- Hong Kong

- /

- Electrical

- /

- SEHK:1133

Revenues Tell The Story For Harbin Electric Company Limited (HKG:1133) As Its Stock Soars 28%

Despite an already strong run, Harbin Electric Company Limited (HKG:1133) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

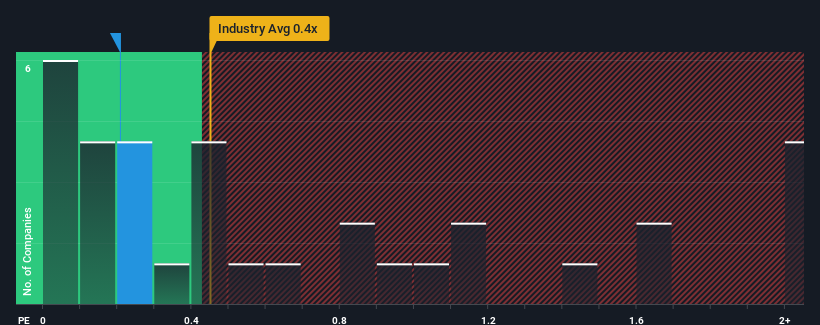

In spite of the firm bounce in price, it's still not a stretch to say that Harbin Electric's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Electrical industry in Hong Kong, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Harbin Electric

How Harbin Electric Has Been Performing

Recent revenue growth for Harbin Electric has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Harbin Electric's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

Harbin Electric's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Revenue has also lifted 19% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the two analysts watching the company. That's shaping up to be similar to the 17% each year growth forecast for the broader industry.

In light of this, it's understandable that Harbin Electric's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Harbin Electric's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Harbin Electric's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electrical industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Harbin Electric that you should be aware of.

If these risks are making you reconsider your opinion on Harbin Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1133

Harbin Electric

Manufactures and sells power plant equipment in the People’s Republic of China, the rest of Asia, Africa, Europe, and the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives