China Bohai Bank Co., Ltd. (HKG:9668) Analysts Just Slashed This Year's Revenue Estimates By 11%

The analysts covering China Bohai Bank Co., Ltd. (HKG:9668) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

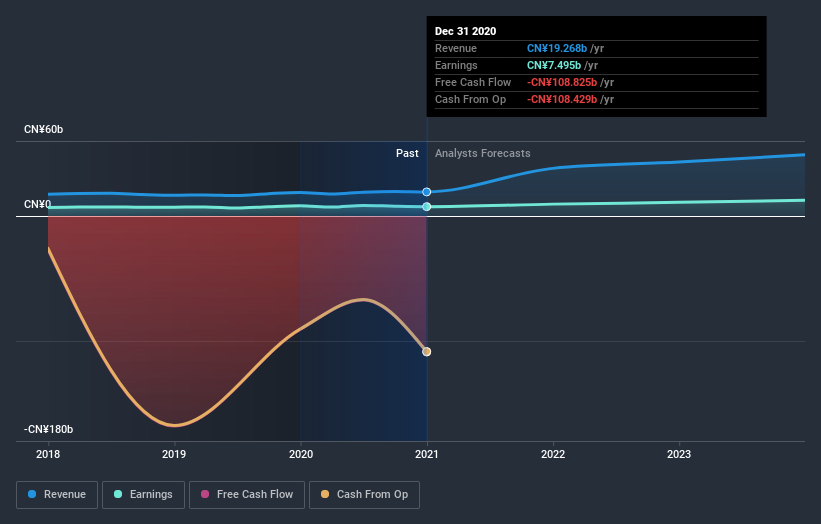

After the downgrade, the two analysts covering China Bohai Bank are now predicting revenues of CN¥38b in 2021. If met, this would reflect a major 98% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to climb 14% to CN¥0.54. Prior to this update, the analysts had been forecasting revenues of CN¥43b and earnings per share (EPS) of CN¥0.57 in 2021. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a substantial drop in revenue estimates and a small dip in EPS estimates to boot.

Check out our latest analysis for China Bohai Bank

The consensus price target fell 14% to CN¥4.07, with the weaker earnings outlook clearly leading analyst valuation estimates. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on China Bohai Bank, with the most bullish analyst valuing it at CN¥4.91 and the most bearish at CN¥4.81 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting China Bohai Bank is an easy business to forecast or the underlying assumptions are obvious.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the China Bohai Bank's past performance and to peers in the same industry. The analysts are definitely expecting China Bohai Bank's growth to accelerate, with the forecast 98% annualised growth to the end of 2021 ranking favourably alongside historical growth of 4.2% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that China Bohai Bank is expected to grow much faster than its industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for China Bohai Bank. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of China Bohai Bank's future valuation. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of China Bohai Bank going forwards.

There might be good reason for analyst bearishness towards China Bohai Bank, like concerns around earnings quality. For more information, you can click here to discover this and the 2 other flags we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade China Bohai Bank, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade China Bohai Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9668

China Bohai Bank

Provides various personal and corporate banking products and services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives