- Hong Kong

- /

- Gas Utilities

- /

- SEHK:2688

SEHK Dividend Stocks To Watch Featuring ENN Energy Holdings

Reviewed by Simply Wall St

As global markets experience fluctuations with rate cuts and economic data shaping investor sentiment, the Hong Kong market has shown resilience amidst these changes. For investors seeking stability and income, dividend stocks can be an attractive option in such a dynamic environment. A good dividend stock typically offers consistent payouts, solid financial health, and potential for long-term growth. In this article, we will explore three notable dividend stocks listed on the SEHK, including ENN Energy Holdings.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.61% | ★★★★★★ |

| Lenovo Group (SEHK:992) | 4.01% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 9.05% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.77% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.50% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.63% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.80% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.83% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 8.20% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.63% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top SEHK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ENN Energy Holdings (SEHK:2688)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Energy Holdings Limited is an investment holding company that focuses on the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China with a market cap of HK$53.01 billion.

Operations: ENN Energy Holdings Limited generates revenue from several segments, including Wholesale of Gas (CN¥40.99 billion), Value Added Business (CN¥7.74 billion), Retail Gas Sales Business (CN¥67.73 billion), Integrated Energy Business (CN¥15.95 billion), and Construction and Installation (CN¥5.58 billion).

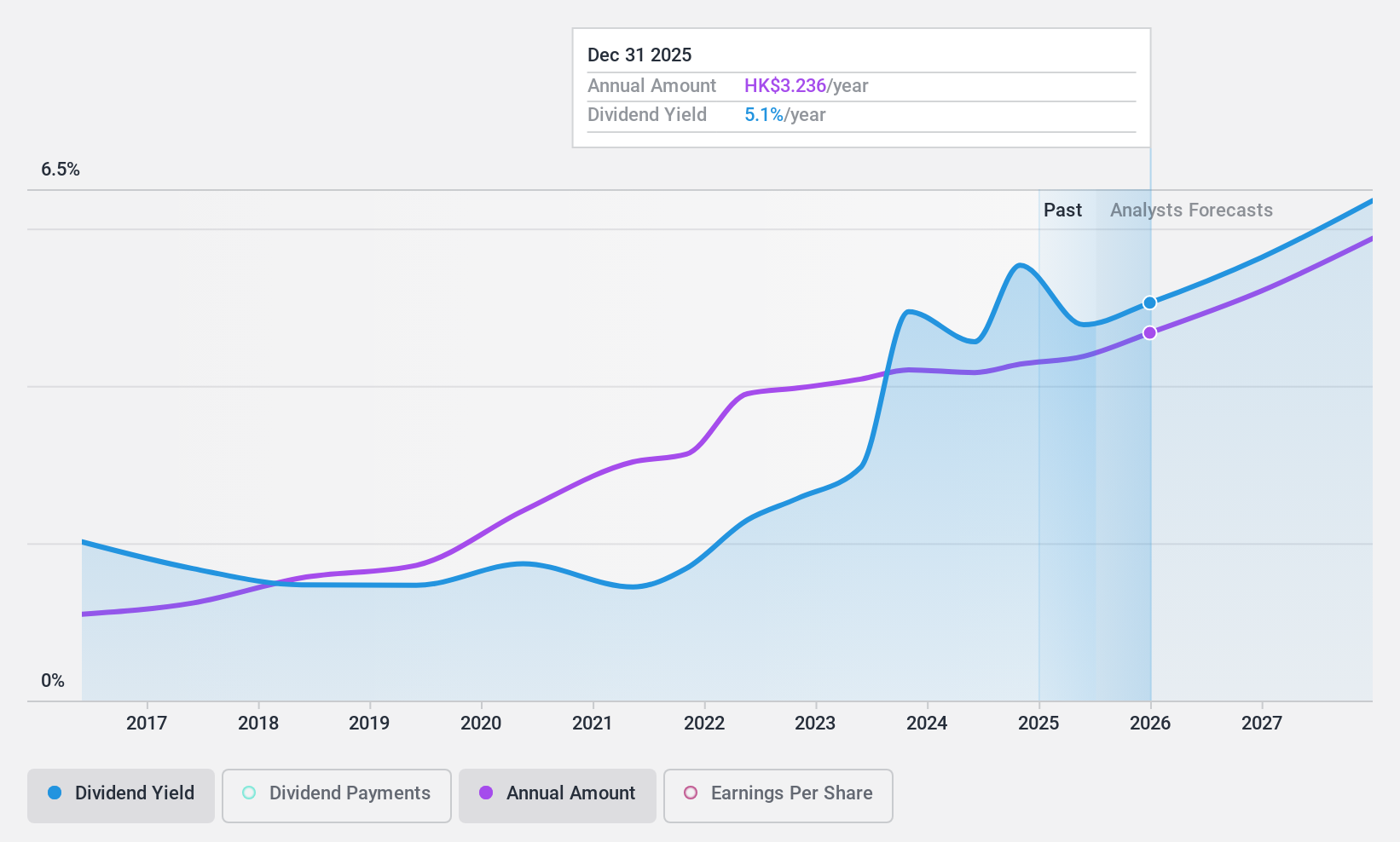

Dividend Yield: 6.2%

ENN Energy Holdings offers a dividend yield of 6.22%, which is lower than the top 25% of dividend payers in Hong Kong. The company has a stable and growing dividend history over the past decade, but its current high cash payout ratio (114.2%) raises concerns about sustainability. Recent results show mixed performance, with sales increasing but net income declining to CNY 2.57 billion from CNY 3.33 billion year-over-year, impacting earnings coverage for dividends.

- Take a closer look at ENN Energy Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ENN Energy Holdings is trading behind its estimated value.

Shanghai Industrial Holdings (SEHK:363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Industrial Holdings Limited is an investment holding company with a market cap of HK$11.81 billion, operating in infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare across Hong Kong, China, the rest of Asia, and internationally.

Operations: Shanghai Industrial Holdings Limited generates revenue from its Real Estate segment (HK$17.26 billion), Consumer Products segment (HK$3.59 billion), and Infrastructure and Environmental Protection segment (HK$9.42 billion).

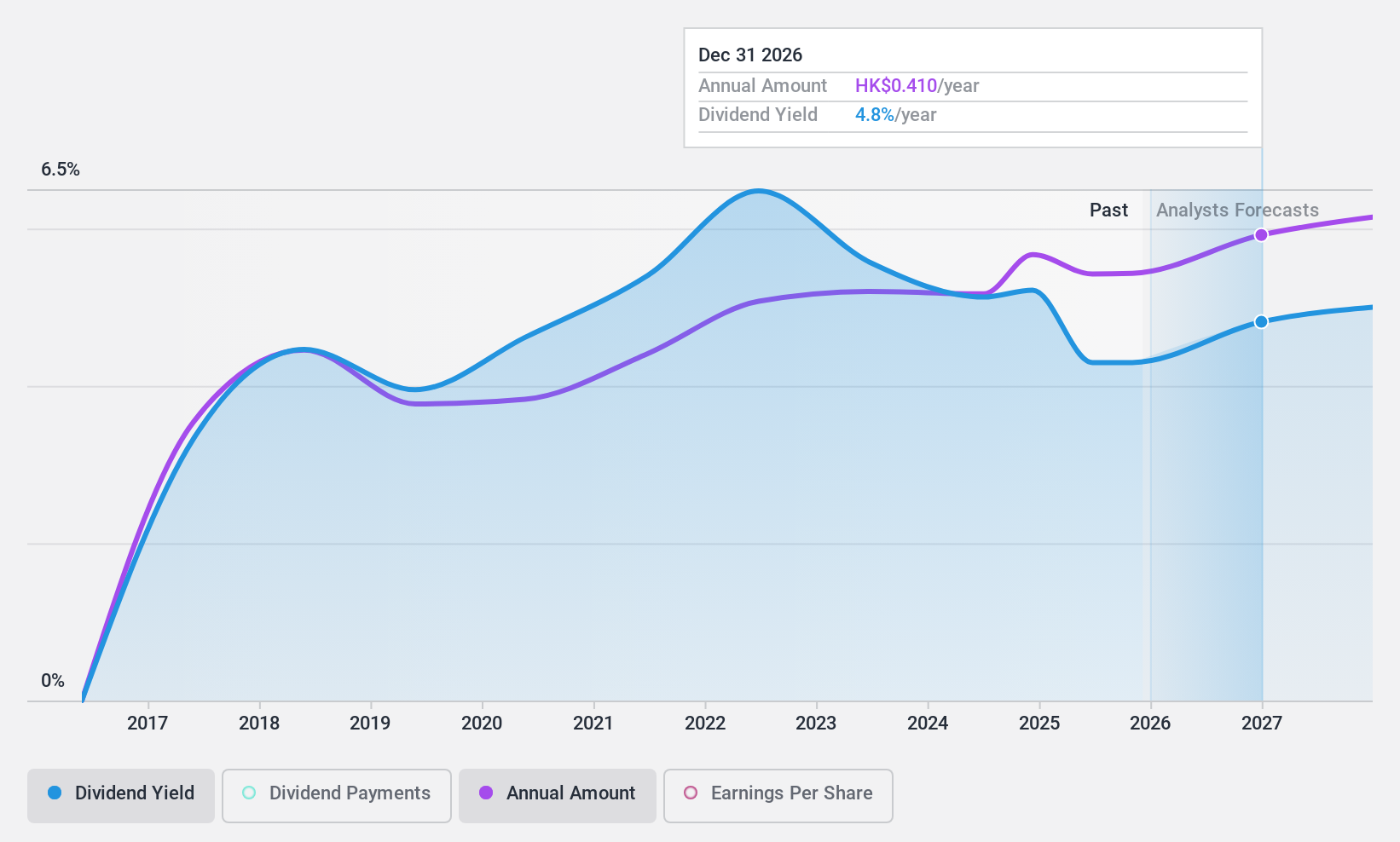

Dividend Yield: 8.7%

Shanghai Industrial Holdings offers a high dividend yield of 8.66%, placing it in the top 25% of dividend payers in Hong Kong. However, its dividends are not well covered by free cash flows, with a cash payout ratio of 109.4%. Despite a reasonably low payout ratio of 31.5%, the company's dividend payments have been volatile and unreliable over the past decade. Recent earnings showed a decline, with net income dropping to HK$1.20 billion from HK$1.38 billion year-over-year.

- Get an in-depth perspective on Shanghai Industrial Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shanghai Industrial Holdings' current price could be quite moderate.

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both within the People’s Republic of China and internationally, with a market cap of HK$313.30 billion.

Operations: China CITIC Bank Corporation Limited's revenue segments include CN¥41.32 billion from Personal Banking, CN¥76.07 billion from Corporate Banking, and CN¥25.62 billion from Treasury Operations.

Dividend Yield: 9%

China CITIC Bank's dividend yield is among the top 25% in Hong Kong, with recent interim dividends of RMB 1.847 per 10 shares announced for H1 2024. The bank's payout ratio is reasonably low at 41.4%, indicating dividends are well covered by earnings, and forecasts suggest continued coverage over the next three years. However, its dividend history has been volatile, and shareholders experienced dilution in the past year.

- Dive into the specifics of China CITIC Bank here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China CITIC Bank shares in the market.

Key Takeaways

- Reveal the 77 hidden gems among our Top SEHK Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ENN Energy Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ENN Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2688

ENN Energy Holdings

An investment holding company, engages in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives