Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Chuan Holdings Limited (HKG:1420) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Chuan Holdings

How Much Debt Does Chuan Holdings Carry?

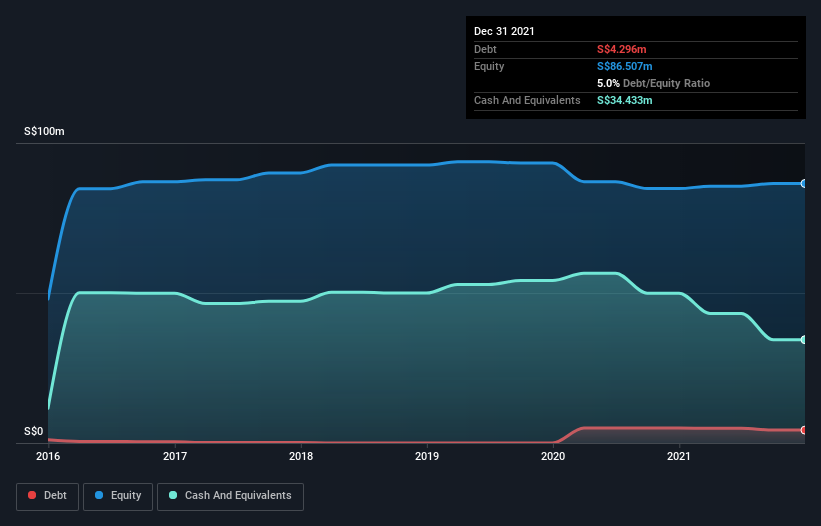

You can click the graphic below for the historical numbers, but it shows that Chuan Holdings had S$4.30m of debt in December 2021, down from S$5.00m, one year before. But it also has S$34.4m in cash to offset that, meaning it has S$30.1m net cash.

How Strong Is Chuan Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Chuan Holdings had liabilities of S$19.6m due within 12 months and liabilities of S$5.73m due beyond that. Offsetting this, it had S$34.4m in cash and S$42.8m in receivables that were due within 12 months. So it can boast S$51.9m more liquid assets than total liabilities.

This excess liquidity is a great indication that Chuan Holdings' balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, Chuan Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Chuan Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Chuan Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 18%, to S$85m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Chuan Holdings?

Although Chuan Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of S$1.5m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. There's no doubt the next few years will be crucial to how the business matures. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Chuan Holdings (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1420

Chuan Holdings

An investment holding company, provides general building and construction services in Singapore.

Excellent balance sheet and good value.