- Hong Kong

- /

- Construction

- /

- SEHK:1499

Investors in OKG Technology Holdings (HKG:1499) from three years ago are still down 55%, even after 14% gain this past week

It's nice to see the OKG Technology Holdings Limited (HKG:1499) share price up 14% in a week. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 55% in that period. So it's good to see it climbing back up. After all, could be that the fall was overdone.

On a more encouraging note the company has added HK$102m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for OKG Technology Holdings

OKG Technology Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years OKG Technology Holdings saw its revenue shrink by 12% per year. That's not what investors generally want to see. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

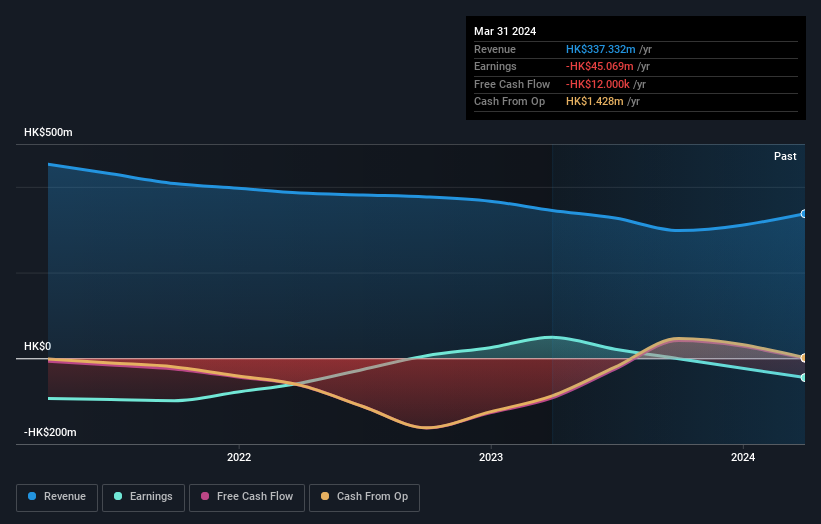

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on OKG Technology Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that OKG Technology Holdings shareholders are down 49% for the year. Unfortunately, that's worse than the broader market decline of 0.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand OKG Technology Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for OKG Technology Holdings you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1499

OKG Technology Holdings

An investment holding company, provides foundation works and ancillary services in the People’s Republic of China and Hong Kong.

Adequate balance sheet and slightly overvalued.