As global markets navigate a landscape marked by record-high U.S. indexes and broad-based gains, investors are keeping a close watch on economic indicators like jobless claims and home sales that are driving positive sentiment. In this context of market optimism, dividend stocks stand out as an appealing option for those seeking steady income streams amidst the ongoing economic developments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

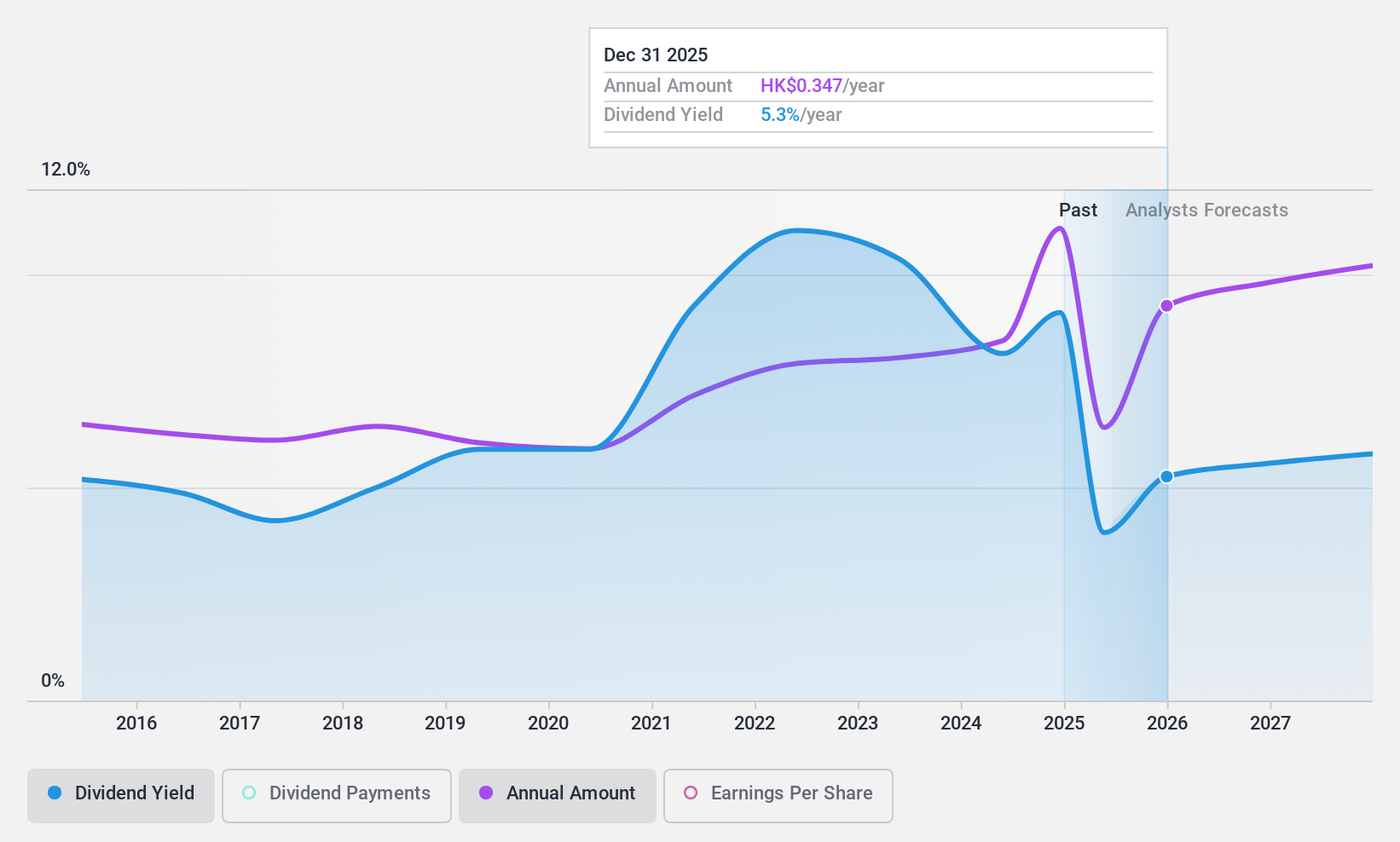

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Rural Commercial Bank Co., Ltd., along with its subsidiaries, provides banking services in the People's Republic of China and has a market capitalization of approximately HK$63.72 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. focuses on offering banking services within the People's Republic of China.

Dividend Yield: 7.4%

Chongqing Rural Commercial Bank recently announced an interim dividend of RMB 2.21 billion, representing 30% of its net profit for the first half of 2024. The bank's dividends are well covered by earnings with a payout ratio of 29.8%, and they have been stable over the past decade. Despite offering a reliable yield of 7.36%, this is slightly below the top tier in Hong Kong's market, which stands at approximately 8%.

- Unlock comprehensive insights into our analysis of Chongqing Rural Commercial Bank stock in this dividend report.

- The valuation report we've compiled suggests that Chongqing Rural Commercial Bank's current price could be quite moderate.

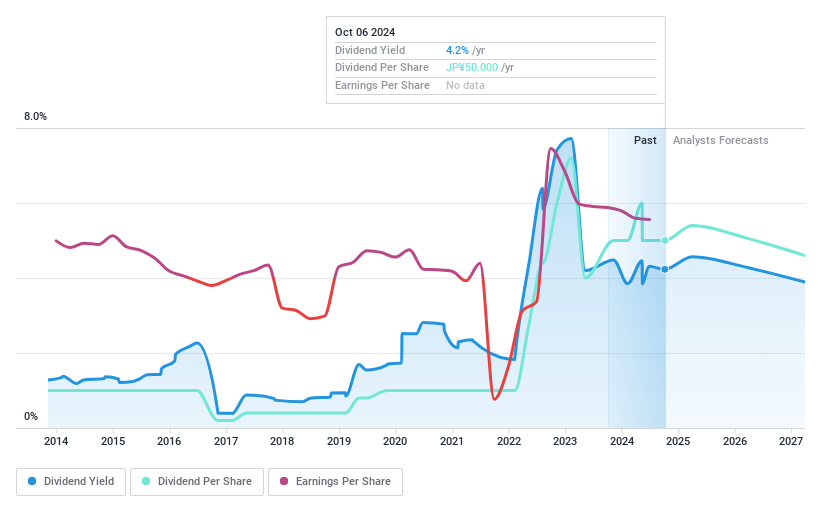

Japan Petroleum Exploration (TSE:1662)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Petroleum Exploration Co., Ltd. operates in the exploration, development, production, and sale of oil, natural gas, and other energy resources across Japan, Europe, North America, and the Middle East with a market cap of ¥271.82 billion.

Operations: Japan Petroleum Exploration Co., Ltd.'s revenue is derived from ¥272.61 billion in Japan, ¥33.82 billion in the Middle East, and ¥43.41 billion in North America.

Dividend Yield: 4.6%

Japan Petroleum Exploration's dividends are covered by earnings with a payout ratio of 33.7%, and cash flows with a 72.7% cash payout ratio, suggesting sustainability despite past volatility. The dividend yield of 4.61% places it in the top quartile of Japanese dividend payers, though historical payments have been unreliable and volatile over the last decade. Recent involvement in CCS projects indicates strategic investments that may impact future financial stability and dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Petroleum Exploration.

- Our expertly prepared valuation report Japan Petroleum Exploration implies its share price may be lower than expected.

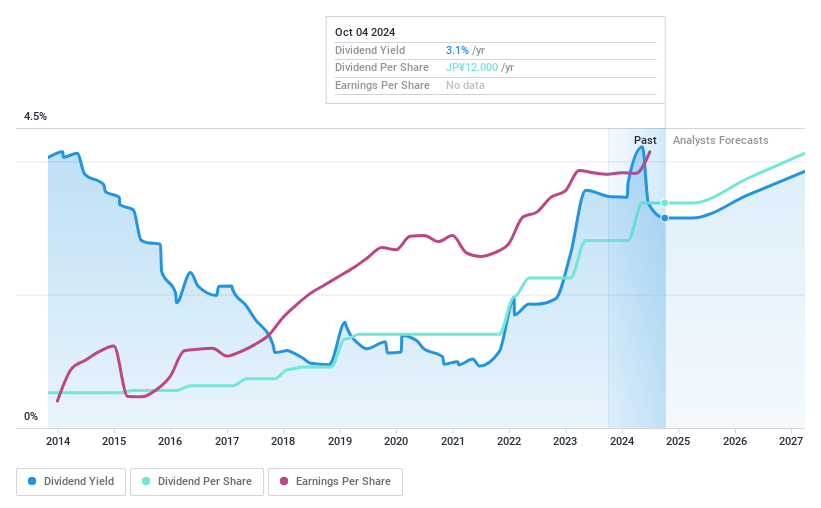

Systena (TSE:2317)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Systena Corporation operates in Japan, focusing on solution and framework design, IT services, business solutions, and cloud businesses, with a market cap of ¥124.04 billion.

Operations: Systena Corporation generates revenue from its core activities in solution and framework design, IT services, business solutions, and cloud services within Japan.

Dividend Yield: 3.4%

Systena Corporation's recent dividend increase from JPY 5 to JPY 6 per share reflects its commitment to rewarding shareholders, supported by a sustainable payout ratio of 23.9% and cash flow coverage at 52.3%. Although the dividend yield of 3.45% is below the top tier in Japan, it has been stable and growing over the past decade. The company's strategic share buyback may enhance shareholder value further, while revised earnings guidance suggests anticipated growth in profitability.

- Click to explore a detailed breakdown of our findings in Systena's dividend report.

- Upon reviewing our latest valuation report, Systena's share price might be too pessimistic.

Key Takeaways

- Access the full spectrum of 1970 Top Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3618

Chongqing Rural Commercial Bank

Engages in the provision of banking services in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.