E-Commodities Holdings And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst the backdrop of heightened global trade concerns and economic uncertainty, Asian markets have been navigating a complex landscape influenced by recent tariff announcements. In such a volatile environment, investors often seek opportunities that promise potential growth despite the risks involved. Penny stocks, though considered niche and somewhat outdated in terminology, continue to represent an intriguing investment area for those willing to explore smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.96 | THB10.02B | ✅ 3 ⚠️ 3 View Analysis > |

| Interlink Telecom (SET:ITEL) | THB1.22 | THB1.69B | ✅ 4 ⚠️ 5 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.345 | SGD139.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.175 | SGD34.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.94 | SGD7.65B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$2.80 | HK$1.15B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$45.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$738.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.09 | HK$1.82B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.87 | CN¥3.32B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,165 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, along with its subsidiaries, is involved in the processing and trading of coal and other products, with a market capitalization of approximately HK$2.18 billion.

Operations: The company generates revenue through two main segments: HK$4.92 billion from rendering integrated supply chain services and HK$35.22 billion from processing and trading coal and other products.

Market Cap: HK$2.18B

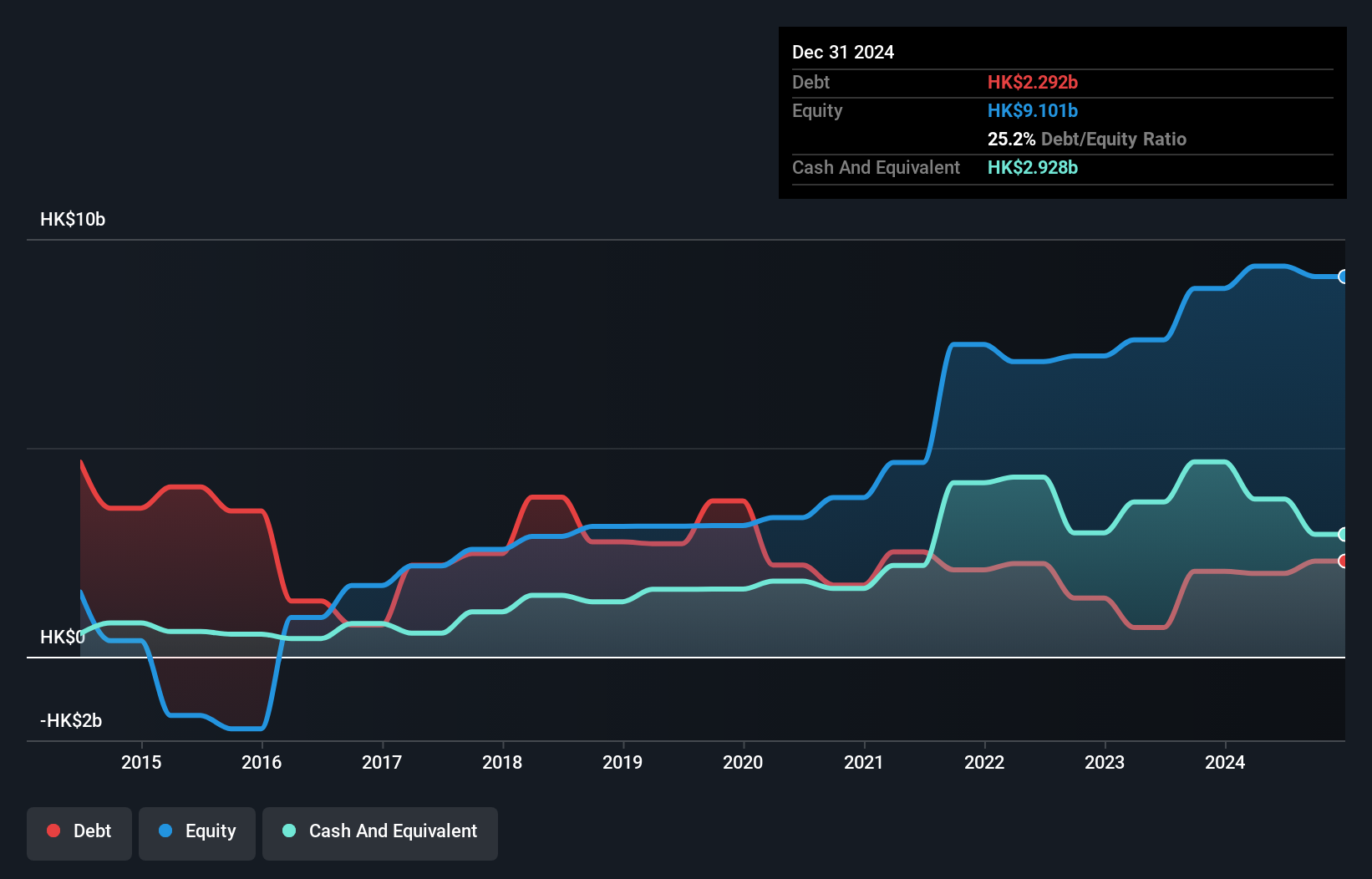

E-Commodities Holdings Limited, with a market cap of HK$2.18 billion, faces challenges from declining coking coal prices and geopolitical tensions impacting supply chains. Despite this, it maintains strong cash flow coverage for its debt and has reduced its debt-to-equity ratio significantly over five years. The company reported HK$39.17 billion in sales for 2024 but experienced a drop in net income to HK$921.53 million due to shrinking profit margins and unstable dividends. While trading below estimated fair value, its earnings growth has been negative recently, contrasting with past profitability improvements.

- Take a closer look at E-Commodities Holdings' potential here in our financial health report.

- Learn about E-Commodities Holdings' historical performance here.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and international markets with a market cap of HK$1.54 billion.

Operations: The company's revenue is derived from three main segments: Branded Medicines (HK$215.22 million), Health and Wellness Products (HK$85.81 million), and Proprietary Chinese Medicines (HK$419.51 million).

Market Cap: HK$1.54B

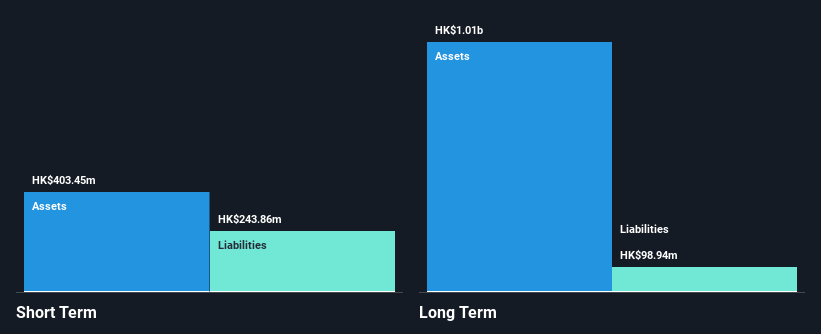

JBM (Healthcare) Limited, with a market cap of HK$1.54 billion, demonstrates financial stability and growth potential within its sector. Its earnings have grown significantly by 67.2% over the past year, surpassing industry averages. The company's debt management is robust, with more cash than total debt and a reduced debt-to-equity ratio from 161.7% to 6.6% over five years. JBM's interest payments are well covered by EBIT at 29.3x coverage, while operating cash flow covers debt at 373.5%. Despite a low return on equity of 16.1%, its profit margins improved to 22.7%, indicating efficient operations and high-quality earnings without shareholder dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of JBM (Healthcare).

- Explore JBM (Healthcare)'s analyst forecasts in our growth report.

Xiwang FoodstuffsLtd (SZSE:000639)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiwang Foodstuffs Co., Ltd. operates in China, focusing on the research, development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements with a market capitalization of CN¥3.07 billion.

Operations: No specific revenue segments are reported for Xiwang Foodstuffs Co., Ltd.

Market Cap: CN¥3.07B

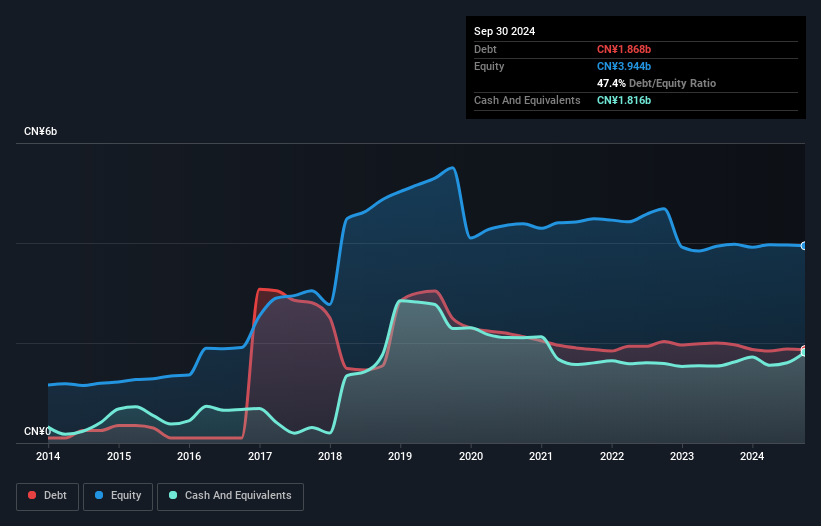

Xiwang Foodstuffs Co., Ltd. faces challenges with a net loss of CN¥443.57 million for 2024, up from CN¥16.87 million the previous year, reflecting its unprofitable status despite reducing losses by 13% annually over five years. The company's financial structure is stable, with short-term assets of CN¥3 billion exceeding both short and long-term liabilities, while maintaining satisfactory debt levels at a net debt to equity ratio of 1.3%. Recent acquisition activity saw insiders acquire a 3.35% stake for approximately CN¥110 million, suggesting confidence in future prospects despite current profitability issues and limited cash flow coverage for debt obligations at only 12.5%.

- Dive into the specifics of Xiwang FoodstuffsLtd here with our thorough balance sheet health report.

- Understand Xiwang FoodstuffsLtd's track record by examining our performance history report.

Where To Now?

- Dive into all 1,165 of the Asian Penny Stocks we have identified here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Xiwang FoodstuffsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000639

Xiwang FoodstuffsLtd

Engages in the research and development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives