How Investors May Respond To China Construction Bank (SEHK:939) Balancing Interim Dividend And Social Commitments

Reviewed by Sasha Jovanovic

- China Construction Bank Corporation recently held an Extraordinary General Meeting where shareholders approved a 2025 interim H share cash dividend of RMB 1.858 per 10 shares and endorsed the appointment of Shi Jian as a non-executive director, subject to regulatory approval.

- The bank is also set to consider a charitable donation to support fire rescue and relief efforts in Hong Kong’s Tai Po District, underlining how capital returns to investors are being balanced with a broader social responsibility agenda.

- We’ll now explore how the newly approved interim dividend shapes China Construction Bank’s existing investment narrative and risk-return profile.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

China Construction Bank Investment Narrative Recap

To own China Construction Bank, you generally need to believe in the resilience of its core lending and fee franchises, despite pressure from low interest rates and real estate exposure. The newly approved 2025 interim H share dividend looks consistent with its existing capital return pattern and does not materially change the near term balance between income appeal and the key risks around net interest margin compression and asset quality.

The interim dividend approval at the November EGM is the clearest recent signal for investors, reinforcing the bank’s focus on steady cash returns while it continues to invest in digital and green finance initiatives. The pending board appointment of Shi Jian and the proposed Hong Kong fire relief donation also sit within this broader picture of governance renewal and a more visible social responsibility profile, but these do not alter the main earnings drivers.

Yet against this stable dividend story, the risk that ongoing low rates keep squeezing net interest margins is something investors should be very aware of...

Read the full narrative on China Construction Bank (it's free!)

China Construction Bank's narrative projects CN¥858.7 billion revenue and CN¥372.3 billion earnings by 2028. This requires 12.8% yearly revenue growth and about CN¥46.1 billion earnings increase from CN¥326.2 billion today.

Uncover how China Construction Bank's forecasts yield a HK$9.42 fair value, a 19% upside to its current price.

Exploring Other Perspectives

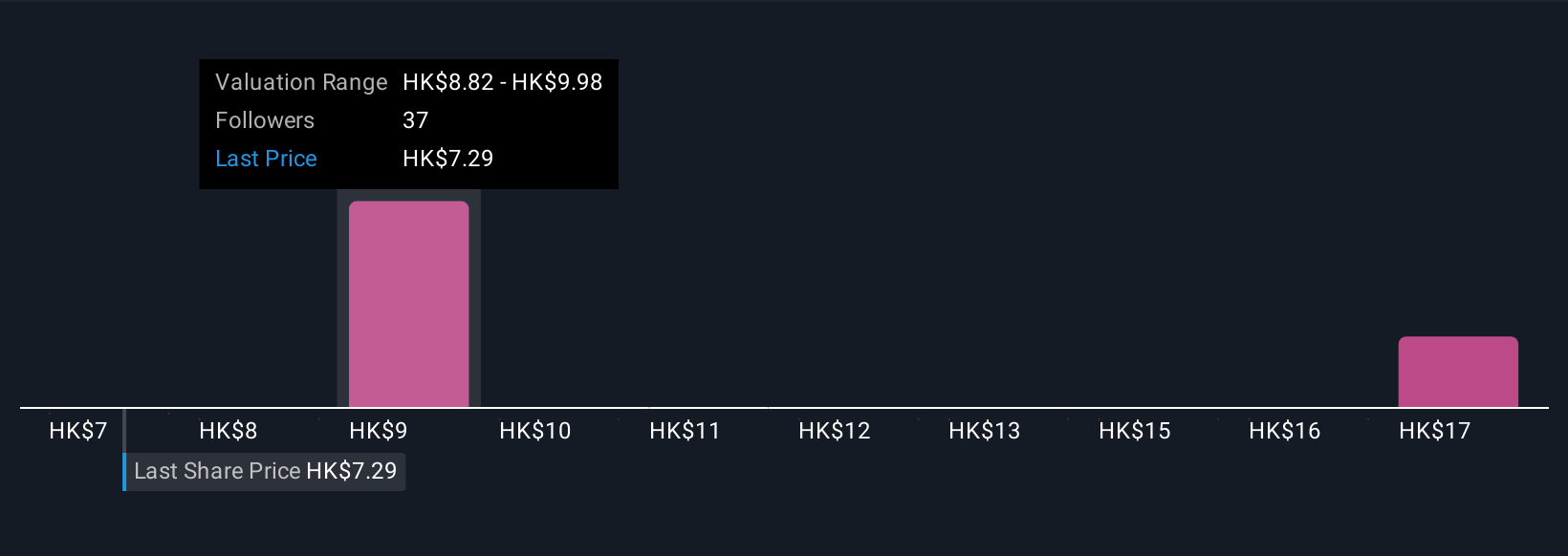

Three Simply Wall St Community valuations for China Construction Bank span roughly HK$9.42 to HK$18.49 per share, showing a wide spread of individual expectations. When you set that range against the ongoing concern about margin pressure from low interest rates, it underlines why you might want to compare several different views on the bank’s future earnings resilience.

Explore 3 other fair value estimates on China Construction Bank - why the stock might be worth over 2x more than the current price!

Build Your Own China Construction Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Construction Bank research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free China Construction Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Construction Bank's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:939

China Construction Bank

Engages in the provision of various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026