Does Haitian International Holdings (HKG:1882) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Haitian International Holdings (HKG:1882). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Haitian International Holdings' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Haitian International Holdings grew its EPS by 7.4% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

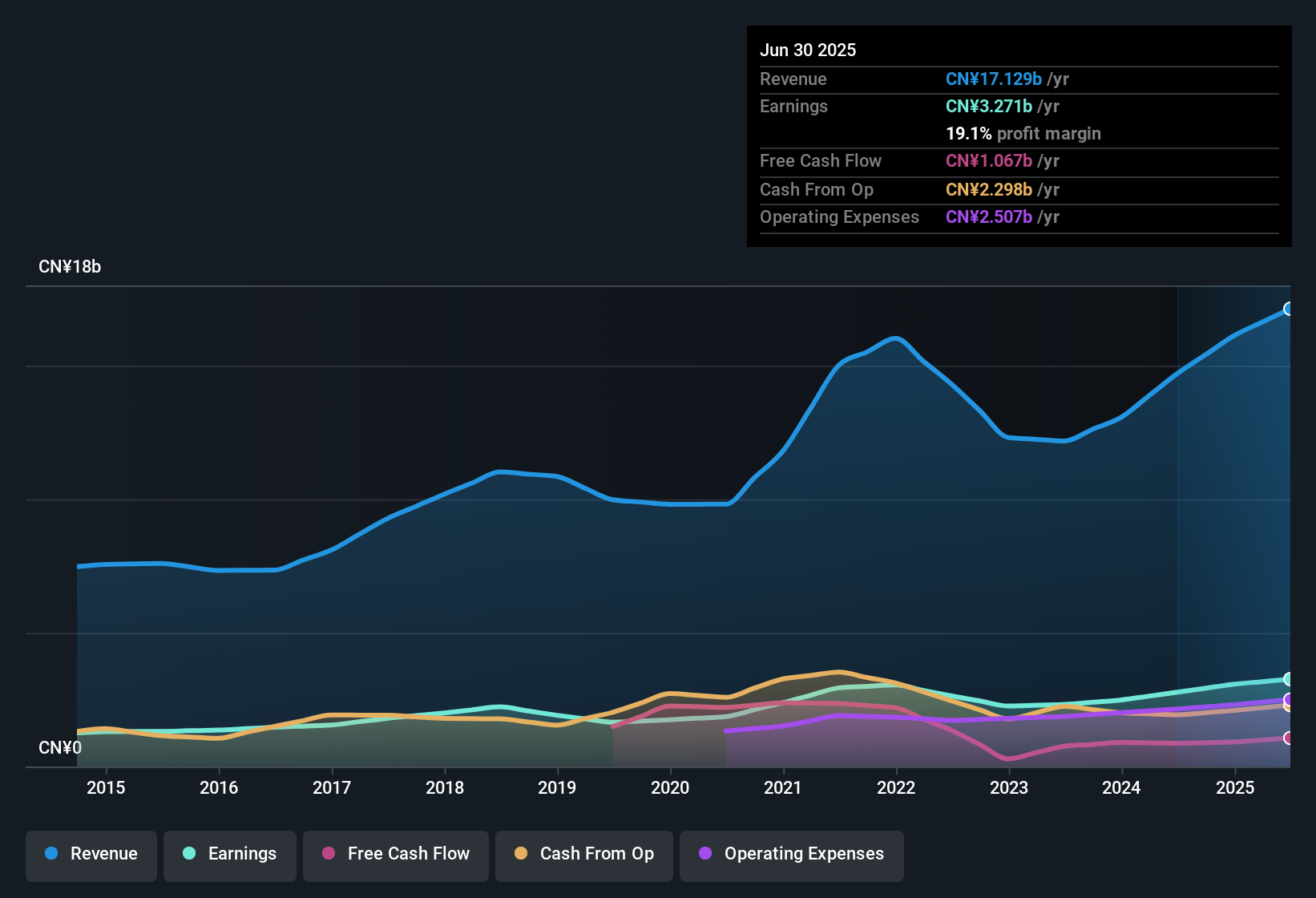

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Haitian International Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to CN¥17b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Check out our latest analysis for Haitian International Holdings

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Haitian International Holdings' future EPS 100% free.

Are Haitian International Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Haitian International Holdings insiders spent a whopping CN¥42m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the Senior VP of Sales & Marketing, Jianfeng Zhang, who made the biggest single acquisition, paying HK$30m for shares at about HK$19.73 each.

Along with the insider buying, another encouraging sign for Haitian International Holdings is that insiders, as a group, have a considerable shareholding. To be specific, they have CN¥147m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Bin Zhang is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Haitian International Holdings, with market caps between CN¥14b and CN¥46b, is around CN¥4.0m.

Haitian International Holdings' CEO took home a total compensation package of CN¥1.9m in the year prior to December 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Haitian International Holdings Worth Keeping An Eye On?

One important encouraging feature of Haitian International Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 1 warning sign for Haitian International Holdings that you need to be mindful of.

Keen growth investors love to see insider activity. Thankfully, Haitian International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Haitian International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in the manufacture, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives