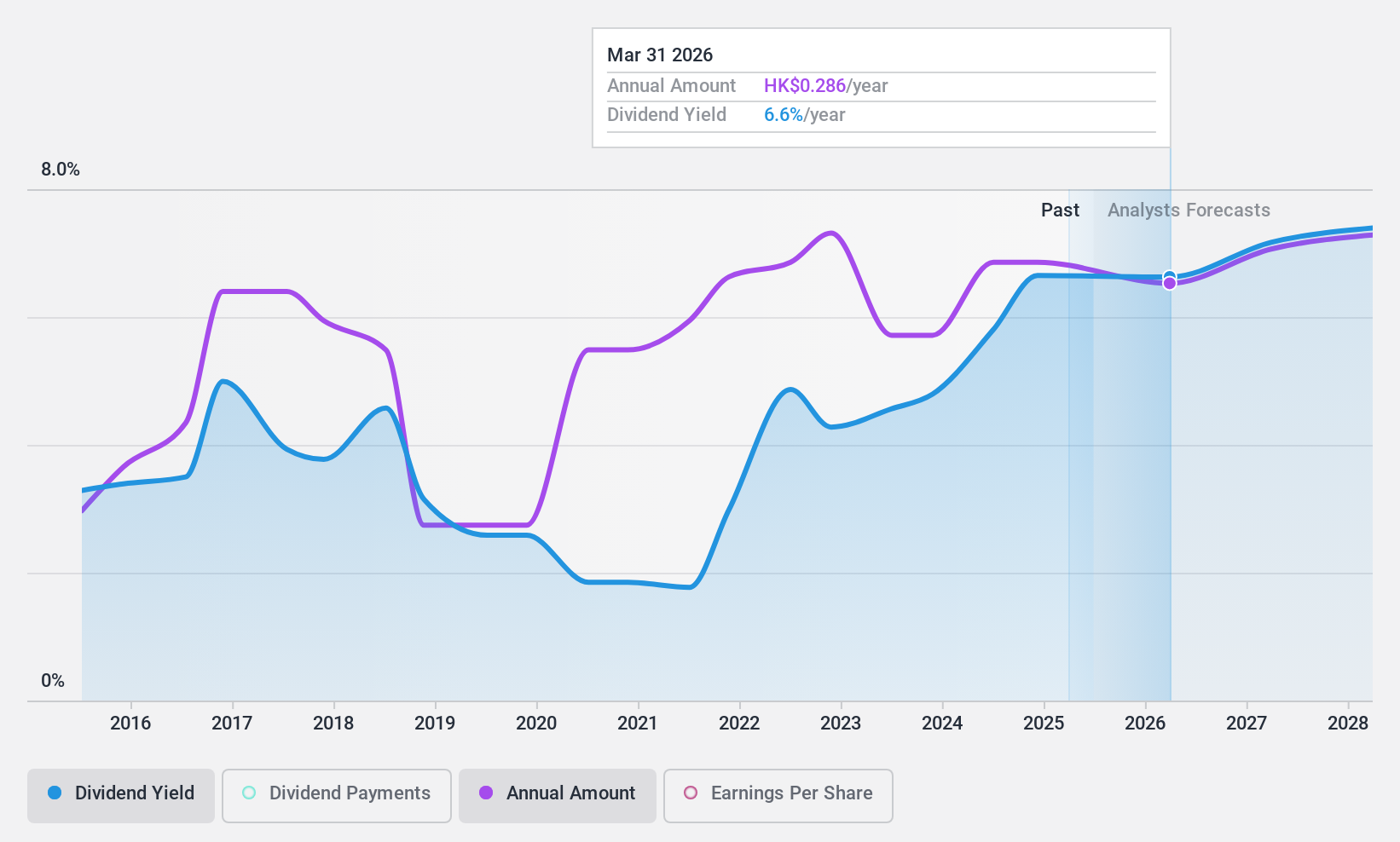

Dividend Yield: 6.3%

Man Wah Holdings, trading at a significant discount to estimated fair value, declared an interim dividend of HK$0.15 per share for the period ending September 2024. Despite a volatile and historically unreliable dividend record, recent payments are covered by earnings (payout ratio: 50.5%) and cash flows (cash payout ratio: 61.9%). Earnings have shown modest growth, with net income slightly increasing year-over-year to HK$1.14 billion despite lower sales figures.

- Navigate through the intricacies of Man Wah Holdings with our comprehensive dividend report here.

- Our valuation report unveils the possibility Man Wah Holdings' shares may be trading at a discount.

Ochi Holdings (TSE:3166)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ochi Holdings Co., Ltd., with a market cap of ¥17.55 billion, operates through its subsidiaries to trade building materials in Japan.

Operations: Ochi Holdings Co., Ltd. generates revenue through its subsidiaries by trading building materials within Japan.

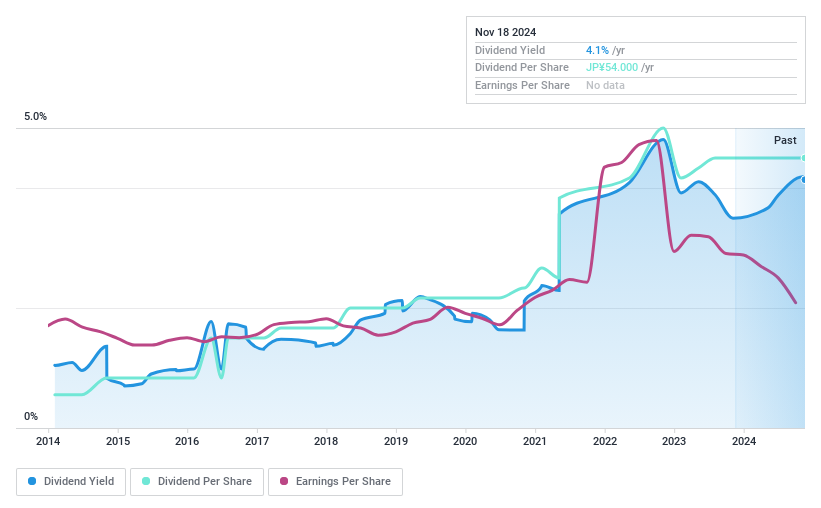

Dividend Yield: 4%

Ochi Holdings' dividend yield of 3.99% ranks in the top 25% in Japan, but its sustainability is questionable due to a high cash payout ratio (99.5%), indicating dividends are not well-covered by cash flows. While dividends have increased over the past decade, they have been volatile and unreliable. The company's financials are impacted by significant one-off items, and it trades at a 25.3% discount to estimated fair value.

- Click here to discover the nuances of Ochi Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Ochi Holdings' share price might be too pessimistic.

Where To Now?

- Click through to start exploring the rest of the 1946 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3166

Ochi Holdings

Through its subsidiaries, trades in building materials in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives