- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1130

Getting In Cheap On China Environmental Resources Group Limited (HKG:1130) Might Be Difficult

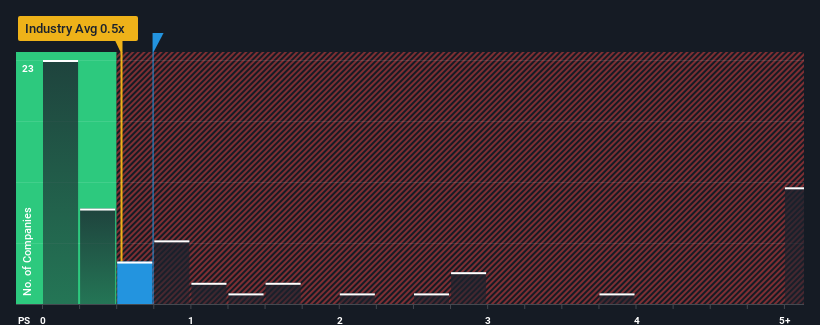

It's not a stretch to say that China Environmental Resources Group Limited's (HKG:1130) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the Trade Distributors industry in Hong Kong, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China Environmental Resources Group

How Has China Environmental Resources Group Performed Recently?

China Environmental Resources Group has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for China Environmental Resources Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

China Environmental Resources Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

It turns out the industry is also predicted to shrink 0.4% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

In light of this, it's understandable that China Environmental Resources Group's P/S sits in line with the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From China Environmental Resources Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of China Environmental Resources Group revealed its three-year contraction in revenue is resulting in a P/S that matches the industry, given the industry is also set to shrink at a similar rate. Right now shareholders are comfortable with the P/S as they seem confident future revenue won't throw up any further unpleasant surprises. Although, we are concerned whether the company's performance will worsen relative to other industry players under these tough industry conditions. In the meantime, unless the company's relative performance changes, the share price should find support at these levels.

You always need to take note of risks, for example - China Environmental Resources Group has 1 warning sign we think you should be aware of.

If you're unsure about the strength of China Environmental Resources Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1130

China Environmental Resources Group

An investment holding company, engages in the trading of motor vehicles and related accessories in the People’s Republic of China, Hong Kong, Macau, Taiwan, and Nepal.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives