- Hong Kong

- /

- Construction

- /

- SEHK:1500

Here's Why We Think In Construction Holdings (HKG:1500) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like In Construction Holdings (HKG:1500), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for In Construction Holdings

In Construction Holdings's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that In Construction Holdings's EPS went from HK$0.027 to HK$0.10 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

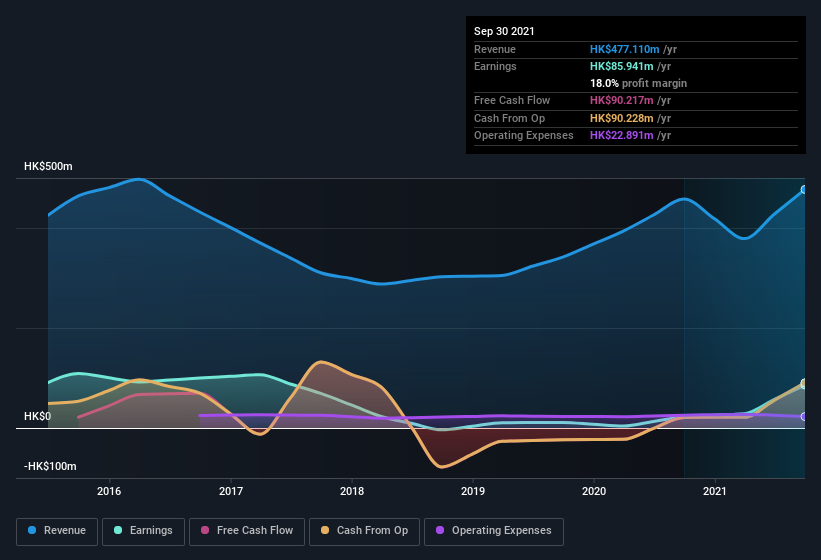

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that In Construction Holdings is growing revenues, and EBIT margins improved by 15.7 percentage points to 21%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since In Construction Holdings is no giant, with a market capitalization of HK$198m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are In Construction Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for In Construction Holdings shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Chi Man Yau, the Independent Non-Executive Director of the company, paid HK$346k for shares at around HK$0.24 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since In Construction Holdings insiders own more than a third of the company. Indeed, with a collective holding of 74%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have HK$147m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Pak Man Lau is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under HK$1.6b, like In Construction Holdings, the median CEO pay is around HK$1.8m.

The In Construction Holdings CEO received HK$1.5m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does In Construction Holdings Deserve A Spot On Your Watchlist?

In Construction Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest In Construction Holdings belongs on the top of your watchlist. Still, you should learn about the 4 warning signs we've spotted with In Construction Holdings (including 1 which is potentially serious) .

The good news is that In Construction Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1500

In Construction Holdings

An investment holding company, operates as a general and foundation contractor primarily in Hong Kong.

Adequate balance sheet low.

Market Insights

Community Narratives