- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1848

Analysts Just Made An Upgrade To Their China Aircraft Leasing Group Holdings Limited (HKG:1848) Forecasts

China Aircraft Leasing Group Holdings Limited (HKG:1848) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

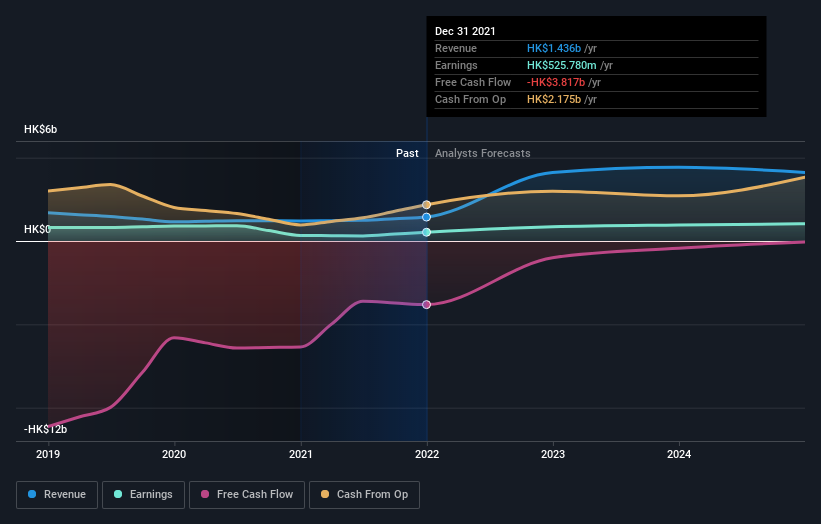

After this upgrade, China Aircraft Leasing Group Holdings' four analysts are now forecasting revenues of HK$4.0b in 2022. This would be a major 181% improvement in sales compared to the last 12 months. Per-share earnings are expected to shoot up 51% to HK$1.07. Prior to this update, the analysts had been forecasting revenues of HK$3.5b and earnings per share (EPS) of HK$1.02 in 2022. The forecasts seem more optimistic now, with a nice gain to revenue and a modest lift to earnings per share estimates.

See our latest analysis for China Aircraft Leasing Group Holdings

As a result, it might be a surprise to see that the analysts have cut their price target 6.9% to HK$6.82, which could suggest the forecast improvement in performance is not expected to last. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic China Aircraft Leasing Group Holdings analyst has a price target of HK$8.40 per share, while the most pessimistic values it at HK$5.40. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that China Aircraft Leasing Group Holdings' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 181% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 2.4% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 2.3% annually. So it looks like China Aircraft Leasing Group Holdings is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The declining price target is a puzzle, but still - with a serious upgrade to this year's expectations, it might be time to take another look at China Aircraft Leasing Group Holdings.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 4 potential warning signs with China Aircraft Leasing Group Holdings, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 3 other warning signs we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1848

China Aircraft Leasing Group Holdings

An investment holding company, provides aircraft leasing services to airline companies in Mainland China and internationally.

High growth potential with acceptable track record.

Market Insights

Community Narratives