- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1102

Investors Continue Waiting On Sidelines For Enviro Energy International Holdings Limited (HKG:1102)

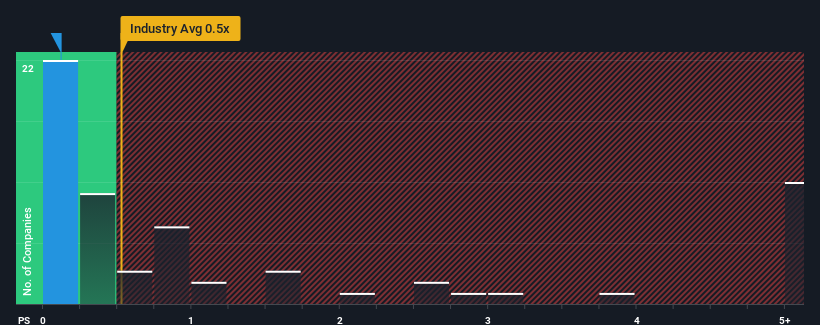

There wouldn't be many who think Enviro Energy International Holdings Limited's (HKG:1102) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Trade Distributors industry in Hong Kong is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Enviro Energy International Holdings

What Does Enviro Energy International Holdings' Recent Performance Look Like?

For example, consider that Enviro Energy International Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Enviro Energy International Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Enviro Energy International Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.5% shows it's a great look while it lasts.

With this in mind, we find it intriguing that Enviro Energy International Holdings' P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As mentioned previously, Enviro Energy International Holdings currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Enviro Energy International Holdings that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enviro Energy International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1102

Enviro Energy International Holdings

An investment holding company, trades in building materials in the People’s Republic of China and Hong Kong.

Excellent balance sheet low.

Market Insights

Community Narratives