Does Jilin Jiutai Rural Commercial Bank (HKG:6122) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Jilin Jiutai Rural Commercial Bank (HKG:6122). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Jilin Jiutai Rural Commercial Bank

Jilin Jiutai Rural Commercial Bank's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that Jilin Jiutai Rural Commercial Bank's EPS have grown from CN¥0.24 to CN¥0.28 over twelve months. That's a 14% gain; respectable growth in the broader scheme of things.

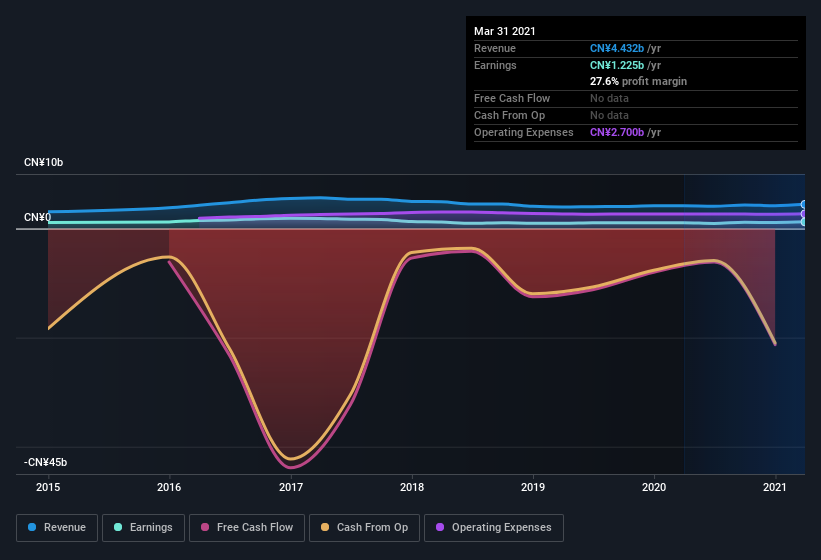

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Jilin Jiutai Rural Commercial Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Jilin Jiutai Rural Commercial Bank maintained stable EBIT margins over the last year, all while growing revenue 6.4% to CN¥4.4b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Jilin Jiutai Rural Commercial Bank's balance sheet strength, before getting too excited.

Are Jilin Jiutai Rural Commercial Bank Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Jilin Jiutai Rural Commercial Bank shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at CN¥679m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between CN¥6.4b and CN¥20b, like Jilin Jiutai Rural Commercial Bank, the median CEO pay is around CN¥4.1m.

The Jilin Jiutai Rural Commercial Bank CEO received total compensation of just CN¥1.8m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Jilin Jiutai Rural Commercial Bank Deserve A Spot On Your Watchlist?

As I already mentioned, Jilin Jiutai Rural Commercial Bank is a growing business, which is what I like to see. Earnings growth might be the main game for Jilin Jiutai Rural Commercial Bank, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Before you take the next step you should know about the 2 warning signs for Jilin Jiutai Rural Commercial Bank (1 is a bit unpleasant!) that we have uncovered.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6122

Jilin Jiutai Rural Commercial Bank

Provides commercial banking and financial services to personal, corporate, and small business customers in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives