- South Korea

- /

- Food and Staples Retail

- /

- KOSE:A026960

Exploring Three Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets face a mix of challenges, from U.S. policy risks to inflationary pressures, Asian markets present unique opportunities for investors seeking growth potential amidst volatility. In this dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals and resilience to navigate economic uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Time Publishing and Media | 2.49% | 7.52% | 18.20% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 6.86% | 2.90% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| Kappa Create | 81.94% | 0.91% | 25.82% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 141.86% | 2.81% | 3.53% | ★★★★☆☆ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Dong Suh Companies (KOSE:A026960)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dong Suh Companies Inc. operates in the food, packaging, tea, logistics, and import and export sectors with a market cap of ₩2.57 trillion.

Operations: Dong Suh Companies generates revenue through its diversified operations in food, packaging, tea, logistics, and import and export sectors. The company has a market cap of ₩2.57 trillion.

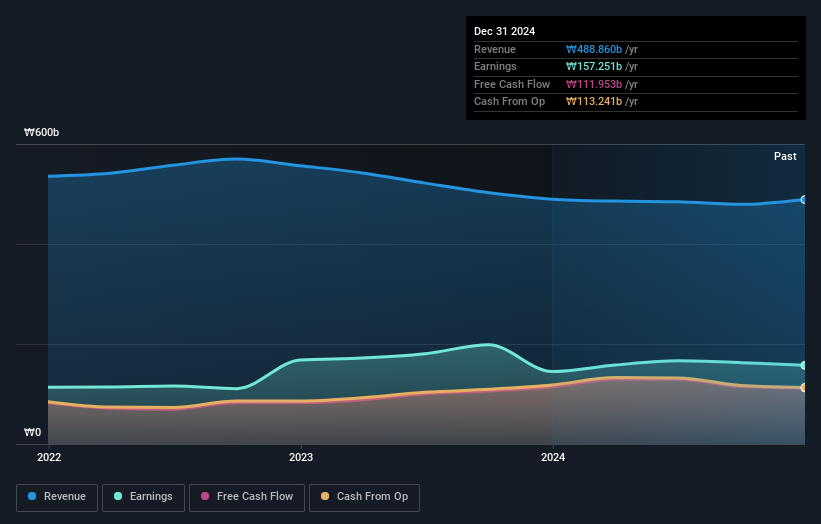

Dong Suh Companies, a promising player in Asia's investment landscape, has seen its earnings grow at 7.4% annually over the past five years, though recent growth of 8.6% lagged behind the Consumer Retailing industry's 11.9%. With high-quality earnings and positive free cash flow, Dong Suh appears financially sound. The debt to equity ratio has slightly increased from 0% to 0.1%, yet interest coverage remains robust as they earn more than they pay in interest expenses. The company holds more cash than total debt, hinting at financial stability despite modest industry underperformance recently reported for fiscal year-end results on January 21, 2025.

- Take a closer look at Dong Suh Companies' potential here in our health report.

Gain insights into Dong Suh Companies' past trends and performance with our Past report.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that specializes in the manufacture and sale of computer numerical control machine tools, operating primarily in Mainland China and internationally, with a market capitalization of HK$8.24 billion.

Operations: Precision Tsugami (China) generates revenue primarily through the manufacture and sale of CNC high precision machine tools, amounting to CN¥3.60 billion. The company's financial performance is highlighted by its net profit margin, which reflects its profitability after accounting for all expenses.

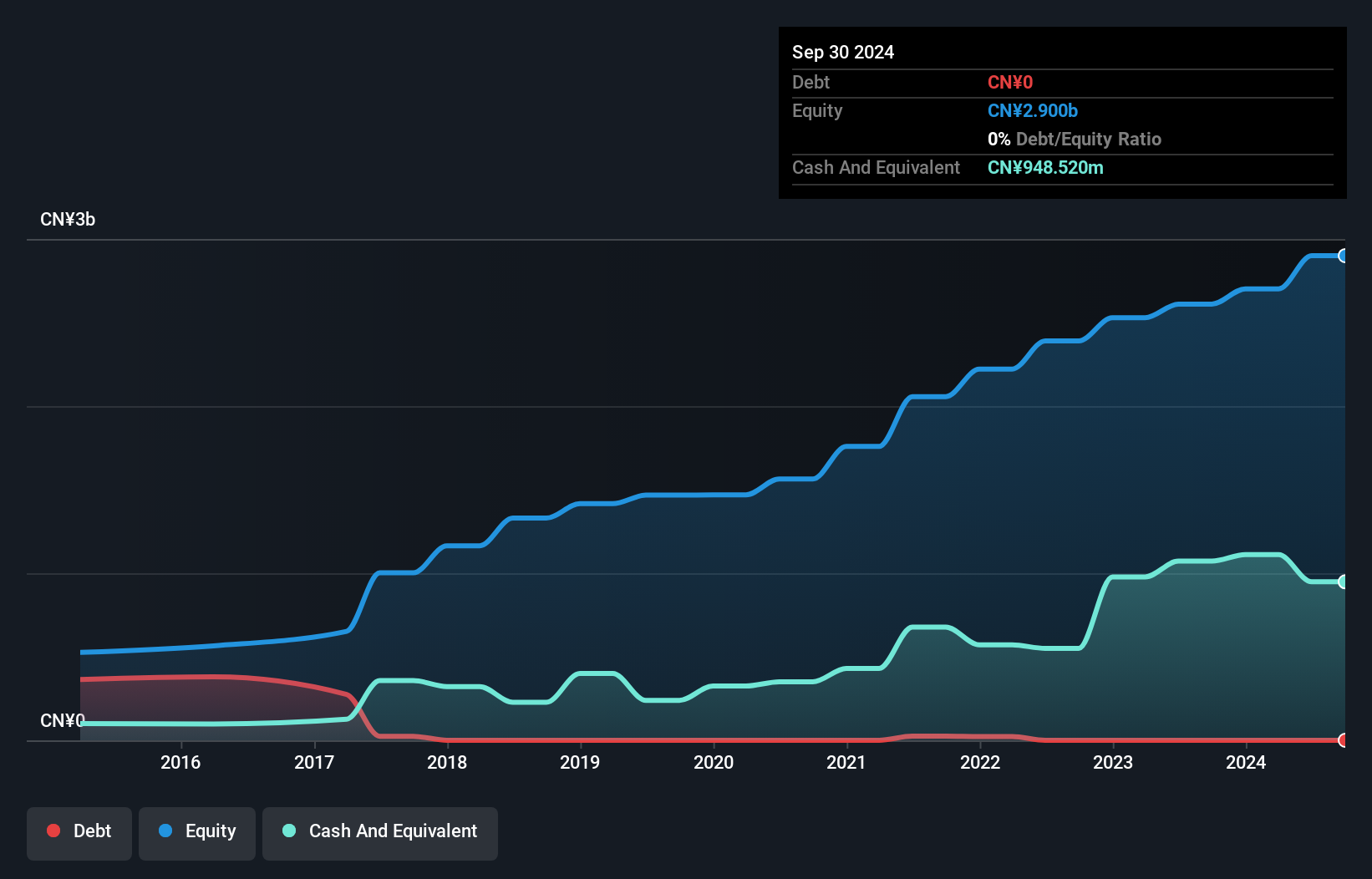

Precision Tsugami (China) stands out with its robust financial health, being debt-free for over five years. The company's earnings grew by 19.8% last year, surpassing the Machinery industry's 11.8%, and are projected to increase by 25.9% annually. Trading at a significant discount of 48.3% below estimated fair value, it offers potential upside for investors seeking undervalued opportunities in Asia's industrial sector. Recent share repurchase plans aim to boost net asset value and earnings per share, reflecting confidence in its future prospects while maintaining high-quality non-cash earnings levels consistently over time.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company offering banking, insurance, and financial services across Hong Kong, Macau, and the People’s Republic of China with a market capitalization of HK$10.23 billion.

Operations: The company's primary revenue streams include Personal Banking, generating HK$2.68 billion, and Treasury and Global Markets with HK$1.34 billion. Corporate Banking contributes HK$853.60 million, while the Insurance Business adds HK$246.25 million to the revenue mix. Mainland China and Macau Banking account for HK$176.27 million in revenue, reflecting its regional diversification strategy.

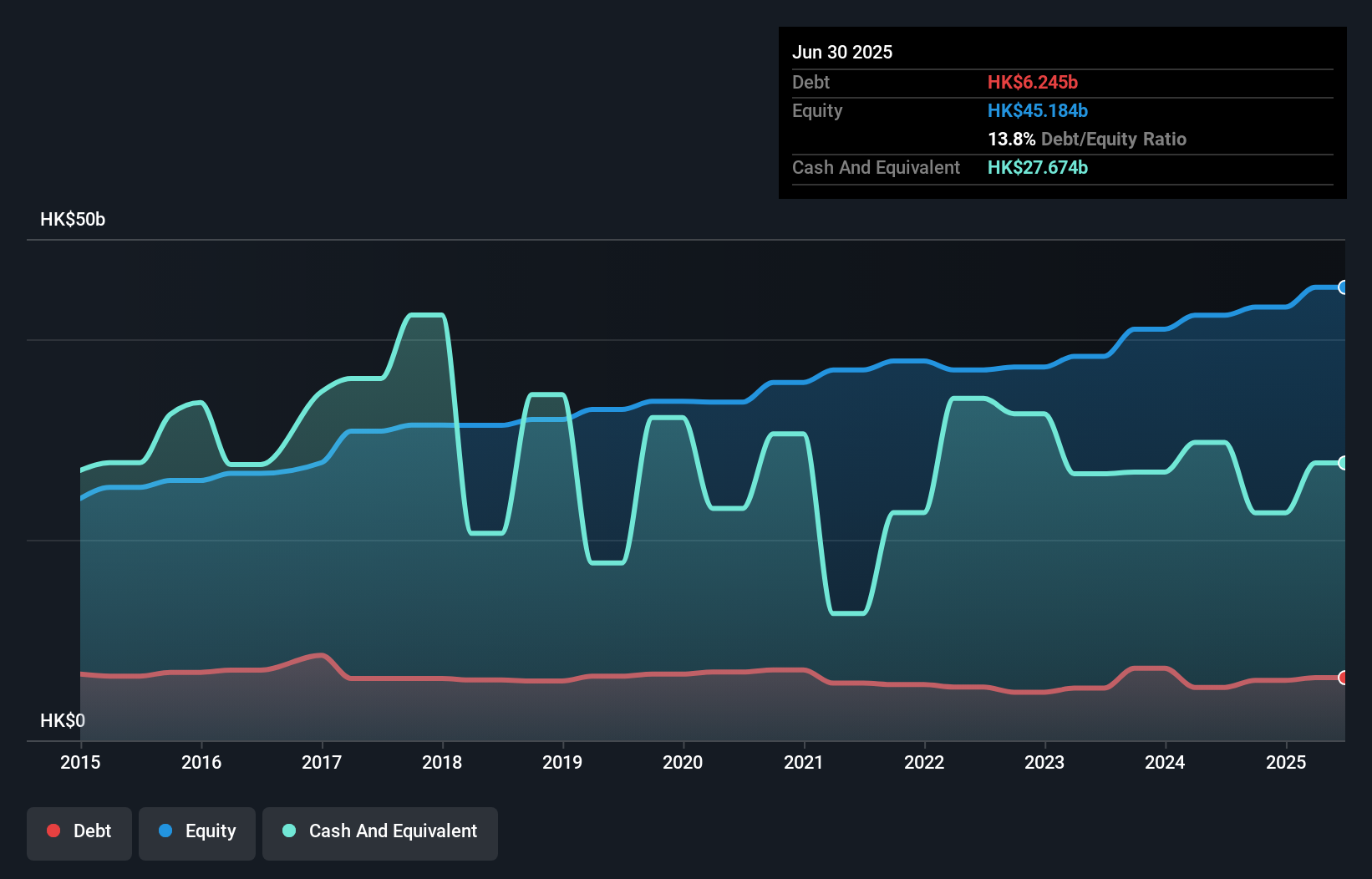

Dah Sing Financial Holdings, with assets totaling HK$272.4 billion and equity of HK$42.4 billion, has shown robust performance in the past year. Its earnings surged by 36.7%, outpacing the industry average of 2.5%. The company maintains a healthy balance sheet with total deposits at HK$214.2 billion and loans at HK$141.9 billion, supported by an appropriate bad loan ratio of 1.9% and a low allowance for bad loans at 43%. Despite significant insider selling recently, Dah Sing's liabilities are primarily funded through low-risk customer deposits, suggesting stability amidst market fluctuations.

Taking Advantage

- Access the full spectrum of 2580 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dong Suh Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A026960

Dong Suh Companies

Engages in the food, packaging, tea, logistics, and import and export businesses.

Excellent balance sheet with proven track record.