Undiscovered Gems with Promising Potential for November 2024

Reviewed by Simply Wall St

As global markets approach record highs with broad-based gains, smaller-cap indexes have been notably outperforming their larger counterparts, signaling a renewed interest in these often-overlooked segments. In this environment of robust economic indicators and positive sentiment, identifying stocks with solid fundamentals and growth potential becomes crucial for investors seeking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components across China, North America, Europe, and other international markets with a market capitalization of HK$3.80 billion.

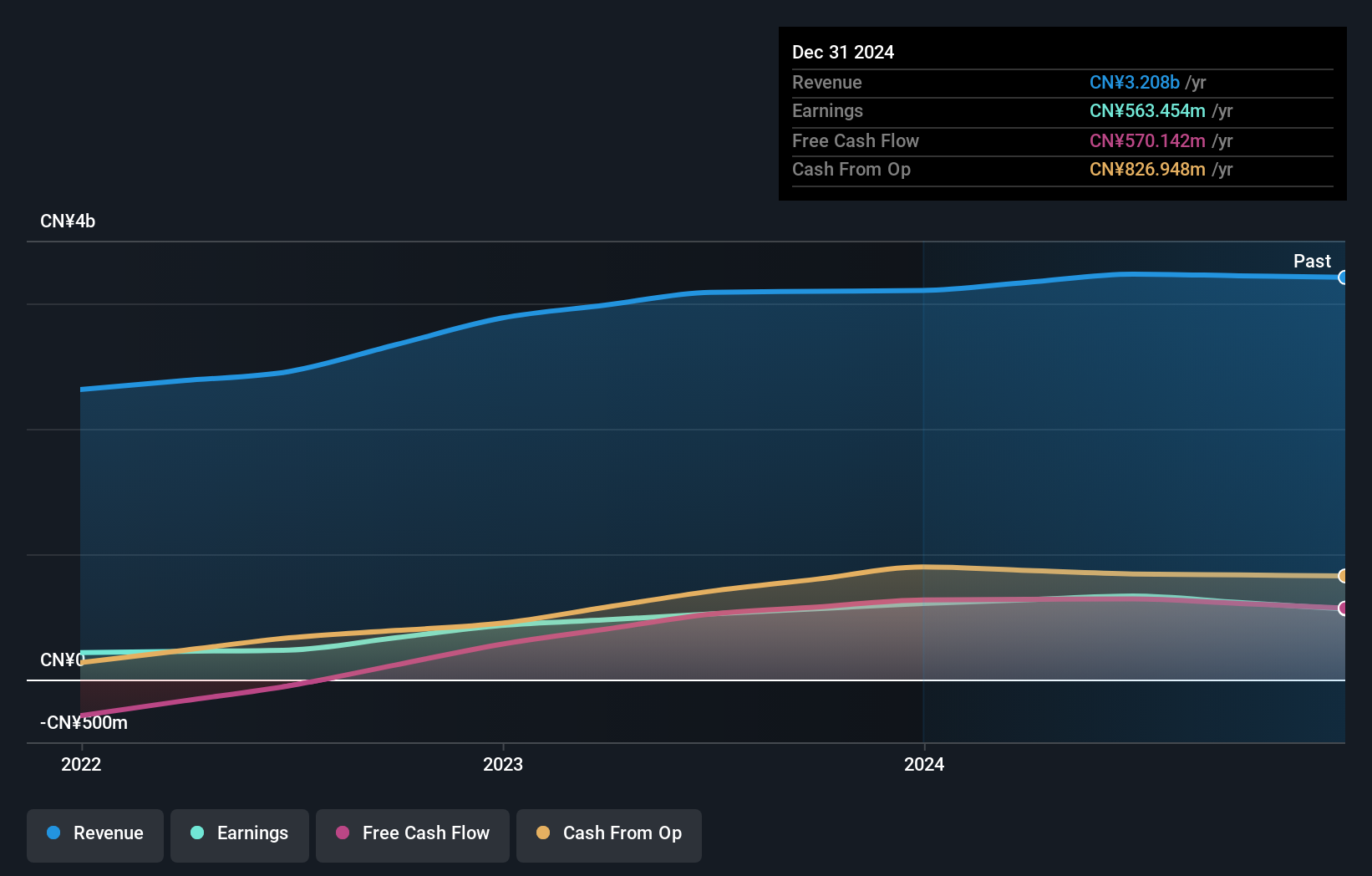

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion.

Xin Point Holdings, a small player in the auto components sector, shows promising prospects with its earnings growing 27% over the past year, outpacing the industry average of -19%. This growth is supported by high-quality earnings and a robust cash position that surpasses total debt. Trading at 75.8% below estimated fair value suggests potential undervaluation relative to peers. However, it's worth noting that their debt-to-equity ratio has climbed from 0.3 to 1.8 over five years, which might raise some concerns about financial leverage. The company seems well-positioned for future growth with forecasted annual earnings expansion of nearly 6%.

- Get an in-depth perspective on Xin Point Holdings' performance by reading our health report here.

Examine Xin Point Holdings' past performance report to understand how it has performed in the past.

Billion Industrial Holdings (SEHK:2299)

Simply Wall St Value Rating: ★★★★★☆

Overview: Billion Industrial Holdings Limited, along with its subsidiaries, specializes in the development, manufacturing, and sale of polyester filament yarns and related products both in China and internationally, with a market cap of approximately HK$9.73 billion.

Operations: Billion Industrial Holdings generates revenue primarily from its textile manufacturing segment, which reported CN¥20.87 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency in managing costs relative to revenue.

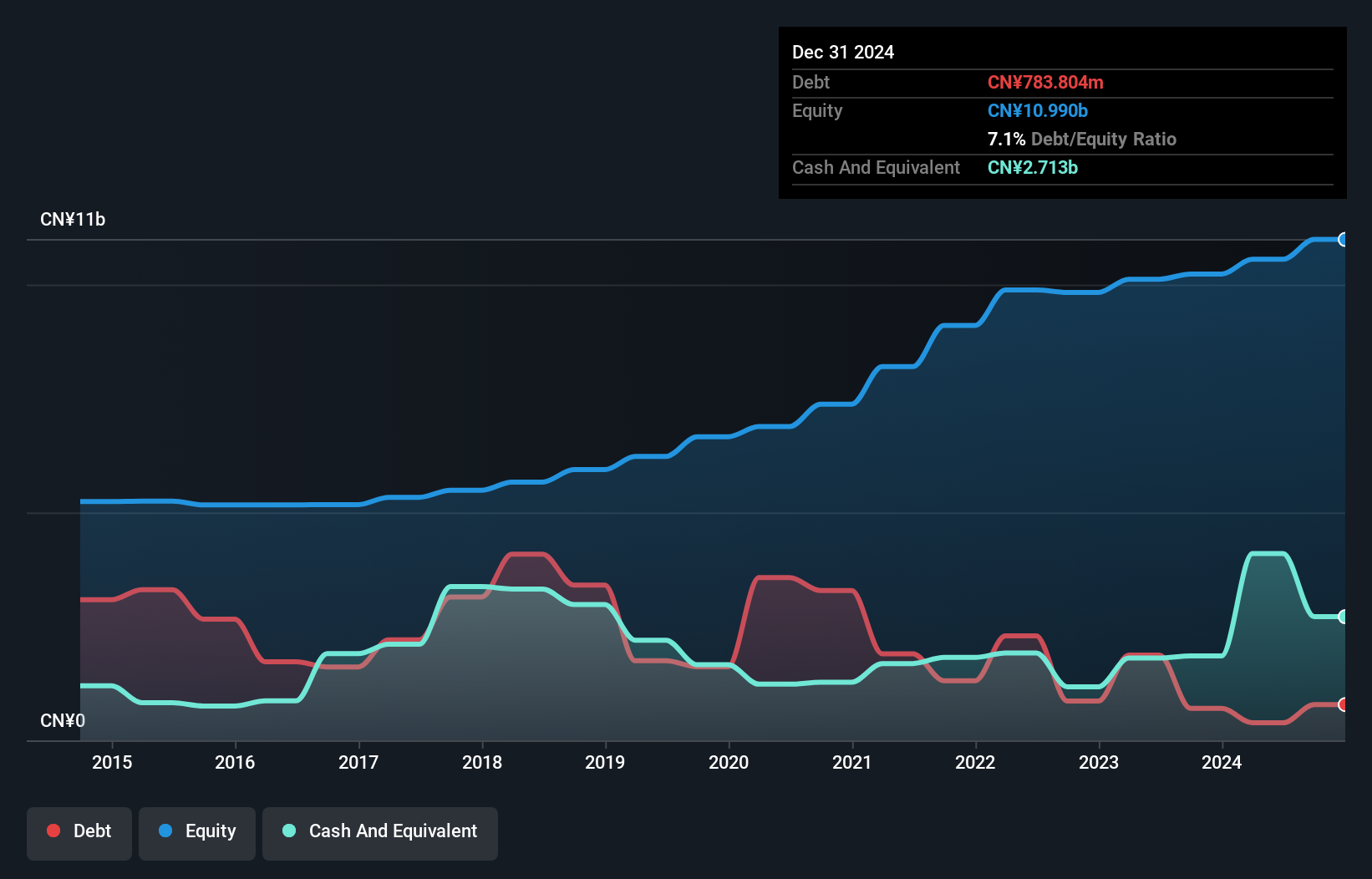

Billion Industrial Holdings, a small cap player in the luxury sector, showcases intriguing financial dynamics. The company's debt to equity ratio impressively dropped from 28% to 3.6% over five years, indicating robust financial management. It seems the firm is outpacing industry growth with earnings surging by 180% last year compared to the industry's modest 15.7%. Despite an average annual earnings decline of 11.4% over five years, recent performance suggests potential for turnaround. With more cash than total debt and positive free cash flow, Billion appears well-positioned for future opportunities in its market niche.

- Click to explore a detailed breakdown of our findings in Billion Industrial Holdings' health report.

Guangdong High Dream Intellectualized Machinery (SZSE:300720)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong High Dream Intellectualized Machinery Co., Ltd. specializes in the development and manufacturing of automated packaging machinery, with a market cap of CN¥3.47 billion.

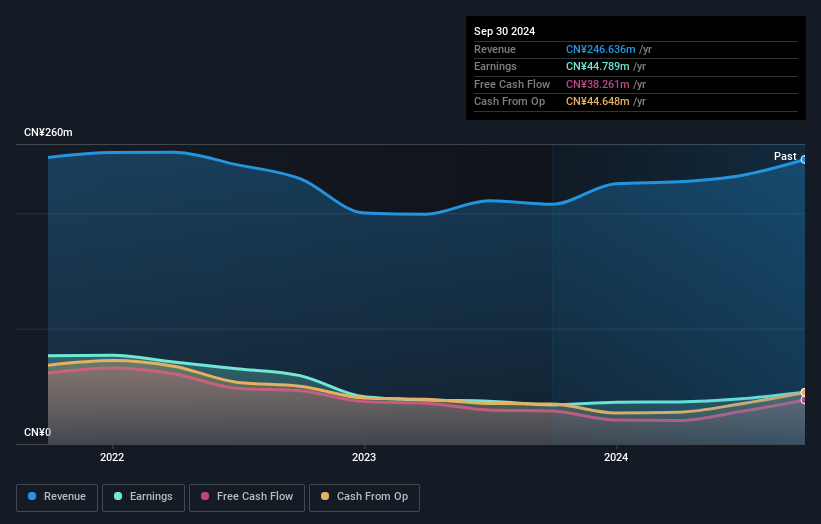

Operations: High Dream generates revenue primarily through the sale of automated packaging machinery. The company's cost structure and financial performance details, such as gross profit margin or net profit margin, are not specified in the provided data.

Guangdong High Dream Intellectualized Machinery, a nimble player in the machinery sector, has shown promising growth with earnings up by 32.3% over the past year, outpacing its industry peers. Despite a volatile share price recently, the company remains debt-free and boasts high-quality earnings. For the nine months ending September 2024, sales reached CNY 174.25 million compared to CNY 153.12 million last year, while net income rose to CNY 36.74 million from CNY 28.13 million previously. With basic earnings per share increasing to CNY 0.1885 from CNY 0.1444, this entity seems poised for continued momentum amidst industry challenges.

Seize The Opportunity

- Navigate through the entire inventory of 4634 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billion Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2299

Billion Industrial Holdings

Develops, manufactures, and sells polyester filament yarns products, polyester products, polyester industrial yarns products, and ES fiber products in the People’s Republic of China and internationally.

Excellent balance sheet with proven track record.