As global markets navigate a landscape of rising inflation and near-record highs in major indices, small-cap stocks have recently lagged behind their larger counterparts. In this environment, identifying promising opportunities requires a keen eye for companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Harbin Bank (SEHK:6138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Harbin Bank Co., Ltd. offers a range of banking products and services mainly in China, with a market capitalization of HK$3.90 billion.

Operations: Harbin Bank generates revenue primarily from its Retail Financial Business (CN¥2.99 billion) and Corporate Financial Business (CN¥1.02 billion). The bank also earns from its Interbank Financial Business, contributing CN¥1.14 billion to the total revenue.

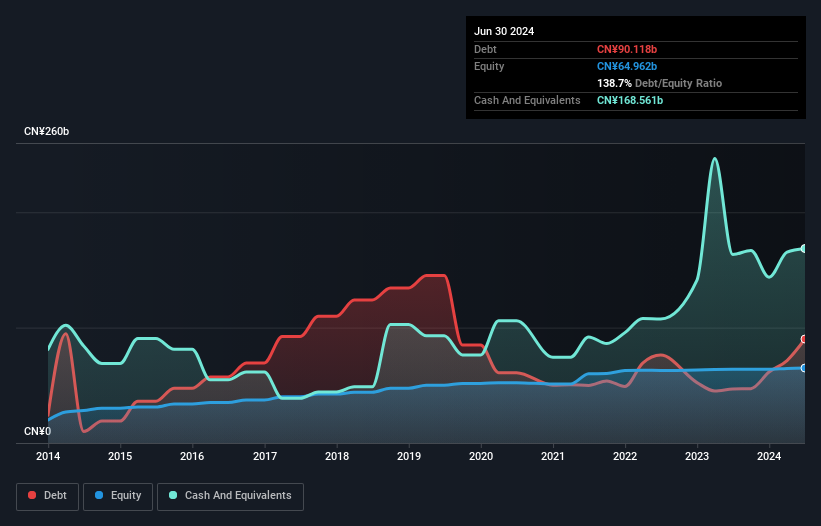

Harbin Bank, with total assets of CN¥882.8 billion and equity of CN¥65 billion, showcases a robust financial structure. Its deposits stand at CN¥704 billion, while loans amount to CN¥358.1 billion, reflecting a stable banking operation. The bank has managed a net interest margin of 1.4% and maintains an allowance for bad loans at 2.7%, which is considered high but adequately covered by a sufficient allowance ratio of 203%. Recent board changes include the appointment of Mr. Jia Haining as a non-executive director, highlighting ongoing strategic leadership adjustments within the bank's governance framework.

- Unlock comprehensive insights into our analysis of Harbin Bank stock in this health report.

Evaluate Harbin Bank's historical performance by accessing our past performance report.

Wuhan Ddmc Culture&SportsLtd (SHSE:600136)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuhan Ddmc Culture&Sports Co., Ltd. engages in the film, television, and sports industries both within China and internationally, with a market capitalization of CN¥4.33 billion.

Operations: The company generates revenue primarily from its activities in the film, television, and sports sectors. It operates both domestically in China and on an international scale.

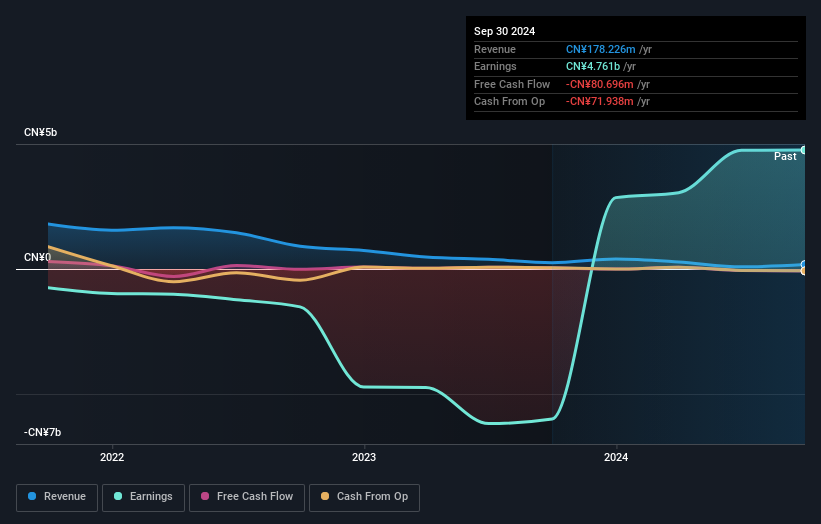

Wuhan Ddmc Culture & Sports Ltd. showcases a compelling story with its price-to-earnings ratio at 0.9x, significantly lower than the CN market average of 37.4x, suggesting potential undervaluation. Over the past five years, it has impressively reduced its debt-to-equity ratio from 79.8% to just 3.3%, indicating strong financial management and a solid balance sheet position as it now holds more cash than total debt. Despite facing a CN¥2.5 billion one-off loss impacting recent financial results, the company achieved profitability this year and covers interest payments comfortably with EBIT at 4.5 times coverage, highlighting robust operational performance amidst industry challenges like -16% earnings growth in entertainment sector last year.

- Take a closer look at Wuhan Ddmc Culture&SportsLtd's potential here in our health report.

Learn about Wuhan Ddmc Culture&SportsLtd's historical performance.

Group Up Industrial (TPEX:6664)

Simply Wall St Value Rating: ★★★★★★

Overview: Group Up Industrial Co., Ltd. manufactures and trades general box-shaped equipment across Taiwan, China, and international markets, with a market capitalization of NT$13.91 billion.

Operations: Group Up Industrial generates revenue primarily from the QunYi Segment, which accounts for NT$2.36 billion, and the Suzhou WangQun Segment contributing NT$148.32 million.

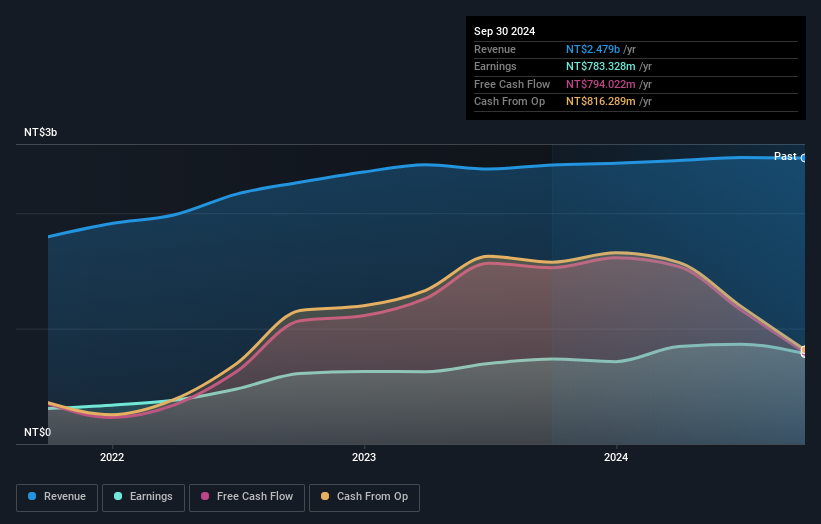

Group Up Industrial, a smaller player in the machinery sector, offers intriguing prospects. Over the past five years, earnings have surged 26.1% annually, though recent growth of 6.2% lagged behind the industry average of 14.6%. The company boasts a solid financial footing with more cash than total debt and a reduced debt-to-equity ratio from 8.4% to 3%. Its price-to-earnings ratio stands at an attractive 17.8x compared to the TW market's 21.4x, suggesting potential undervaluation. High-quality earnings and positive free cash flow further enhance its appeal as a promising investment opportunity in its field.

- Dive into the specifics of Group Up Industrial here with our thorough health report.

Assess Group Up Industrial's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 4711 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6138

Harbin Bank

Provides various banking products and services primarily in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives