- Hong Kong

- /

- Construction

- /

- SEHK:1718

These 4 Measures Indicate That Wan Kei Group Holdings (HKG:1718) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Wan Kei Group Holdings Limited (HKG:1718) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Wan Kei Group Holdings

What Is Wan Kei Group Holdings's Debt?

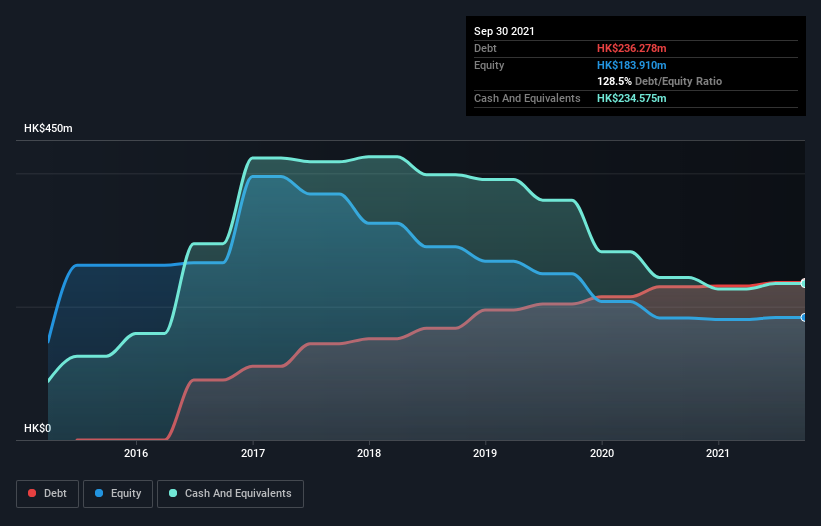

The chart below, which you can click on for greater detail, shows that Wan Kei Group Holdings had HK$236.3m in debt in September 2021; about the same as the year before. On the flip side, it has HK$234.6m in cash leading to net debt of about HK$1.70m.

How Strong Is Wan Kei Group Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Wan Kei Group Holdings had liabilities of HK$278.5m due within 12 months and liabilities of HK$3.53m due beyond that. Offsetting these obligations, it had cash of HK$234.6m as well as receivables valued at HK$186.6m due within 12 months. So it can boast HK$139.2m more liquid assets than total liabilities.

This luscious liquidity implies that Wan Kei Group Holdings' balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. But either way, Wan Kei Group Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Given net debt is only 0.14 times EBITDA, it is initially surprising to see that Wan Kei Group Holdings's EBIT has low interest coverage of 0.48 times. So one way or the other, it's clear the debt levels are not trivial. We also note that Wan Kei Group Holdings improved its EBIT from a last year's loss to a positive HK$5.1m. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Wan Kei Group Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Wan Kei Group Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We weren't impressed with Wan Kei Group Holdings's interest cover, and its conversion of EBIT to free cash flow made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble staying on top of its total liabilities. Considering this range of data points, we think Wan Kei Group Holdings is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Wan Kei Group Holdings (of which 1 is a bit unpleasant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Wan Kei Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1718

Wan Kei Group Holdings

An investment holding company, provides foundation construction and ground investigation field works to public and private sectors in Hong Kong and Mainland China.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives