Haitian International Holdings Limited Just Reported And Analysts Have Been Cutting Their Estimates

As you might know, Haitian International Holdings Limited (HKG:1882) last week released its latest yearly, and things did not turn out so great for shareholders. Results look to have been somewhat negative - revenue fell 3.8% short of analyst estimates at CN¥9.8b, and statutory earnings of CN¥1.10 per share missed forecasts by 2.5%. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Haitian International Holdings

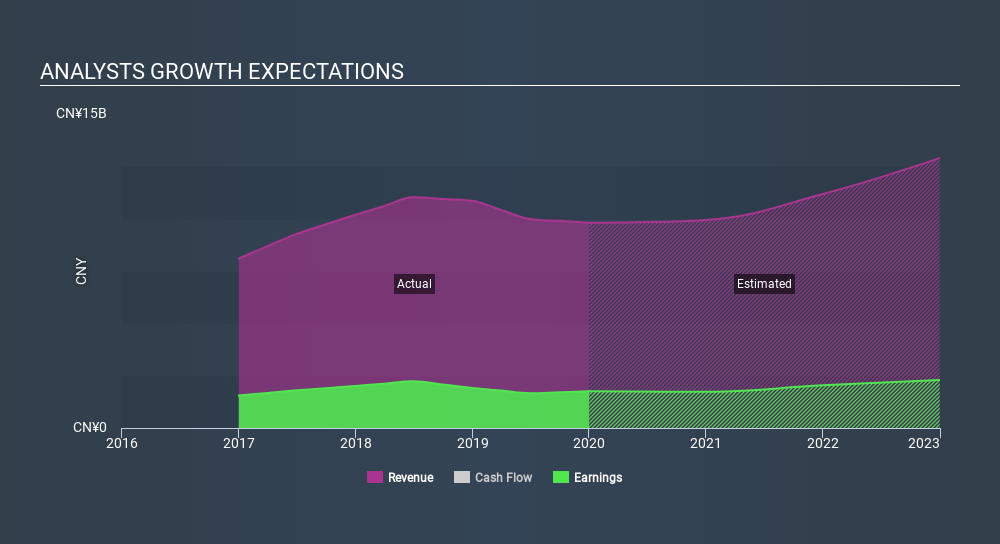

Taking into account the latest results, Haitian International Holdings's six analysts currently expect revenues in 2020 to be CN¥9.94b, approximately in line with the last 12 months. Statutory per-share earnings are expected to be CN¥1.08, roughly flat on the last 12 months. Before this earnings report, analysts had been forecasting revenues of CN¥11.0b and earnings per share (EPS) of CN¥1.27 in 2020. Analysts seem less optimistic after the recent results, reducing their sales forecasts and making a substantial drop in earnings per share forecasts.

The consensus price target fell 8.4% to CN¥17.19, with the weaker earnings outlook clearly leading analyst valuation estimates. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Haitian International Holdings at CN¥21.74 per share, while the most bearish prices it at CN¥12.82. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that analysts expect Haitian International Holdings's revenue growth will slow down substantially, with revenues next year expected to grow 1.3%, compared to a historical growth rate of 8.7% over the past five years. Compare this against other companies (with analyst forecasts) in the market, which are in aggregate expected to see revenue growth of 12% next year. So it's pretty clear that, while revenue growth is expected to slow down, analysts still expect the wider market to grow faster than Haitian International Holdings.

The Bottom Line

The most important thing to take away is that analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, analysts also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider market. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target fell measurably, with analysts seemingly not reassured by the latest results, leading to a lower estimate of Haitian International Holdings's future valuation.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Haitian International Holdings going out to 2022, and you can see them free on our platform here.

You can also see our analysis of Haitian International Holdings's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in manufacturing, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives