Dubai Investments PJSC And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have recently demonstrated resilience, with U.S. indexes approaching record highs and smaller-cap indexes outperforming their larger counterparts. Against this backdrop, investors may find opportunities in penny stocks—smaller or newer companies that can offer affordability and growth potential when backed by strong financials. Despite being an outdated term, penny stocks remain relevant as they provide a gateway to potentially uncovering value in lesser-known market segments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$552.27M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.23 | £104.97M | ★★★★★★ |

Click here to see the full list of 5,767 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED9.01 billion.

Operations: The company's revenue is primarily derived from the property sector at AED2.21 billion, followed by manufacturing, contracting and services at AED1.24 billion, and investments totaling AED330.77 million.

Market Cap: AED9.01B

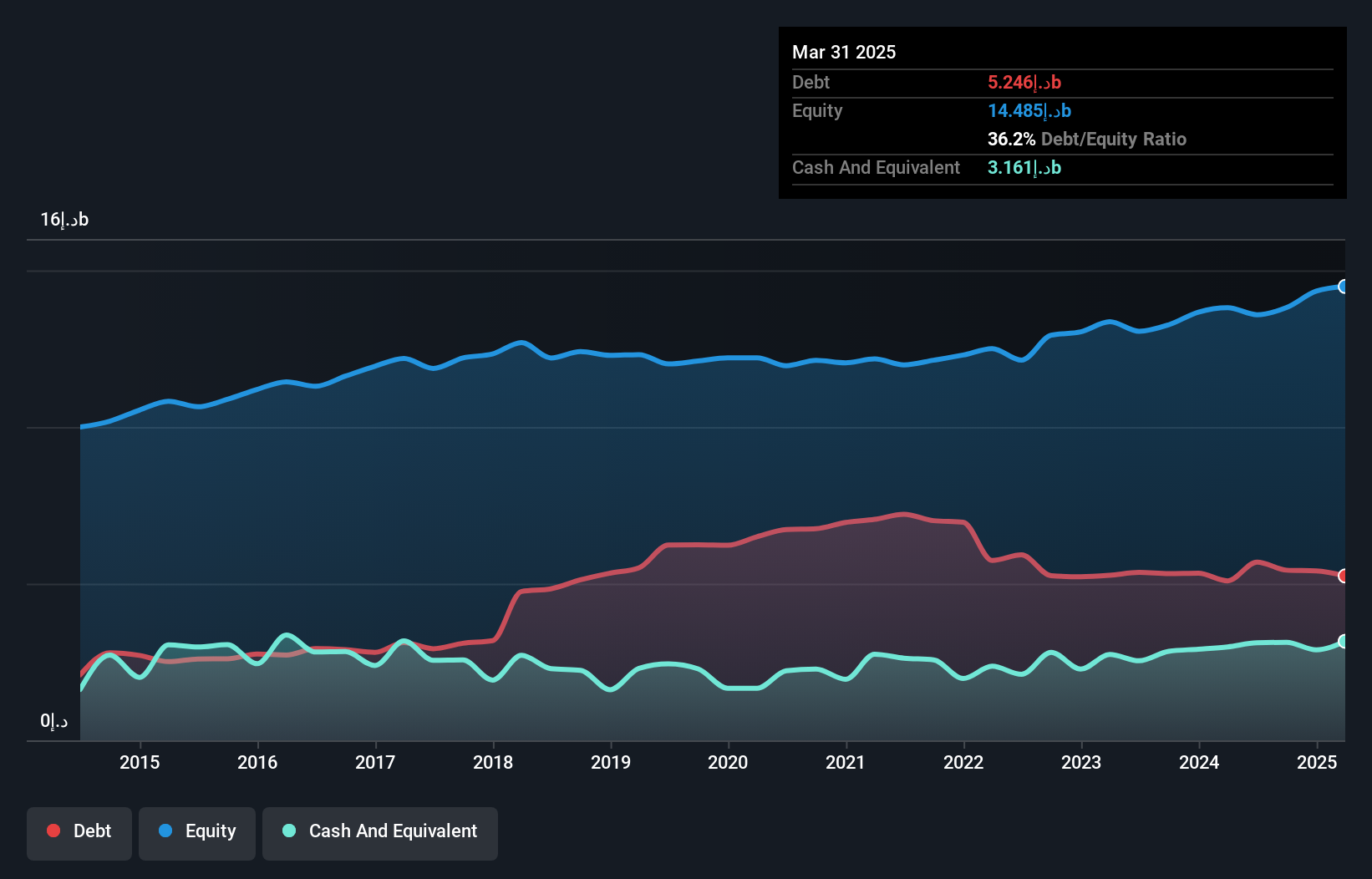

Dubai Investments PJSC, with a market cap of AED9.01 billion, shows a mixed financial picture. Its revenue is primarily driven by the property sector at AED2.21 billion. Despite stable weekly volatility and satisfactory debt coverage by operating cash flow (20.1%), the company faces challenges such as lower current net profit margins (25.6%) compared to last year and a low return on equity (6.7%). Earnings growth has slowed to 3% over the past year, below its five-year average of 22.5%, but still outpaced the industry's 1.8%. The Price-To-Earnings ratio of 9.3x suggests it could be undervalued relative to the AE market average of 13.2x.

- Unlock comprehensive insights into our analysis of Dubai Investments PJSC stock in this financial health report.

- Understand Dubai Investments PJSC's earnings outlook by examining our growth report.

China Boton Group (SEHK:3318)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Boton Group Company Limited manufactures and sells flavors, fragrances, and e-cigarette products in China and internationally, with a market cap of HK$1.74 billion.

Operations: The company's revenue is primarily derived from its e-cigarette products (CN¥831.16 million), flavor enhancers (CN¥776.68 million), food flavors (CN¥184.96 million), fine fragrances (CN¥173.32 million), and investment properties (CN¥49.30 million).

Market Cap: HK$1.74B

China Boton Group, with a market cap of HK$1.74 billion, has shown significant earnings growth of 396.5% over the past year, surpassing industry averages despite a historically declining trend. The company benefits from seasoned management and board experience but faces challenges such as low return on equity at 3.5% and insufficient operating cash flow to cover debt effectively (14.4%). Short-term assets adequately cover liabilities, yet interest payments remain poorly covered by EBIT at 2.8x. Trading below estimated fair value by 23%, its net debt to equity ratio is satisfactory at 34.2%. Revenue is forecasted to grow annually by 14.87%.

- Click here and access our complete financial health analysis report to understand the dynamics of China Boton Group.

- Gain insights into China Boton Group's future direction by reviewing our growth report.

Jilin Jiutai Rural Commercial Bank (SEHK:6122)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jilin Jiutai Rural Commercial Bank Corporation Limited offers commercial banking and financial services to personal, corporate, and small business customers in China, with a market cap of HK$4.36 billion.

Operations: Revenue segment information is not provided for this company.

Market Cap: HK$4.36B

Jilin Jiutai Rural Commercial Bank, with a market cap of HK$4.36 billion, is currently unprofitable, facing challenges such as a net loss of CNY 87.13 million for the nine months ended September 2024 compared to a net income the previous year. Despite its volatility and declining earnings over five years at an annual rate of 20.3%, it trades significantly below estimated fair value by 68.7%. The bank's funding structure is primarily low-risk with customer deposits comprising 97% of liabilities, and it maintains an appropriate loans-to-assets ratio at 70%, alongside a seasoned management team with extensive tenure averaging over nine years.

- Get an in-depth perspective on Jilin Jiutai Rural Commercial Bank's performance by reading our balance sheet health report here.

- Understand Jilin Jiutai Rural Commercial Bank's track record by examining our performance history report.

Seize The Opportunity

- Discover the full array of 5,767 Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3318

China Boton Group

Manufactures and sells flavors, fragrances, and e-cigarette products in the People’s Republic of China, Europe, the United States, the rest of Asia, and internationally.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives