- Hong Kong

- /

- Construction

- /

- SEHK:1735

Getting In Cheap On Central New Energy Holding Group Limited (HKG:1735) Might Be Difficult

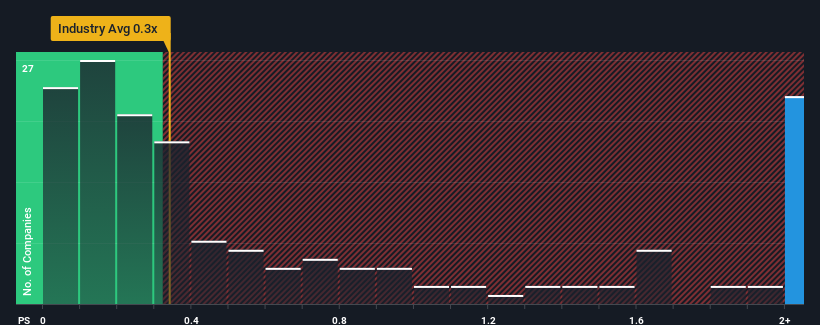

When close to half the companies in the Construction industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.3x, you may consider Central New Energy Holding Group Limited (HKG:1735) as a stock to avoid entirely with its 7.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Central New Energy Holding Group

What Does Central New Energy Holding Group's P/S Mean For Shareholders?

Recent times have been quite advantageous for Central New Energy Holding Group as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Central New Energy Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Central New Energy Holding Group?

Central New Energy Holding Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 102% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Central New Energy Holding Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Central New Energy Holding Group's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Central New Energy Holding Group revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Central New Energy Holding Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1735

Central New Energy Holding Group

An investment holding company, engages in the business of foundation, superstructure building, and other construction works in Hong Kong and the People’s Republic of China.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives