- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1660

Zhaobangji Lifestyle Holdings Limited (HKG:1660) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Those holding Zhaobangji Lifestyle Holdings Limited (HKG:1660) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

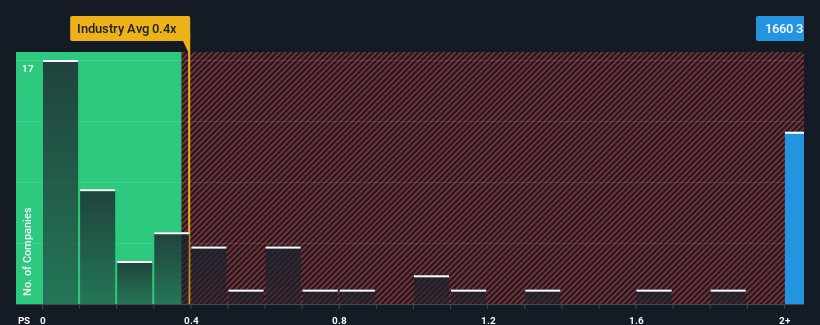

Following the firm bounce in price, you could be forgiven for thinking Zhaobangji Lifestyle Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Hong Kong's Trade Distributors industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Zhaobangji Lifestyle Holdings

What Does Zhaobangji Lifestyle Holdings' P/S Mean For Shareholders?

The recent revenue growth at Zhaobangji Lifestyle Holdings would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhaobangji Lifestyle Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Zhaobangji Lifestyle Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.6% last year. Revenue has also lifted 11% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Zhaobangji Lifestyle Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Zhaobangji Lifestyle Holdings' P/S

The strong share price surge has lead to Zhaobangji Lifestyle Holdings' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhaobangji Lifestyle Holdings revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Zhaobangji Lifestyle Holdings (including 1 which is potentially serious).

If you're unsure about the strength of Zhaobangji Lifestyle Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhaobangji Lifestyle Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1660

Zhaobangji Lifestyle Holdings

An investment holding company, engages in the trade and lease of machinery and spare parts in Hong Kong and the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives