- China

- /

- Tech Hardware

- /

- SHSE:600734

Discover November 2024's Standout Penny Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of policy shifts and economic indicators, investors are keenly observing how these factors influence various sectors. Amidst this backdrop, penny stocks—often representing smaller or newer companies—remain a captivating area for those seeking potential growth at lower price points. While the term may seem outdated, the opportunities they present are still very much alive, especially when these stocks exhibit strong financials and robust fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR346.22M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Genetec Technology Berhad (KLSE:GENETEC) | MYR0.83 | MYR651.46M | ★★★★★★ |

Click here to see the full list of 5,801 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hao Tian International Construction Investment Group (SEHK:1341)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hao Tian International Construction Investment Group Limited is an investment holding company involved in the rental and trade of construction machinery across Hong Kong, the United Kingdom, China, Malaysia, Cambodia, and Macau with a market cap of HK$5.72 billion.

Operations: The company's revenue is primarily derived from the rental and sale of construction machinery and spare parts (HK$157 million), supplemented by money lending (HK$3 million), provision of repair, maintenance, and transportation services (HK$6 million), and asset management, securities brokerage, along with other financial services (HK$7 million).

Market Cap: HK$5.72B

Hao Tian International Construction Investment Group recently raised HK$609.69 million through a follow-on equity offering, indicating efforts to bolster its financial position amid ongoing unprofitability. Despite being added to the S&P Global BMI Index, the company faces challenges with a high net debt to equity ratio of 60.8% and increased weekly volatility from 14% to 19%. While short-term assets cover both short- and long-term liabilities, profitability remains elusive with losses growing by 45.4% annually over five years. The experienced management team may provide stability as they navigate these financial hurdles.

- Unlock comprehensive insights into our analysis of Hao Tian International Construction Investment Group stock in this financial health report.

- Review our historical performance report to gain insights into Hao Tian International Construction Investment Group's track record.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market cap of approximately HK$5.57 billion.

Operations: The company's revenue is primarily derived from three segments: Software and Operating Services (CN¥5.31 billion), Traditional and Localization Services (CN¥10.03 billion), and Big Data Products and Solutions (CN¥3.39 billion).

Market Cap: HK$5.57B

Digital China Holdings faces challenges with profitability, reporting a net income of CN¥10.81 million for the first half of 2024, down from CN¥40.36 million the previous year. The company's earnings are forecasted to grow significantly at over 60% annually, yet it remains unprofitable with negative return on equity and insufficient interest coverage by EBIT. Despite stable weekly volatility and satisfactory net debt to equity ratio of 18.9%, operating cash flow is negative, leaving debt poorly covered. Short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst competitive pressures affecting subsidiary performance.

- Click to explore a detailed breakdown of our findings in Digital China Holdings' financial health report.

- Evaluate Digital China Holdings' prospects by accessing our earnings growth report.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co.Ltd operates in China, providing anti-intrusion detection systems, with a market cap of CN¥9.50 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥9.5B

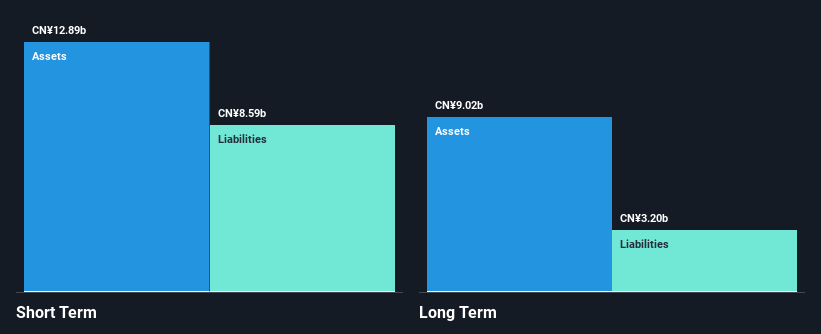

Fujian Start Group Co. Ltd has demonstrated significant earnings growth, with a 532.7% increase over the past year, surpassing its five-year average and industry growth rates. Despite this impressive performance, the company's revenue has decreased to CN¥63.49 million for the first nine months of 2024 from CN¥207.82 million a year ago, highlighting volatility in sales figures. The company maintains more cash than debt and short-term assets exceed liabilities, suggesting financial resilience; however, negative operating cash flow indicates challenges in covering debt obligations effectively. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Take a closer look at Fujian Start GroupLtd's potential here in our financial health report.

- Gain insights into Fujian Start GroupLtd's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Unlock our comprehensive list of 5,801 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fujian Start GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600734

Fujian Start GroupLtd

Provides anti-intrusion detection systems in China.

Proven track record with adequate balance sheet.