- Switzerland

- /

- Insurance

- /

- SWX:ZURN

Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and concerns over consumer spending, investors are closely monitoring the impact of these factors on economic indicators and stock performance. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance risk while benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.40% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

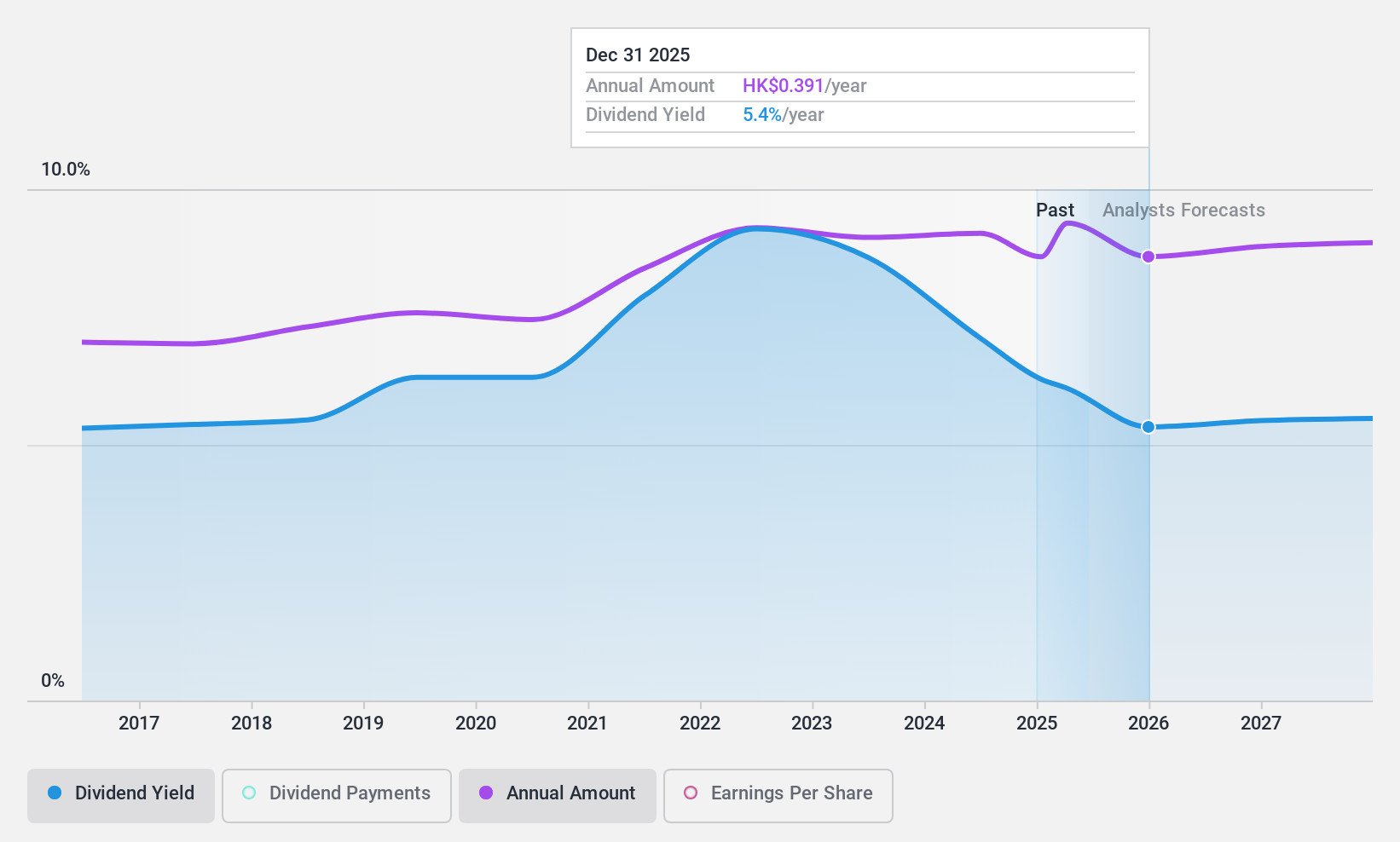

Bank of Communications (SEHK:3328)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. offers commercial banking products and services in China, with a market cap of approximately HK$543.88 billion.

Operations: Bank of Communications Co., Ltd.'s revenue segments include various commercial banking products and services within China.

Dividend Yield: 5.8%

Bank of Communications offers a stable dividend profile, with consistent payments over the past decade and a current payout ratio of 48.5%, suggesting dividends are well covered by earnings. The bank recently affirmed an interim cash dividend for H1 2024, reflecting its commitment to shareholder returns. Although its yield of 5.84% is below top-tier dividend payers in Hong Kong, the forecasted payout ratio is set to decrease to 31.3%, indicating sustainability.

- Take a closer look at Bank of Communications' potential here in our dividend report.

- Upon reviewing our latest valuation report, Bank of Communications' share price might be too pessimistic.

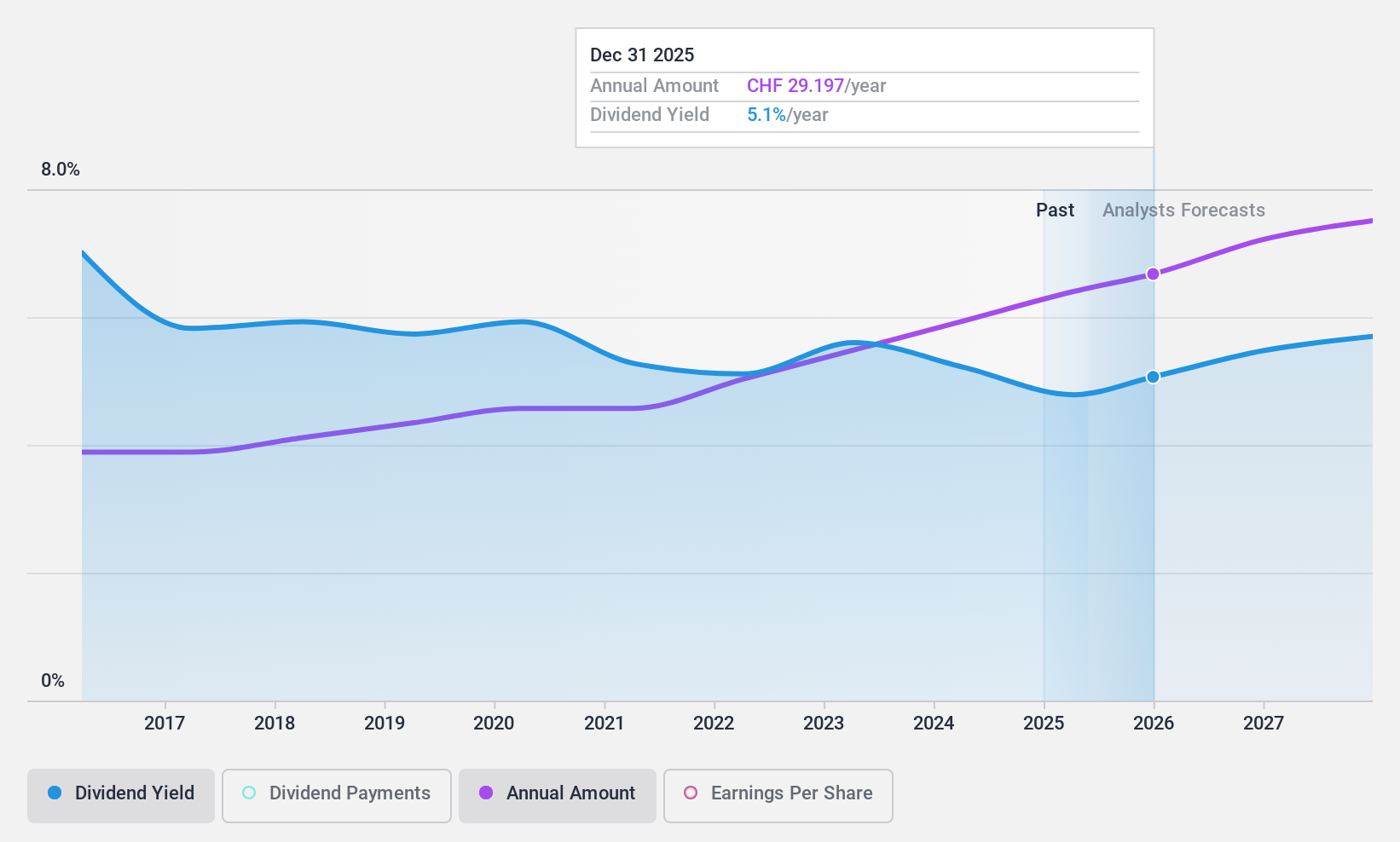

Zurich Insurance Group (SWX:ZURN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zurich Insurance Group AG, along with its subsidiaries, offers insurance products and related services across Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific regions with a market capitalization of CHF82.24 billion.

Operations: Zurich Insurance Group AG's revenue segments include various insurance products and services provided across multiple regions including Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific.

Dividend Yield: 4.4%

Zurich Insurance Group's dividend yield of 4.39% is among the top 25% in the Swiss market, supported by a stable and growing dividend history over the past decade. Despite a high payout ratio of 91.2%, recent earnings growth—net income rose to US$5.81 billion from US$4.35 billion—suggests potential for future coverage improvement. The company announced an increased annual dividend of CHF28 per share, payable on April 15, 2025, highlighting its commitment to returning value to shareholders.

- Click here to discover the nuances of Zurich Insurance Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Zurich Insurance Group is trading behind its estimated value.

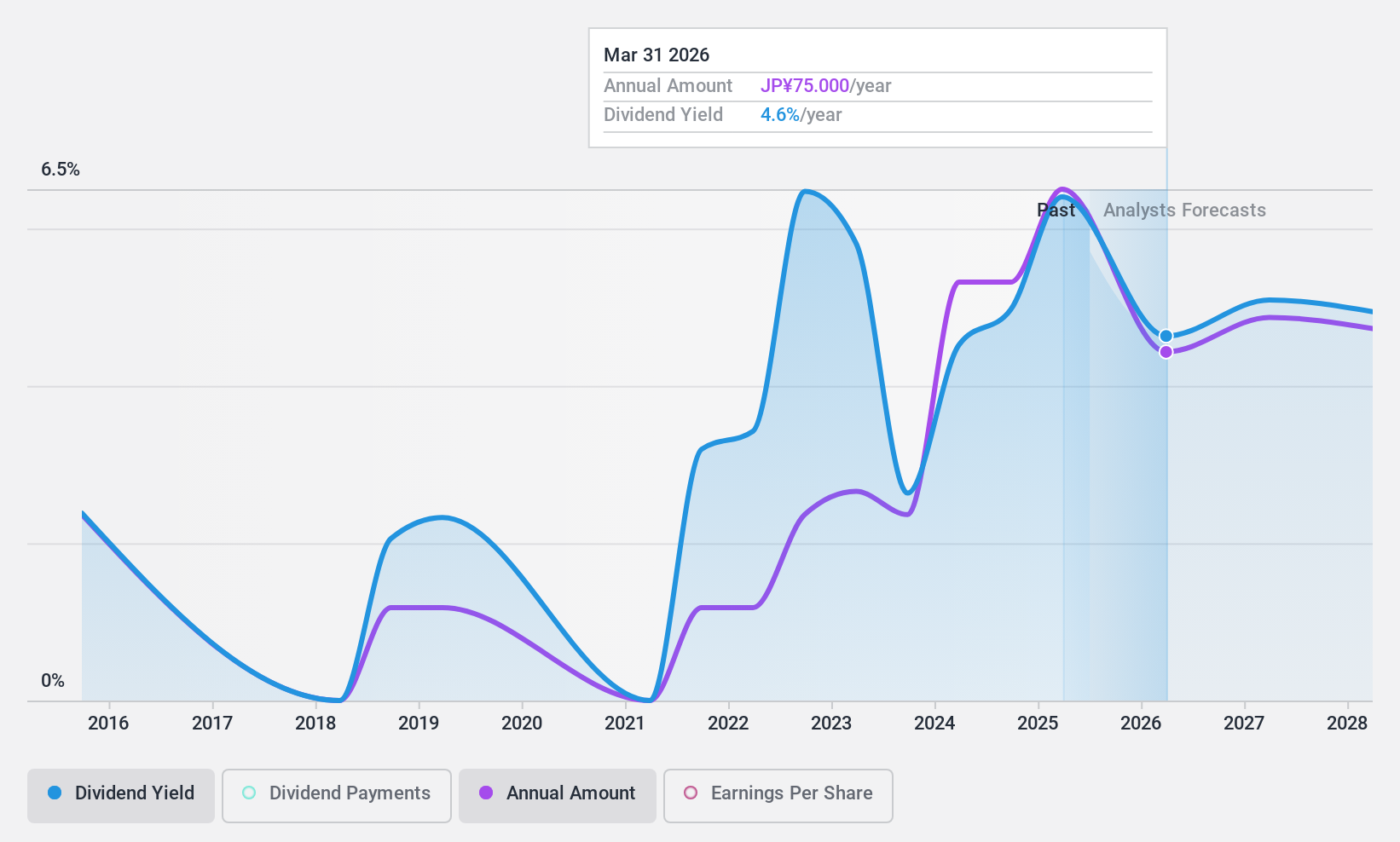

Kobe Steel (TSE:5406)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kobe Steel, Ltd. operates globally in the materials, machinery, and electric power sectors with a market cap of ¥690.91 billion.

Operations: Kobe Steel, Ltd.'s revenue is derived from several segments, including Steel & Aluminum (¥1.12 billion), Construction Machinery (¥0.39 billion), Advanced Materials (¥0.31 billion), Electric Power (¥0.27 billion), Machinery (¥0.26 billion), Engineering (¥0.16 billion), and Welding (¥93.24 million).

Dividend Yield: 6.3%

Kobe Steel recently revised its dividend forecast, increasing the year-end dividend to JPY 55 per share, resulting in an annual dividend of JPY 100. Despite a history of volatility and unreliable payments, the current payout ratio is a manageable 34.6%. However, dividends are not covered by free cash flows. The company targets a payout ratio of approximately 30% and remains committed to enhancing shareholder value despite earnings forecasts indicating potential declines.

- Get an in-depth perspective on Kobe Steel's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Kobe Steel is priced lower than what may be justified by its financials.

Summing It All Up

- Explore the 2007 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurich Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ZURN

Zurich Insurance Group

Provides insurance products and related services in Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific.

Outstanding track record 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives