If You Had Bought CIMC Vehicles (Group) (HKG:1839) Stock A Year Ago, You Could Pocket A 15% Gain Today

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the CIMC Vehicles (Group) Co., Ltd. (HKG:1839) share price is 15% higher than it was a year ago, much better than the market return of around 2.5% (not including dividends) in the same period. That's a solid performance by our standards! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for CIMC Vehicles (Group)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, CIMC Vehicles (Group) actually shrank its EPS by 27%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We haven't seen CIMC Vehicles (Group) increase dividend payments yet, so the yield probably hasn't helped drive the share higher. It saw it's revenue decline by 15% over twelve months. It's fair to say we're a little surprised to see the share price up, and that makes us cautious.

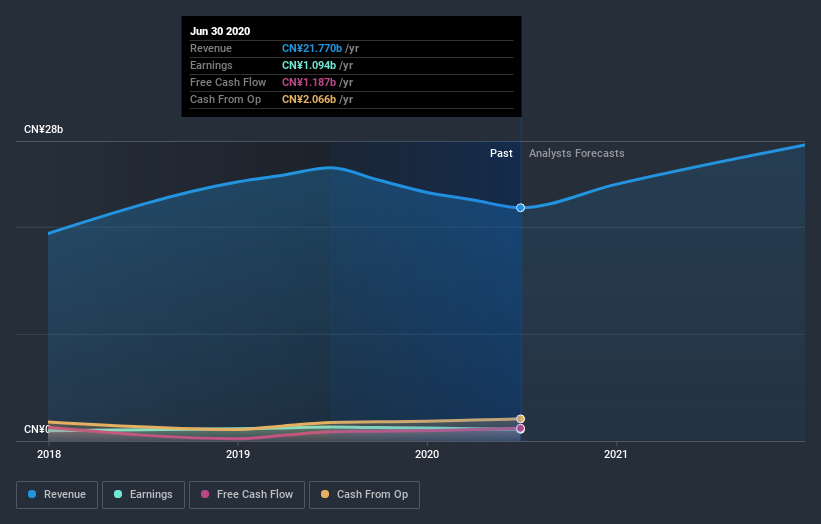

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling CIMC Vehicles (Group) stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of CIMC Vehicles (Group), it has a TSR of 26% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

CIMC Vehicles (Group) boasts a total shareholder return of 26% for the last year (that includes the dividends) . The more recent returns haven't been as impressive as the longer term returns, coming in at just 2.7%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand CIMC Vehicles (Group) better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for CIMC Vehicles (Group) you should be aware of.

Of course CIMC Vehicles (Group) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade CIMC Vehicles (Group), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1839

CIMC Vehicles (Group)

Designs, develops, produces, and sells specialty vehicles, semi-trailers, spare parts, and related technical services in China.

Flawless balance sheet with solid track record.