As global markets edge toward record highs, driven by U.S. stock indexes and buoyed by easing trade tensions, investors are closely monitoring inflation data that could influence future monetary policy. In this environment of economic uncertainty and fluctuating interest rates, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive option for those seeking to balance growth with income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

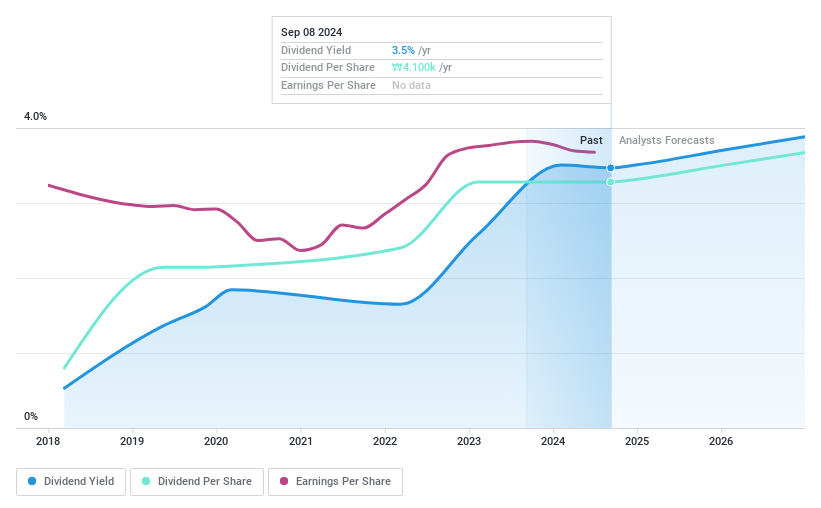

BGF retail (KOSE:A282330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BGF Retail Co., Ltd. operates convenience stores in South Korea and has a market cap of ₩1.81 trillion.

Operations: BGF Retail Co., Ltd. generates revenue primarily from its convenience store operations in South Korea, with a reported revenue of ₩8.70 billion.

Dividend Yield: 3.9%

BGF Retail's dividend yield of 3.94% places it in the top 25% of dividend payers in the South Korean market. The company's dividends are well covered, with a payout ratio of 37.2% and a cash payout ratio of 15.7%, indicating sustainability from both earnings and cash flows. Although BGF Retail has only paid dividends for seven years, these payments have been stable and reliable, with no significant volatility observed during this period.

- Delve into the full analysis dividend report here for a deeper understanding of BGF retail.

- According our valuation report, there's an indication that BGF retail's share price might be on the cheaper side.

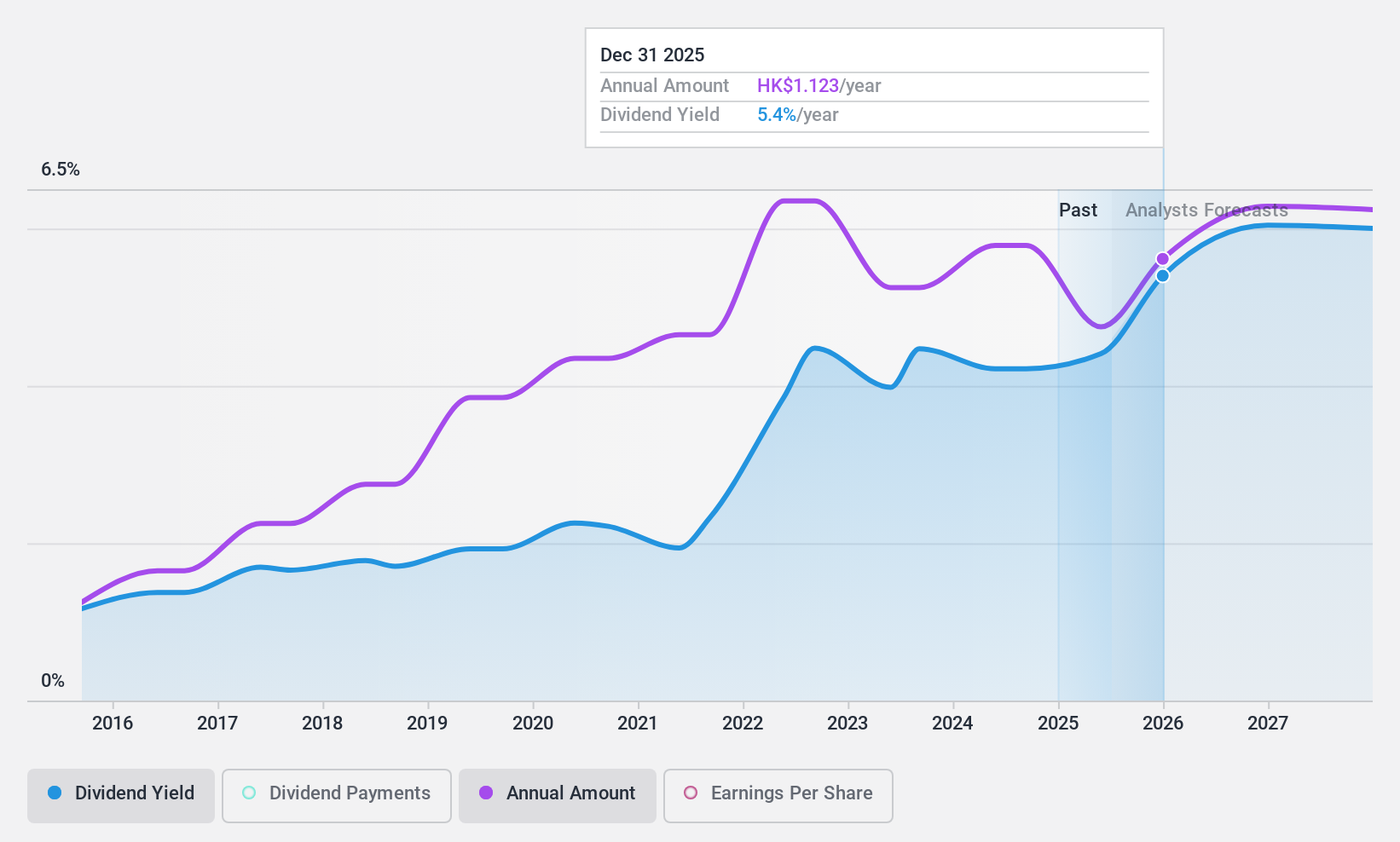

China Resources Gas Group (SEHK:1193)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Gas Group Limited is an investment holding company involved in the sale of natural and liquefied gas and the connection of gas pipelines, with a market cap of HK$61.78 billion.

Operations: China Resources Gas Group Limited's revenue segments include the sale and distribution of gas fuel and related products (excluding gas stations) at HK$87.31 billion, gas connection services at HK$9.65 billion, comprehensive services at HK$4.34 billion, gas stations at HK$3.23 billion, and design and construction services at HK$444.11 million.

Dividend Yield: 4.3%

China Resources Gas Group's dividend payments are covered by earnings and cash flows, with payout ratios of 55.5% and 61.6%, respectively, suggesting sustainability. However, dividends have been volatile over the past decade without consistent growth or stability. The yield is relatively low at 4.25% compared to Hong Kong's top payers. Recent executive changes include the appointment of Ms. Qin Yan as CEO in December 2024 and Mr. Fang Xin joining the board in January 2025, potentially impacting future strategies.

- Get an in-depth perspective on China Resources Gas Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that China Resources Gas Group's current price could be quite moderate.

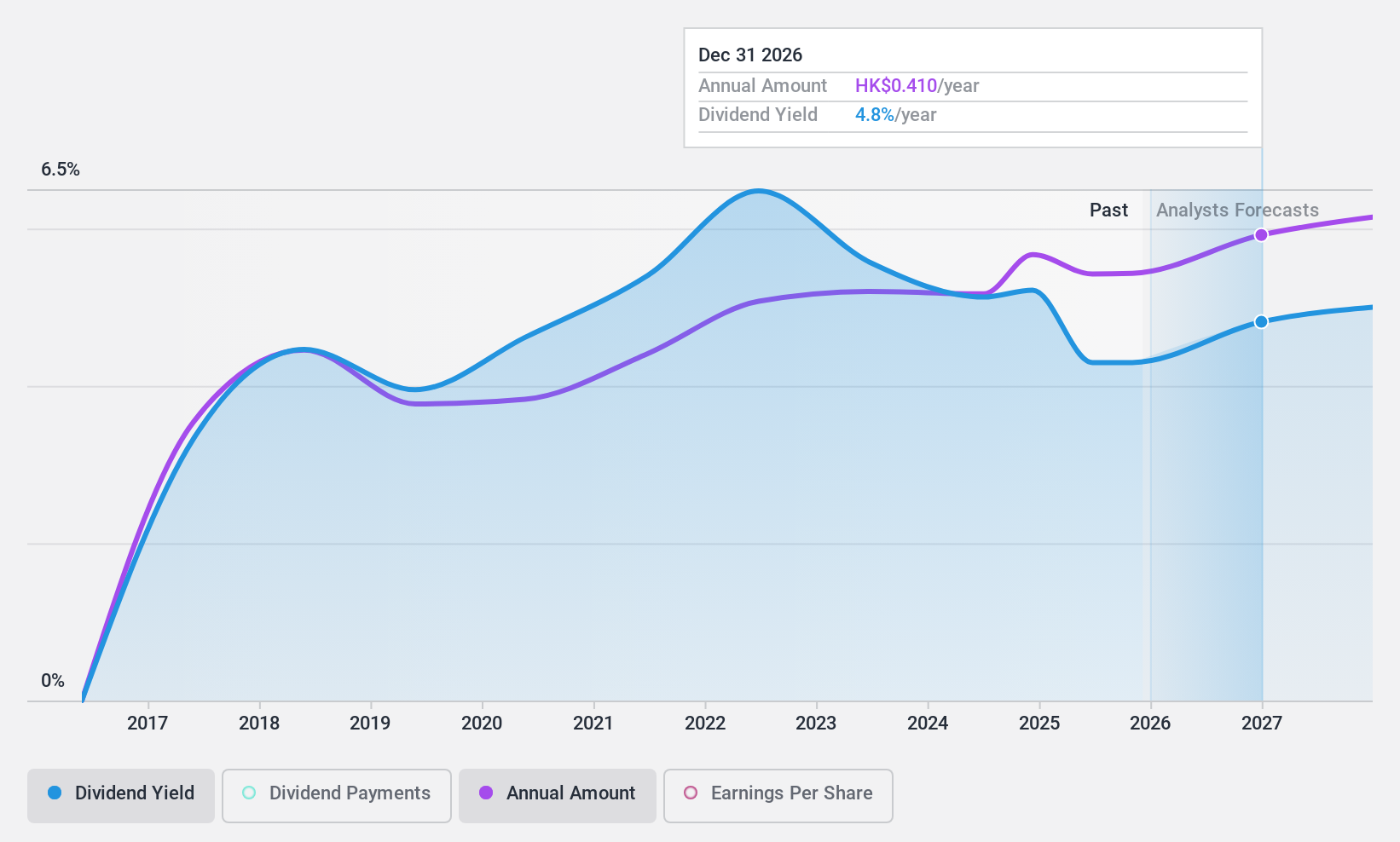

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both in the People’s Republic of China and internationally, with a market cap of HK$358.32 billion.

Operations: China CITIC Bank Corporation Limited generates revenue through its diverse banking products and services offered domestically and internationally.

Dividend Yield: 7.0%

China CITIC Bank's dividend is well covered by a low payout ratio of 41.8%, with future coverage expected to improve to 27.7% in three years. Despite this, its dividend payments have been unstable over the past decade, showing volatility but some growth during this period. The current yield of 6.95% is below the top quartile in Hong Kong's market, and recent earnings show modest growth with net income rising to CNY 68.58 billion for 2024 from CNY 67.02 billion in the previous year.

- Dive into the specifics of China CITIC Bank here with our thorough dividend report.

- The analysis detailed in our China CITIC Bank valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Take a closer look at our Top Dividend Stocks list of 1968 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:998

China CITIC Bank

Provides various banking products and services in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives