Undiscovered Gems Harbin Bank And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of a new U.S. administration and fluctuating economic indicators, small-cap stocks have experienced mixed performance, with indices like the Russell 2000 reflecting these broader market sentiments. In this dynamic environment, identifying potential growth opportunities often involves looking beyond immediate market trends to uncover stocks that exhibit strong fundamentals and resilience amidst uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Harbin Bank (SEHK:6138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Harbin Bank Co., Ltd. offers a range of banking products and services mainly in China, with a market capitalization of HK$4.01 billion.

Operations: The bank's revenue streams are primarily derived from its Retail Financial Business (CN¥2.99 billion) and Corporate Financial Business (CN¥1.02 billion).

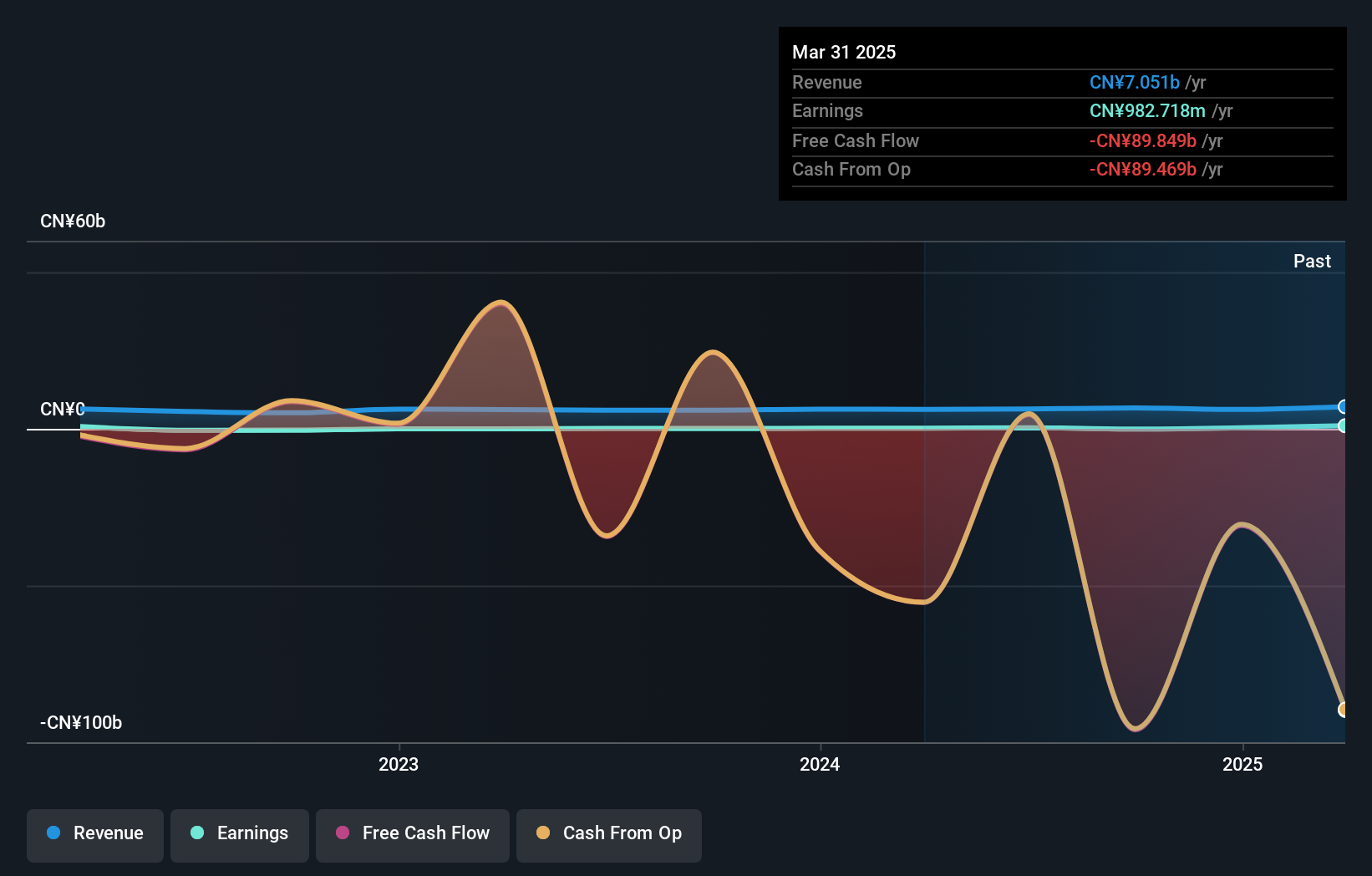

Harbin Bank, with total assets of CN¥882.8 billion and equity of CN¥65.0 billion, is navigating the financial landscape with a net interest margin of 1.4%. The bank's earnings surged by 202% over the past year, outpacing the industry average of 1.6%, though it faces challenges with a high bad loans ratio at 2.7%. Total deposits stand at CN¥704 billion against loans totaling CN¥358.1 billion, supported by low-risk funding sources comprising 86% liabilities from customer deposits. Recent leadership changes see Mr. Yao Chunhe poised to take over as Chairman pending regulatory approval, signaling potential strategic shifts ahead.

- Get an in-depth perspective on Harbin Bank's performance by reading our health report here.

Assess Harbin Bank's past performance with our detailed historical performance reports.

Ningbo Runhe High-Tech Materials (SZSE:300727)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Runhe High-Tech Materials Co., Ltd. operates in the high-tech materials industry and has a market capitalization of CN¥3.60 billion.

Operations: Ningbo Runhe High-Tech Materials generates revenue primarily from its high-tech materials segment. The company has a market capitalization of CN¥3.60 billion.

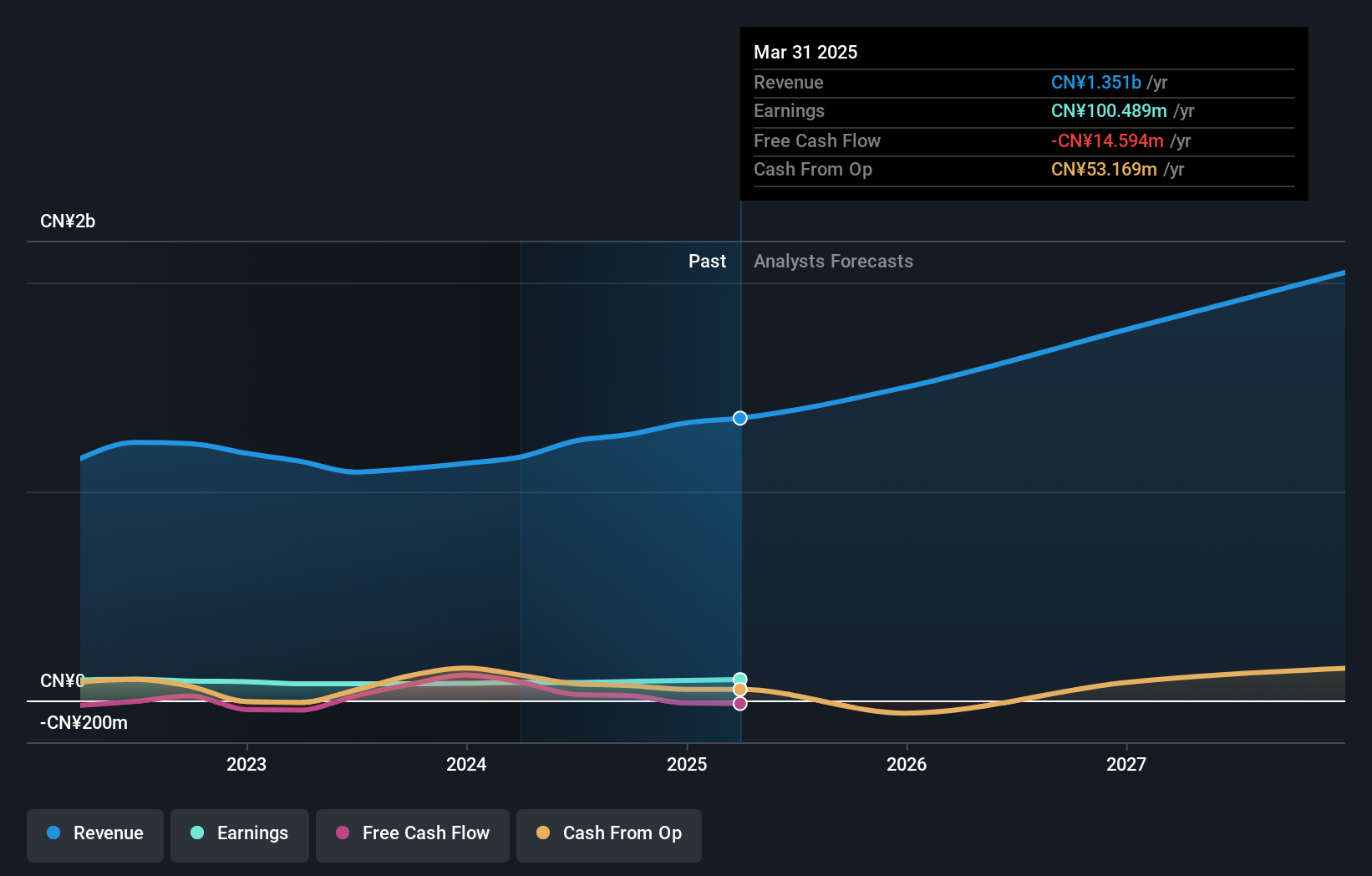

Ningbo Runhe High-Tech Materials, a player in the chemical sector, has been showing promising growth. Over the past year, earnings surged by 14.2%, outpacing the industry average of -5.3%. The company reported sales of CNY 993.65 million for the first nine months of 2024, up from CNY 854.42 million a year prior, with net income rising to CNY 69.89 million from CNY 61 million last year. Its debt-to-equity ratio has increased to 27.2% over five years but remains manageable with well-covered interest payments (23.7x EBIT coverage). Revenue is expected to grow annually by approximately 17%, indicating robust future potential.

- Click here to discover the nuances of Ningbo Runhe High-Tech Materials with our detailed analytical health report.

Learn about Ningbo Runhe High-Tech Materials' historical performance.

Kuo Yang Construction (TWSE:2505)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kuo Yang Construction Co., Ltd. is involved in the construction of public housing projects in Taiwan and has a market capitalization of NT$8.49 billion.

Operations: Kuo Yang Construction generates revenue primarily from its public housing construction projects in Taiwan. The company has a market capitalization of NT$8.49 billion.

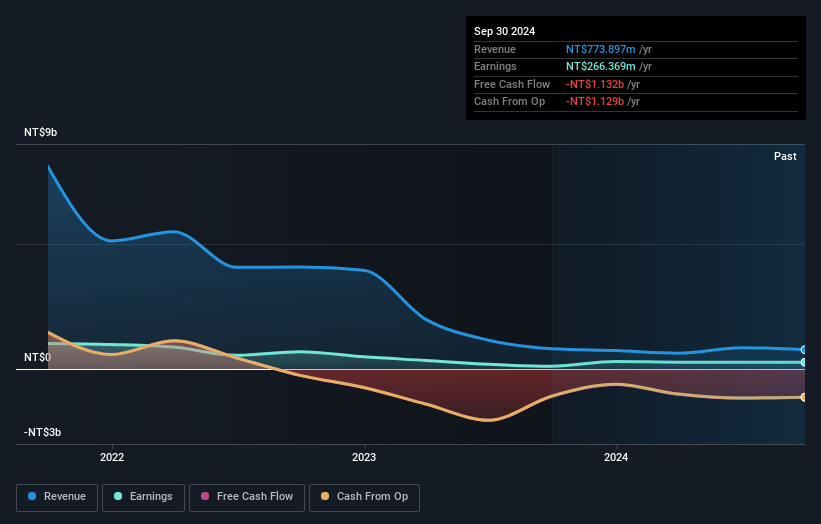

Kuo Yang Construction, a nimble player in the real estate sector, has shown mixed performance recently. Over the past year, earnings surged by 139%, outpacing industry growth of 52%. However, its net debt to equity ratio remains high at 56%, suggesting leverage concerns. The company's third-quarter sales fell to TWD 73 million from TWD 150 million last year, while net income slightly dipped to TWD 38 million from TWD 41 million. Despite these challenges, Kuo Yang's strategic relocation in Taipei hints at expansion ambitions that could bolster future prospects.

- Take a closer look at Kuo Yang Construction's potential here in our health report.

Explore historical data to track Kuo Yang Construction's performance over time in our Past section.

Taking Advantage

- Discover the full array of 4629 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Harbin Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harbin Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6138

Harbin Bank

Provides various banking products and services primarily in China.

Excellent balance sheet with proven track record.