- Hong Kong

- /

- Construction

- /

- SEHK:1735

Central New Energy Holding Group Limited's (HKG:1735) P/S Is Still On The Mark Following 28% Share Price Bounce

Central New Energy Holding Group Limited (HKG:1735) shareholders have had their patience rewarded with a 28% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

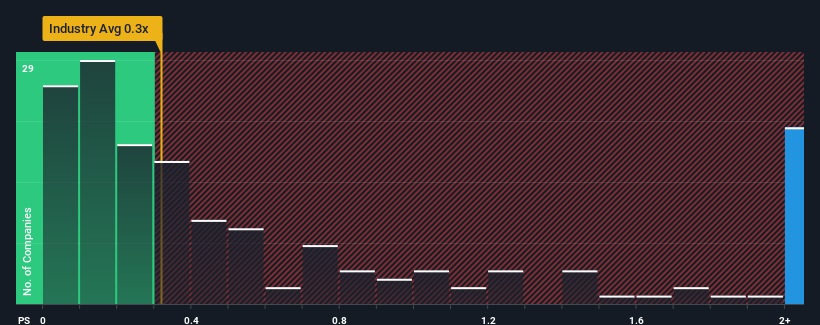

Since its price has surged higher, you could be forgiven for thinking Central New Energy Holding Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.1x, considering almost half the companies in Hong Kong's Construction industry have P/S ratios below 0.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Central New Energy Holding Group

How Has Central New Energy Holding Group Performed Recently?

With revenue growth that's exceedingly strong of late, Central New Energy Holding Group has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Central New Energy Holding Group will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Central New Energy Holding Group?

Central New Energy Holding Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 150%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Central New Energy Holding Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Central New Energy Holding Group's P/S

Central New Energy Holding Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Central New Energy Holding Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Central New Energy Holding Group is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1735

Central New Energy Holding Group

An investment holding company, engages in the business of foundation, superstructure building, and other construction works in Hong Kong and the People’s Republic of China.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives