- India

- /

- Trade Distributors

- /

- NSEI:MSTCLTD

Undiscovered Gems Exploring Hidden Stocks In November 2024

Reviewed by Simply Wall St

In the wake of recent market fluctuations driven by uncertainty surrounding the incoming Trump administration's policies, U.S. stocks have experienced a partial retreat from previous gains, with notable sector disparities reflecting investor sentiment. Amidst this backdrop of volatility and shifting economic indicators, identifying promising small-cap stocks becomes crucial as investors seek opportunities that may be undervalued or overlooked in the broader market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Jash Engineering (NSEI:JASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Jash Engineering Limited is involved in the manufacturing, trading, and selling of engineering products for sectors such as general engineering, water and wastewater management, power plants, and bulk solids handling both in India and internationally with a market capitalization of ₹30.52 billion.

Operations: Jash Engineering derives its revenue from manufacturing and trading engineering products across sectors like water management and power plants. The company's financial performance is reflected in a market capitalization of ₹30.52 billion.

Jash Engineering, a nimble player in the machinery sector, has shown impressive growth with earnings up 41% over the past year, outpacing its industry. The company reported a solid net income of INR 160 million for Q2 2024, compared to INR 85 million a year ago. Its debt-to-equity ratio has improved significantly from 58.7% to 24.6% over five years, reflecting prudent financial management. Despite some shareholder dilution and notable insider selling recently, Jash maintains robust order bookings worth INR 8.73 billion as of November 2024, indicating strong demand across both domestic and international markets.

MSTC (NSEI:MSTCLTD)

Simply Wall St Value Rating: ★★★★★★

Overview: MSTC Limited operates in marketing, e-commerce, and scrap recovery and allied job businesses primarily in India with a market capitalization of ₹41.02 billion.

Operations: MSTC Limited generates revenue primarily from its e-commerce and marketing segments, with e-commerce contributing significantly more at ₹3.47 billion compared to marketing's ₹1.24 billion.

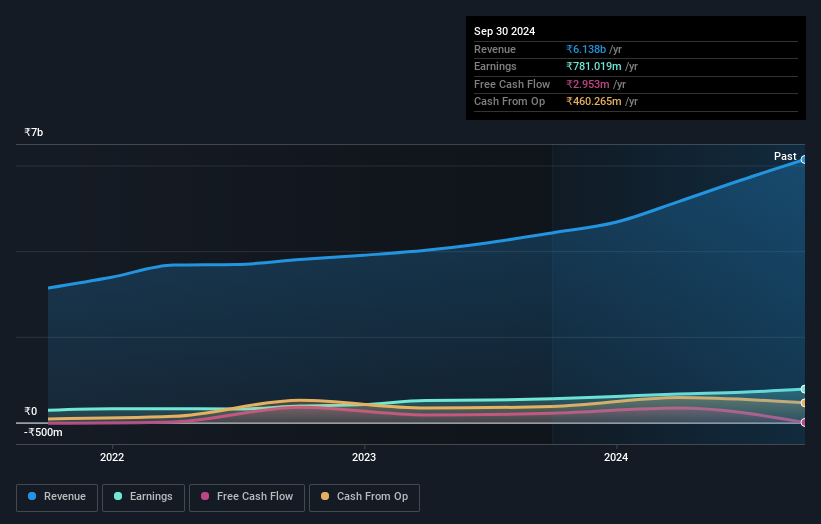

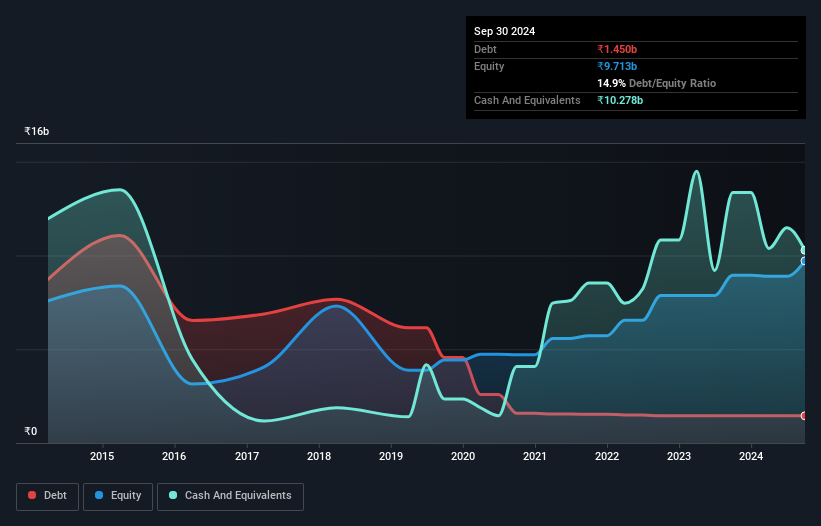

MSTC, a lesser-known player in the trade distribution sector, has seen its debt to equity ratio significantly improve from 103.1% to 14.9% over five years, indicating better financial health. Despite negative earnings growth of -15.4% last year compared to the industry average of 24.4%, MSTC's price-to-earnings ratio at 22.6x remains attractive against the Indian market's 31.1x benchmark, suggesting potential value for investors seeking bargains in this space. Recent earnings reports show net income for Q2 at INR 563 million and an interim dividend declared at INR 4 per share, reflecting ongoing shareholder returns amidst fluctuating sales and revenue figures.

- Click here to discover the nuances of MSTC with our detailed analytical health report.

Understand MSTC's track record by examining our Past report.

Jinshang Bank (SEHK:2558)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinshang Bank Co., Ltd. offers a range of banking products and services in China with a market capitalization of HK$7.94 billion.

Operations: Jinshang Bank's primary revenue streams are corporate banking and retail banking, generating CN¥2.66 billion and CN¥1.10 billion, respectively. Treasury business contributes an additional CN¥593.83 million to the revenue mix.

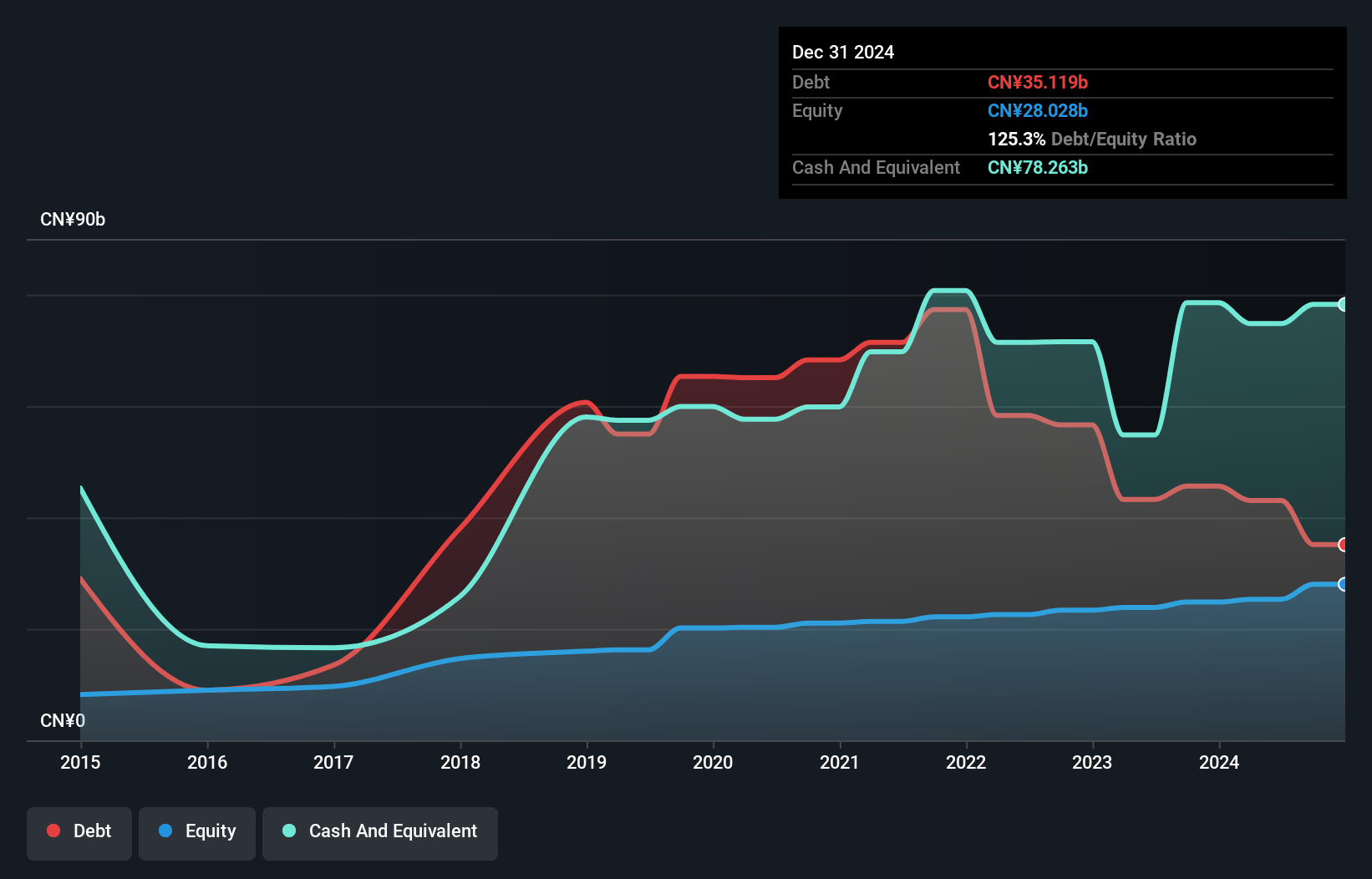

With a focus on low-risk funding, Jinshang Bank relies heavily on customer deposits, which make up 84% of its liabilities. This strategy appears to support its solid financial standing, with total assets at CN¥370.9 billion and equity at CN¥25.3 billion. The bank's net interest margin is modest at 1.4%, yet it maintains a sufficient allowance for bad loans at 1.9% of total loans, indicating prudent risk management practices. Despite reporting a levered free cash flow deficit recently, the bank trades significantly below estimated fair value and has shown earnings growth of 5.2%, outpacing the industry average of 1.6%.

- Navigate through the intricacies of Jinshang Bank with our comprehensive health report here.

Review our historical performance report to gain insights into Jinshang Bank's's past performance.

Summing It All Up

- Click this link to deep-dive into the 4646 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MSTCLTD

MSTC

Engages in marketing, e-commerce, and scrap recovery and allied job businesses primarily in India.

Flawless balance sheet with acceptable track record.