- Hong Kong

- /

- Construction

- /

- SEHK:1500

Should You Be Adding In Construction Holdings (HKG:1500) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like In Construction Holdings (HKG:1500). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for In Construction Holdings

In Construction Holdings's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that In Construction Holdings grew its EPS from HK$0.027 to HK$0.10, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

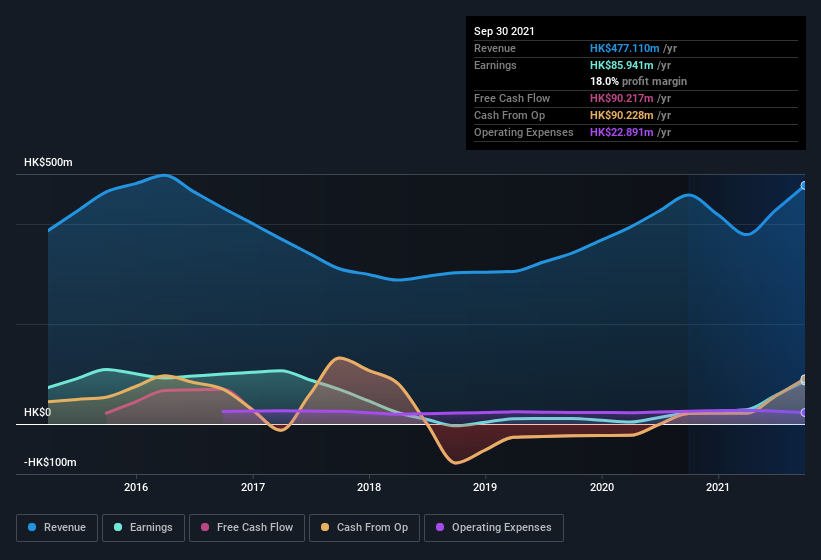

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. In Construction Holdings shareholders can take confidence from the fact that EBIT margins are up from 5.4% to 21%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In Construction Holdings isn't a huge company, given its market capitalization of HK$249m. That makes it extra important to check on its balance sheet strength.

Are In Construction Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling In Construction Holdings shares, in the last year. With that in mind, it's heartening that Chi Man Yau, the Independent Non-Executive Director of the company, paid HK$253k for shares at around HK$0.25 each.

On top of the insider buying, we can also see that In Construction Holdings insiders own a large chunk of the company. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about HK$185m riding on the stock, at current prices. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Pak Man Lau, is paid less than the median for similar sized companies. For companies with market capitalizations under HK$1.6b, like In Construction Holdings, the median CEO pay is around HK$1.8m.

In Construction Holdings offered total compensation worth HK$1.5m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does In Construction Holdings Deserve A Spot On Your Watchlist?

In Construction Holdings's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest In Construction Holdings belongs on the top of your watchlist. You still need to take note of risks, for example - In Construction Holdings has 4 warning signs (and 1 which is potentially serious) we think you should know about.

The good news is that In Construction Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1500

In Construction Holdings

An investment holding company, operates as a contractor in the foundation industry in Hong Kong.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives